Shares of information technology companies, led by Persistent Systems Ltd., LTIMindtree Ltd., Tata Consultancy Services Ltd. and Infosys Ltd., jumped on Wednesday, amid gains in American bourses on the back of the 2024 presidential elections.

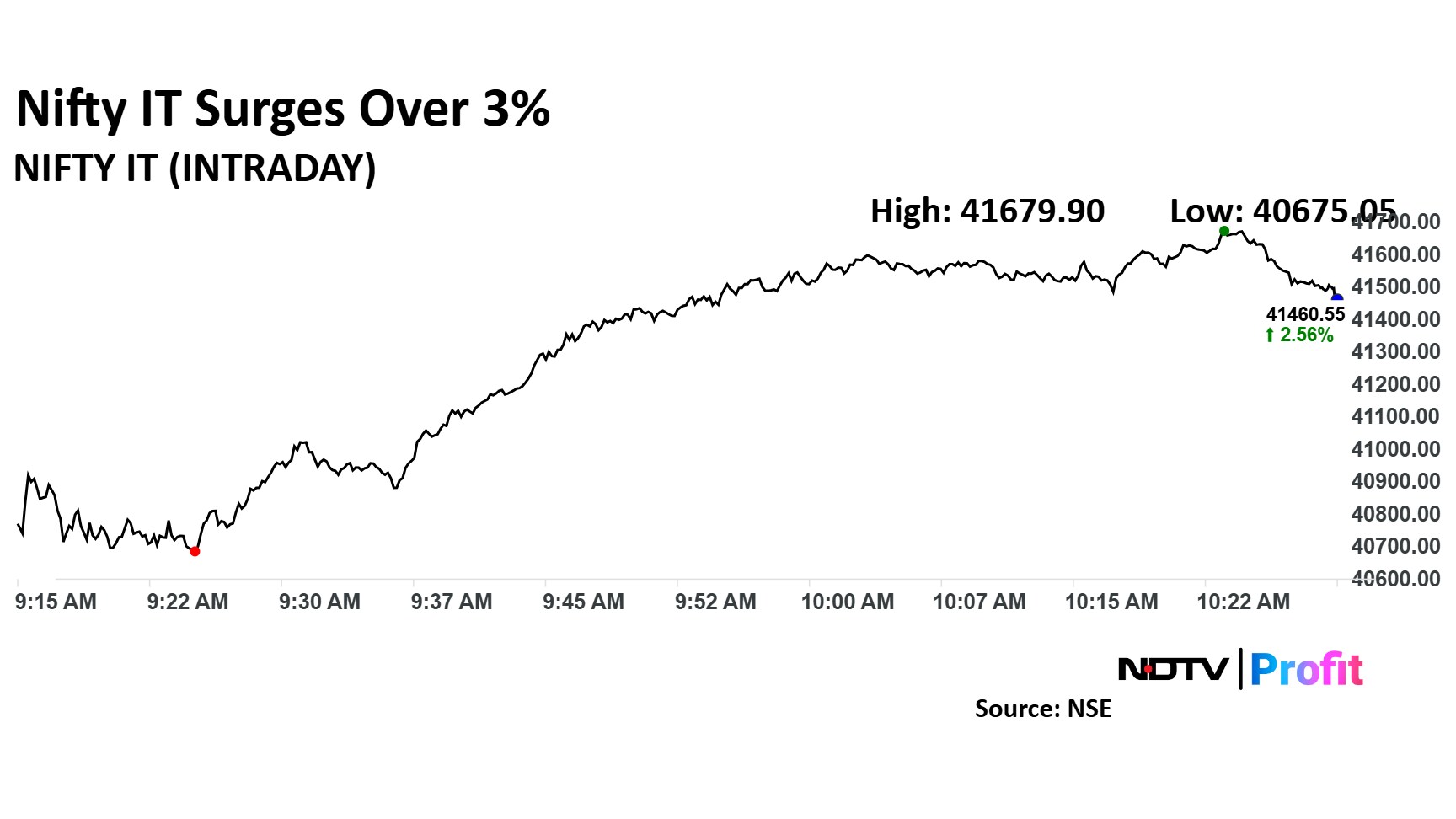

All companies part of the Nifty IT advanced, leading to a 3.11% intraday jump to 41,679.90. The benchmark Nifty 50 was up 0.62%.

The US is the biggest market for India's IT services.

