Stocks ended Friday close to session highs after a stronger-than-expected jobs report underscored the resilience of the US economy and boosted soft-landing hopes. Treasuries sank as traders recalibrated their bets on the size of the Federal Reserve's next rate cut.

The S&P 500 and the Nasdaq 100 rose the most since Sept. 19. Both eked out modest gains for the week. The policy-sensitive two-year US Treasury yield touched 3.93% after employers added 254,000 jobs in September — the most in six months — and the unemployment rate unexpectedly declined.

The dollar had its best week in two years. Traders are now pricing in less than a quarter-point worth of easing in November.

Apart from Friday's labor-market report, a slew of other economic data this week — including private-sector job numbers and a measure of the services sector — painted a picture of a strong US economy.

“Coming off a string of relatively weak jobs data over the summer months, the September jobs report was just what the doctor – or in this case the Fed – ordered,” Jim Baird, chief investment officer at Plante Moran Financial Advisors. It “broke the recent trend and provided reason for optimism in the underlying resiliency of the labor economy.”

He added that while the report doesn't change the economic outlook, it should assuage any concerns investors or the Fed had about the jobs market. Earlier this week, Fed Chair Jerome Powell said he wouldn't want to see the labor market weaken further. One of the main reasons the central bank decided to cut rates by a half a percentage point last month was softer hiring and a rise in the unemployment rate earlier this year.

But not all investors were positive about Friday's jobs report. Mohamed El-Erian warned that it means the Fed's fight against inflation isn't over.

“This is not just a solid labor market, but if you take these numbers at face value, it's a strong labor market late in the cycle,” El-Erian, the president of Queens' College, Cambridge, told Bloomberg Television.

The wage increases reflected in the report will likely remind the central bank that inflation will remain sticky, said Lindsey Bell, chief investment strategist of 248 Ventures.

Still, overall, Friday's data boosted hopes that the Fed will be able to pull off a soft landing.

“Today's report should give the Fed more flexibility as it looks to continue lowering rates and it should help counter arguments that the Fed acted too late,” said Eric Merlis, managing director and co-head of global markets at Citizens.

Policymakers will get one more jobs report — along with inflation data — ahead of its meeting next month.

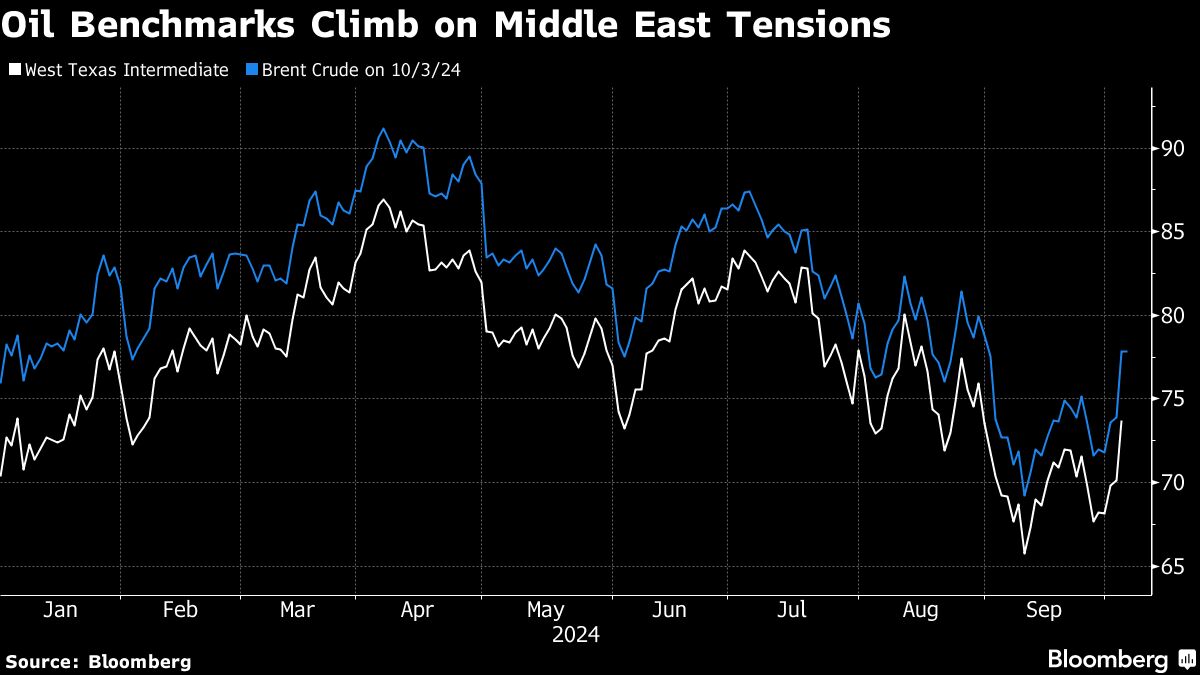

Oil pared gains after President Joe Biden sought to discourage Israel from attacking Iran's oil fields. Geopolitical concerns persist as Israel carried out bombing raids in the suburbs of Beirut alongside ground attacks in southern Lebanon, while Iran said it would support a conditional cease-fire in the conflicts involving its allied groups Hezbollah and Hamas.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.