Varun Beverages Ltd.'s board has approved a fundraise of up to Rs 7,500 crore through Qualified Institutions Placement, in one or more tranches.

The proposed move is subject to the approval of the company's equity shareholders through a postal ballot and any necessary regulatory or statutory clearances. In line with this, Varun Beverages has issued a notice of postal ballot to seek shareholder approval for the proposed equity share issuance.

The largest PepsiCo bottler aims to utilise these funds for its growth and expansion plans. Further details on the timing and specific terms of the QIP will be shared after obtaining requisite approvals.

HSBC Global Research initiated coverage on the company with a 'buy' rating and a target price of Rs 780 per share, implying a potential upside of 24.4% on Sept. 30.

The brokerage expects Varun Beverages to become the largest PepsiCo bottler in history, holding a 28% market share in carbonated soft drinks and entering the fast-growing energy drinks space by positioning Sting Energy as a disruptor. Sting is priced at a slight premium to soft drinks, but significantly lower than competitors like Red Bull and Monster, marking a unique approach in the energy drinks segment, it said.

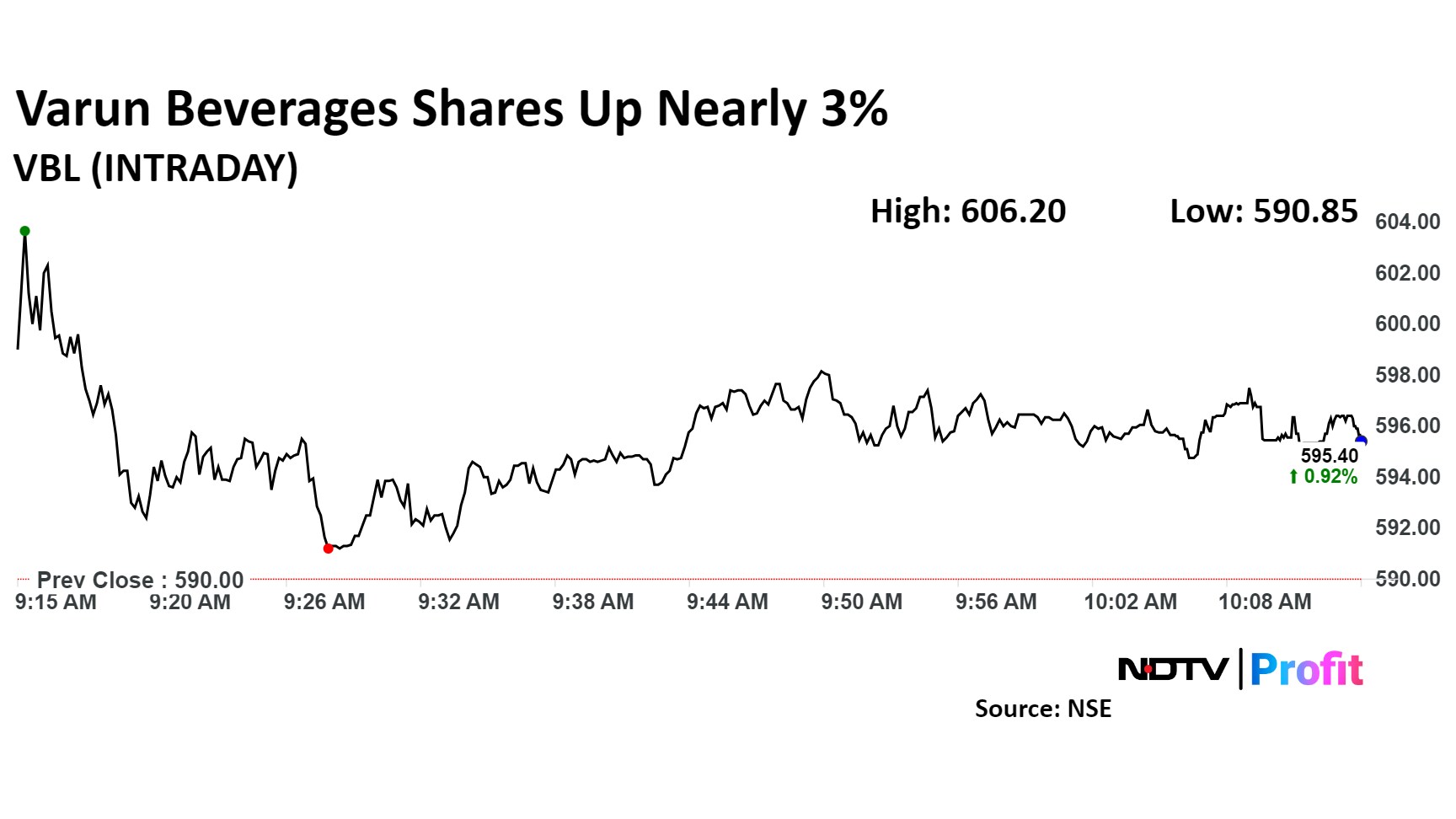

Varun Beverages Share Price Today

Varun Beverage share price today

Varun Beverages stock rose as much as 2.75% during the day to Rs 606.20 apiece on the NSE. It pared gains to trade 1% higher at Rs 595.90 apiece, compared to a 0.62% advance in the benchmark Nifty 50 as of 10:15 a.m.

It has risen 60.40% in the last 12 months and 20.54% on a year-to-date basis. The relative strength index was at 46.10.

Of the 23 analysts tracking Varun Beverages, 20 have a 'buy' rating on the stock, and three recommend a 'hold', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 21.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.