Ujjivan Small Finance Bank Ltd.'s share price plunged as analysts reduced their target prices as well as earnings projection, after a 29% decline in the net profit in the quarter ended September 2024.

The private lender earned a net profit of Rs 233 crore, compared to Rs 328 crore in the year-ago period. The 29% decline was largely due to higher provisioning. Analyst consensus estimate compiled by Bloomberg was Rs 289 crore.

However, the total income rose to Rs 1,820 crore in the quarter under review from Rs 1,580 crore in the same period a year ago. Net interest income advanced 15% to Rs 944 crore, as against Rs 823 crore last year.

On a sequential basis, gross non-performing assets were flat at 2.52%, while net NPA rose 15 basis points to 0.56%.

The results came during market hours on Thursday and the scrip closed lower.

Analyst Views

ICICI Securities said Ujjivan SFB is likely to miss guidance on all parameters, as it is significantly impacted by the stress in the microfinance portfolio, which has a double whammy of higher credit cost and decline in revenue.

Considering the lack of visibility around the revival in the microfinance segment, the brokerage downgraded Ujjivan stock to 'hold' from 'buy' with a revised target price of Rs 36.

Emkay Global cut its three-year earnings projections factoring in lower NIM and higher provisions. It also reduced the target price to Rs 45 from Rs 55, while retaining 'buy' call.

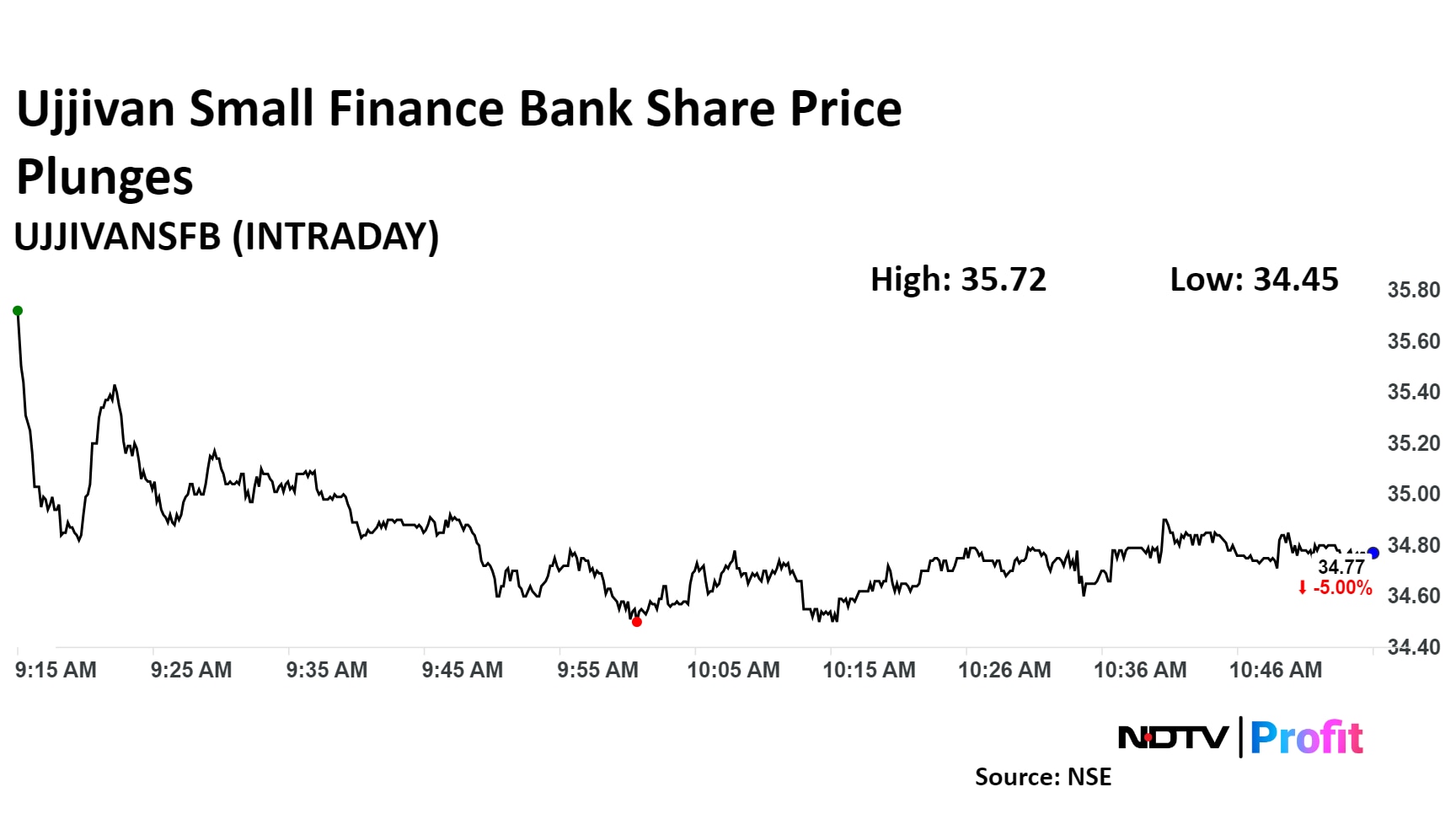

Ujjivan Small Finance Bank share price fell 6% intraday to Rs 34.45 apiece, the lowest since May 2023.

Ujjivan Small Finance Bank share price fell 6% intraday to Rs 34.45 apiece, the lowest since May 2023. The scrip was trading 5% lower by 10:55 a.m. The benchmark NSE Nifty 50 was down 1.1%.

The stock has fallen 34% in the last 12 months and 39% on a year-to-date basis. The total traded volume so far in the day stood at 3.4 times its 30-day average. The relative strength index was at 52.

Thirteen out of the 16 analysts tracking Ujjivan Small Finance Bank have a 'buy' rating on the stock, two recommend a 'hold' and one suggests a 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs 49 implies a potential upside of 42%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.