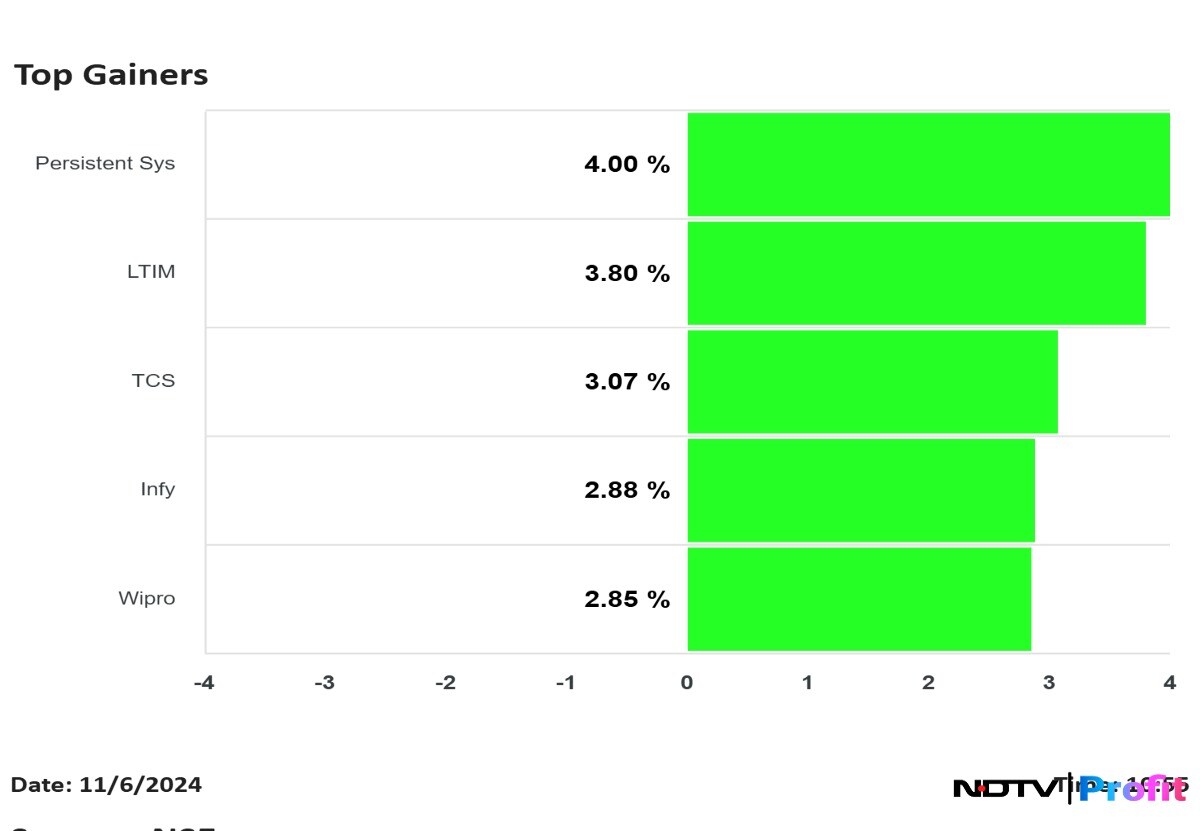

Persistent Systems Ltd.'s share price rose 4% to Rs 4,990 apiece, as of 10:54 a.m. While, LTIMindtree Ltd. stock also posted gain of 3.86% to Rs 5,940 apiece.

TCS shares were trading 3.06% higher at Rs 4,093 apiece, while Infosys was up 2.88% at Rs 1,804.65 and Wipro shares also were trading around 2.85% higher at Rs 559.20.

In the event of Trump coming to power, one of the positives for the Indian IT sector would be reduced corporate taxes, which might aid margins. However, a setback would be increased visa costs and growing denials of the H-1B visa.

Under Biden's presidency, the denial rate was the lowest at 2% in fiscal 2021 and 2022.

Infosys is likely to benefit owing to its 57% exposure to the US, as of the second quarter of financial year 2025. The company is set to benefit the most from discretionary spends revenue revival.

Brokerages suggest that under a Republican government, tax rates are likely to be reduced due to expansionary fiscal policies, which would be favourable for corporates, particularly benefiting Indian IT companies.

In contrast, under a Democratic administration, corporate tax rates are expected to increase from 21% to 28%.

Emkay and JM Financial highlight that lower tax rates under a Republican sweep would likely result in higher IT budgets, which would be positive for the sector. However, they caution that this benefit could be temporary.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.