US stocks held onto gains buoyed by a jump in Nvidia Corp.'s shares as traders largely shrugged off a grim consumer confidence reading.

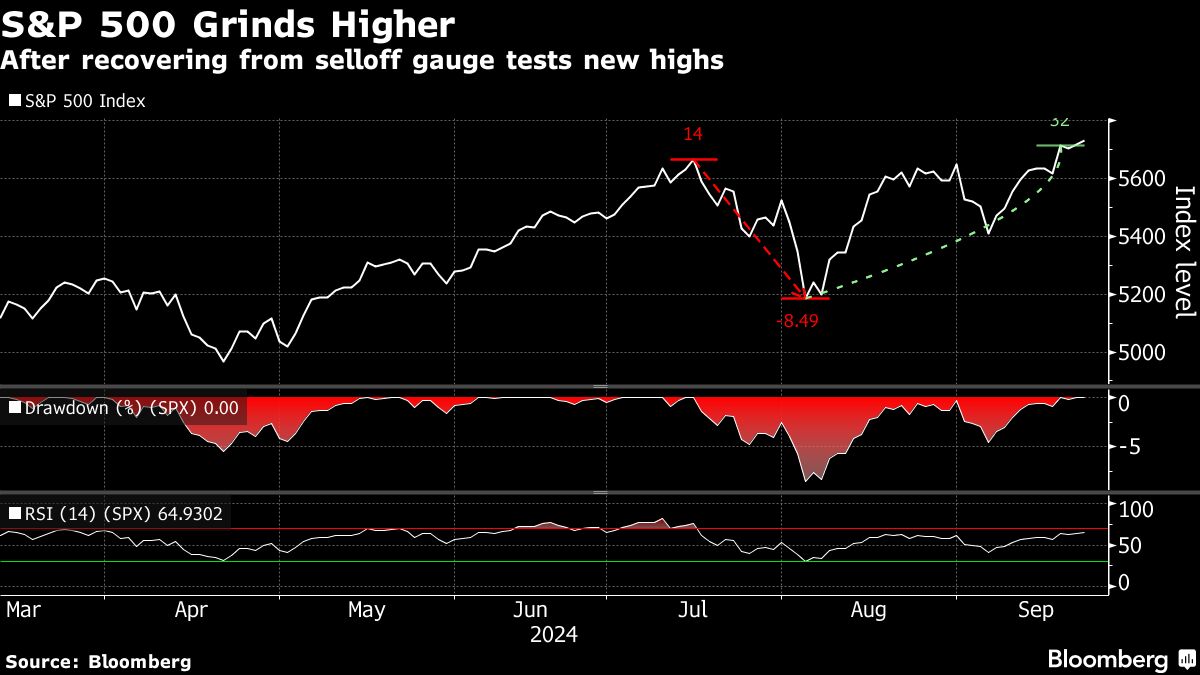

The S&P 500 Index edged up 0.3% — ending the day with its 41st record close this year — the blue-chip Dow Jones Industrial average also notched a record with a 0.2% gain while the tech-heavy Nasdaq 100 rose 0.5%. A sweeping stimulus package from China helped shore up stocks with economic ties to the country.

The benchmarks had initially sold off after a Tuesday reading on the Conference Board's gauge of consumer sentiment posted the biggest drop since August 2021 — only to reverse course after a report that Nvidia's chief executive officer was done selling shares. That sent the stock up around 4% and dragged the S&P 500 higher.

The consumer confidence report flagged concerns about a slowdown in the labor market while manufacturing data also came in weaker than expected.

“The decay in the perceptions of jobs available was striking,” according to Carl Weinberg, chief economist at High Frequency Economics. “It also will deliver a warning message about the state of the economy to financial markets.”

Swaps traders increased their wagers to more than three-quarters of a point of policy easing by year-end, suggesting at least one more major cut is in store, after the data.

To BMO's Ian Lyngen the report did little to change the Fed's trajectory.

“Unless and until flagging confidence translates into lower consumer spending, the shift in sentiment won't become a monetary policy influence,” Lyngen wrote.

The report contrasted with the views of Fed Governor Michelle Bowman, the only policymaker to dissent on last week's half a percent cut. She said the central bank should lower interest rates at a “measured” pace, arguing that inflationary risks remain and that the labor market has not shown significant weakening.

A handful of other policymakers, including Chicago Fed President Austan Goolsbee, have said the focus needs to shift from inflation to jobs. Goolsbee said the central bank may need to cut rates “significantly.”

In individual stock moves, Visa Inc. slumped 5.5% on a report that the US Justice Department plans to file a lawsuit over its alleged monopoly on debit cards. Estee Lauder Cos was among equities rallying after China's stimulus package. The beauty company generates nearly a third of its sales from Asia.

US bond yields were mostly lower with the biggest drop seen in shorter dated securities after a $69 billion auction of two-year notes.

Investors are awaiting data on the Fed's preferred price metric and US personal spending later this week for further clues on the depth of future reductions.

Elsewhere, the mood was risk-on as equities climbed after China's stimulus plan. European stock gauges traded higher as sectors exposed to the Chinese economy rallied. A gauge of the dollar slumped against a basket of Group-of-10 currencies.

China's broad package of monetary stimulus on Tuesday included reduced reserve requirements for banks and at least 800 billion yuan ($114 billion) of liquidity support for stocks. A gauge of the nation's stocks had its best day since July 2020.

Still, Michael Sneyd, head of cross-asset and macro quantitative strategy at BNP Paribas, said it would take time for the economic impact of stimulus to feed through. “That China stimulus news is probably not enough to take off those downside risks in the European economy just yet.”

Oil prices climbed on hopes of a stronger Chinese economy and as a major Israeli strike on Hezbollah targets in Lebanon kept tensions high in the Middle East. Gold hit a record trading above $2,662 an ounce.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.