Vedanta Ltd.'s share price declined as its steel production fell 7% year-on-year to 652,000 tonnes in the first half of financial year 2024–25, from 702,000 tonnes during the same period in the preceding financial year. Maintenance in an Oxygen plant, and debottlenecking of steel melting shop in the second quarter impacted the steel production, the company said in the exchange filing.

Meanwhile, it recorded its highest ever quarterly and half yearly aluminium production in July–September, and in the first half of the year, it said in an exchange filing on Thursday. Aluminium production rose 21% to 1,205 kilo tonnes in the first half ended in September.

Vedanta also recorded its highest ever second-quarter mined and refined metal production of zinc in India, the exchange filing said. Its refined metal production increased 5% on year to 524 KT in the second half.

Vedanta's power sale increased 10%, while ferrochrome production rose 70% to 53 KT. Commission of the new furnace drove the increase in ferrochrome production, it said in an exchange filing.

Iron ore volumes increased 6% to 2.6 million tonnes during April–Sept. Its pig iron production was affected due to maintenance activity, the exchange filing said.

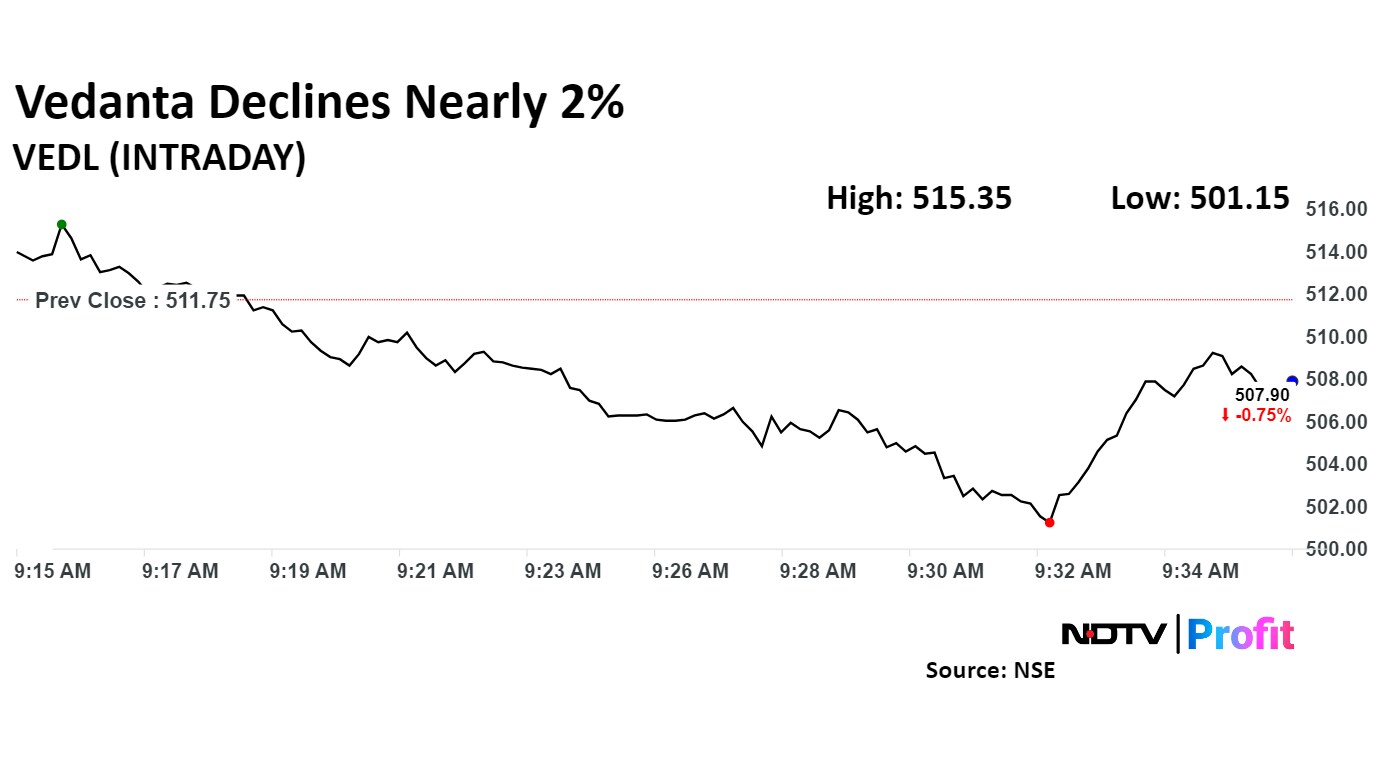

Vedanta share price declined 1.89% to Rs 502.10 apiece, the lowest level since Sept 26. It pared losses to trade 0.87% lower at Rs 507.30 as of 09:40 a.m., as compared to 0.21% decline in the NSE Nifty 50 index.

The stock increased 125.07% in 12 months, and 96.69% this year so far. The relative strength index was at 68.12.

Out of 13 analysts tracking the company, seven maintain a 'buy' rating, five recommend a 'hold,' and one suggests to 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 6.9%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.