Jefferies Research has initiated coverage on Virat Kohli-backed Go Digit General Insurance Ltd., with a 24% upside potential on profitability focus, aided by an upcycle in the motor segment.

The brokerage has 'buy' on the recently listed company, with a target price of Rs 420 per share, against the current Rs 359.6 apiece on the BSE.

As growth moderates, product diversification and operating leverage can improve the combined operating ratio, Jefferies said.

"We expect EPS CAGR of ~73% and return on equity expansion to ~16%. Given the unwinding of the combined operating ratio, earnings per share and return on equity momentum can be sustained beyond FY27E."

Jefferies was positive on the large private insurers, as they are set to gain from multi-year upcycle in the motor segment. This is led by premiumisation of underlying auto mix and moderating competitive intensity, it said. "Health can see pressure in its retail segment from rising claims frequency and elevated competition."

Shares of the general insurance company debuted on the exchanges on May 13 at a premium of 5.15% over their IPO price. On the BSE it closed 24.65% higher from the opening price and it was 33.75% above the IPO price.

The insurance company's initial public offering was subscribed to 9.60 times on the final day of bidding, led by institutional investors. The Pune-based company aims to use the net proceeds towards the maintenance of its solvency ratio.

The brokerage also initiated coverage on Star Health and Allied Insurance Co., with a 'hold' rating and a target price of Rs 550 per share. This implies 10% downside from the previous market close.

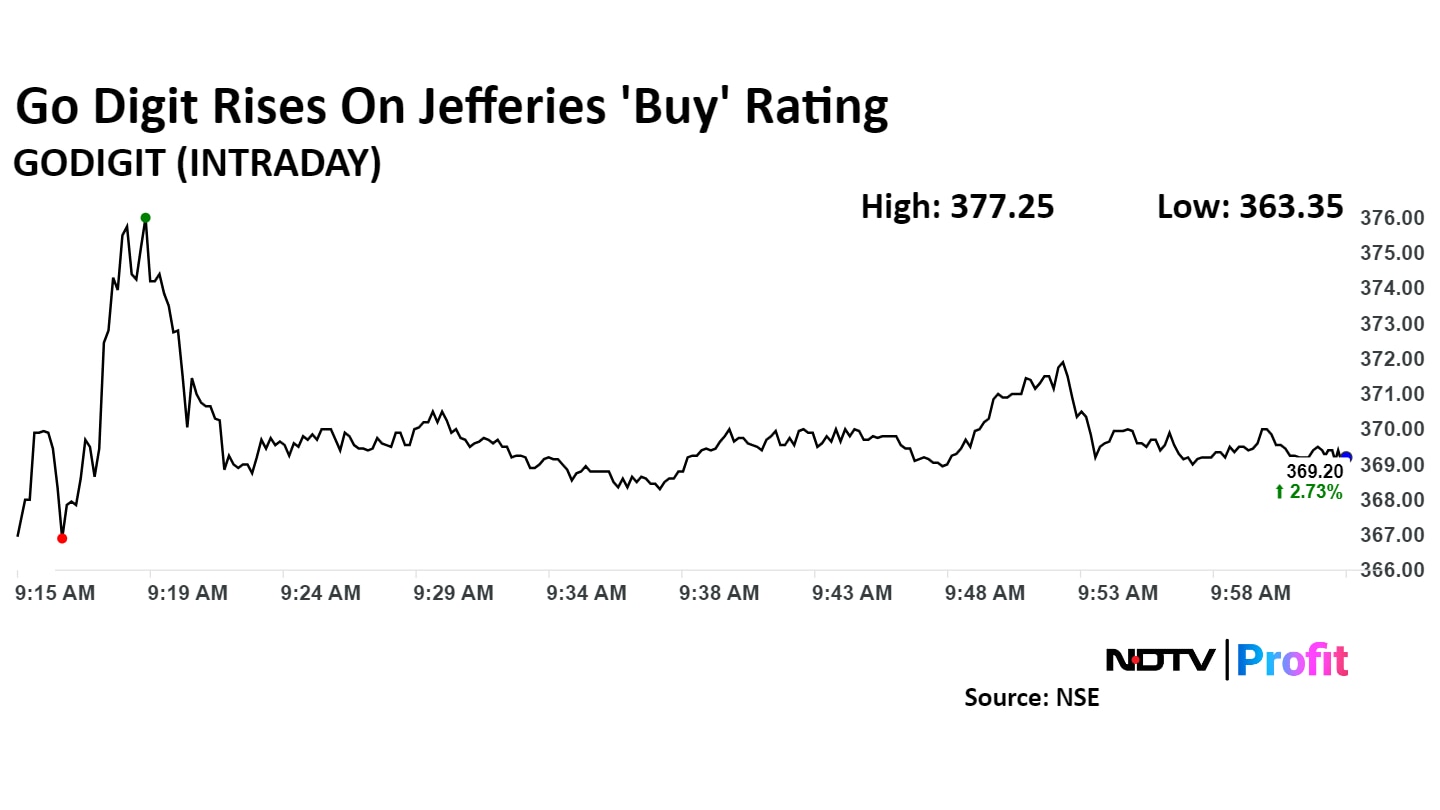

Go Digit share rose as much as 4.96% to 377.25 per share, before cooling off to trade 2.73% higher at 369.2 apiece. Meanwhile, the benchmark NSE Nifty 50 had fallen 0.03%.

The stock has risen 23.28% since listing and around 20% in the past three months. The total traded quantity stood at 1.43 times the 30-day average. RSI stood at 58.63.

Out of the five analysts tracking the company, three maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell,' according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.