Nifty's immediate support levels are around 24,200 and 24,000, with resistance zones identified between 24,700 and 24,800, according to analysts, after the index closed at 24,479 levels on budget day.

The markets fluctuated during the Union Budget 2024-25 presentation, with buying in consumer durables, FMCG, and pharma sectors following proposed incentives by Finance Minister Nirmala Sitharaman.

The budget's emphasis on employment, skilling initiatives, and continued infrastructure investment contributed to the market swinging between gains and losses.

"We expect consolidation in the index in this zone in the near term. Hence, traders should look to trade with a stock-specific approach, where opportunities could be seen on both sides of the trade," according to Ruchit Jain, lead of research at 5paisa.com.

"Amongst sectoral indices, defensive indices such as IT, pharma and FMCG have seen relative strength in this volatility and hence, we expect outperformance to continue in stocks from these sectors," he added.

The surprise came after the government proposed an increase in long-term and short-term taxes, along with an increase in the securities transaction tax on futures and options.

According to Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd., "This rise in short-term capital gains tax from 15% to 20% will thus discourage excess trading activities, while the hike in long-term capital gain taxes from 10% to 12.5% is sentimentally negative for the market in the near term."

However, he said that the brokerage is of the view that the long-term fundamentals of India remain strong, "with the government walking the fiscal prudence path and reducing the target to 4.9% in FY25 and further to 4.5% in FY26."

The Nifty Bank index had consolidated in a range in the last few days before the event, but it corrected on the event day and despite some recovery from the lows, it ended with a loss of about a percent at 51,778 levels.

"On the upside, 52,000 and 52,550 will act as resistance points for Bank Nifty, while on the downside 51,200 and 51,000 will act as key support points," according to Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Interrmediates Ltd.

GIFT Nifty was trading 21.5 points, or 0.09%, lower at 24,415 as of 06:51 a.m.

F&O Action

The Nifty July futures are down 0.23% to 24,452.95 at a discount of 26.1 points, with open interest down 5.4%.

Nifty Bank July futures are up by 1% to 51,765 at a discount of 13.3 points, while its open interest is up by 1.22%.

The open interest distribution for the Nifty 50 July 25 expiry series indicated most activity at 25,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options July 24 expiry, the maximum call open interest was at 53,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors turned net sellers of Indian equities on Tuesday after six days.

Foreign portfolio investors offloaded stocks worth Rs 2,975.3 crore on the budget day, while domestic institutional investors stayed net buyers for the second session and mopped up equities worth Rs 1,418.8 crore, the NSE data showed.

Market Recap

India's benchmark stock indices extended losses for the third session on Tuesday as shares of HDFC Bank Ltd. and Larsen & Toubro Ltd. dragged after India received its final budget for financial year 2025.

The NSE Nifty 50 settled 30.20 points, or 0.12%, lower at 24,479.05, while the S&P BSE Sensex ended down 73.04 points, or 0.1%, at 80,429.04.

During the day, Nifty fell 1.78% to 24,074, and Sensex declined 1.59% to 79,224.32. The indices witnessed a sharp fall after the Union government proposed higher taxation on short-term and long-term capital gains in the final budget for the current fiscal.

Broader markets ended lower. The S&P BSE Midcap and S&P BSE Smallcap ended 0.74% and 0.18% lower, respectively.

On the BSE, 12 out of 20 sectors declined, and eight advanced. The S&P BSE FMCG rose the most, while the S&P BSE Realty declined the most.

Market breadth was skewed in favour of sellers. Around 2,155 stocks declined, 1,743 stocks rose, and 118 stocks remained unchanged on the BSE.

Major Stocks In News

SpiceJet: The company will raise up to Rs 3,000 crore via rights issue at Rs 818 per share.

Suven Pharmaceuticals: The company received an observation letter with 'no adverse observations' from BSE and 'no observations' from NSE. Observations is for a scheme of amalgamation seeking amalgamation of Cohance Lifesciences with the company.

IOL Chemicals And Pharmaceuticals: EDQM issued a certificate of suitability for Valsartan tablets. Valsartan is used to treat high blood pressure.

Titagarh Rail Systems: The company begins the export of traction converters with the first shipment to Italy.

Shilpa Medicare: The company's unit manufacturing facility in Karnataka received GMP certification from COFEPRIS- Mexico. The inspection was conducted from Nov 6- Nov 10, 2023.

Infosys: The company has signed a contract with UVC Partners to co-create next-generation solutions using AI and Deep Tech.

MIC Electronics: Kalidindi Satyanarayana Raju resigned as CEO effective July 10 and appointed Rakshit Mathur as CEO effective Aug 1. The company also appointed Vivek Reddy Venumuddala as COO with immediate effect.

South Indian Bank: The company is to consider fundraising on July 30.

Bajel Projects: The company received an order worth Rs 568 crore from PowerGrid Corp for a period of 23 months. The project includes a transmission system for the evacuation of power from Rajasthan.

Tide Water Oil: The company has decided to change its name to Veedol Corporation.

Global Cues

Stocks in the Asia-Pacific region got off to a muted start taking overnight cues from Wall Street after the underwhelming earnings of Big Tech companies.

Equity gauges in South Korea and Australia fell marginally lower while those in Australia were flat in early trade. The Nikkei 225 was 18 points or 0.05% lower at 39,576, while the S&P ASX 200 was 11.3 points or 0.14% down at 7,960 as of 06:40 a.m.

The bourse in Taipei will be closed due to a typhoon and the Central Bank of Sri Lanka will issue its rate decision on Wednesday.

The upbeat earnings in the US companies which was needed to drive equities failed to impress investors with Tesla Inc., and United Parcel Service Inc. falling to beat estimates. The scrip of Alphabet Inc. remained flat even after its revenue beat analyst estimates.

The S&P 500 Index and Nasdaq Composite declined 0.16% and 0.06%, respectively as of Tuesday. Dow Jones Industrial Average fell 0.14%.

Brent crude was trading 0.47% higher at $81.39 a barrel. Gold was 0.03% up at $2,410.46 an ounce.

Key Levels

US Dollar Index at 104.53

US 10-year bond yield at 4.26%

Brent crude up 0.47% at $81.39 per barrel

Bitcoin was down 0.04% at $65,829.06

Gold spot was up 0.03% at $2,410.46

Money Market Update

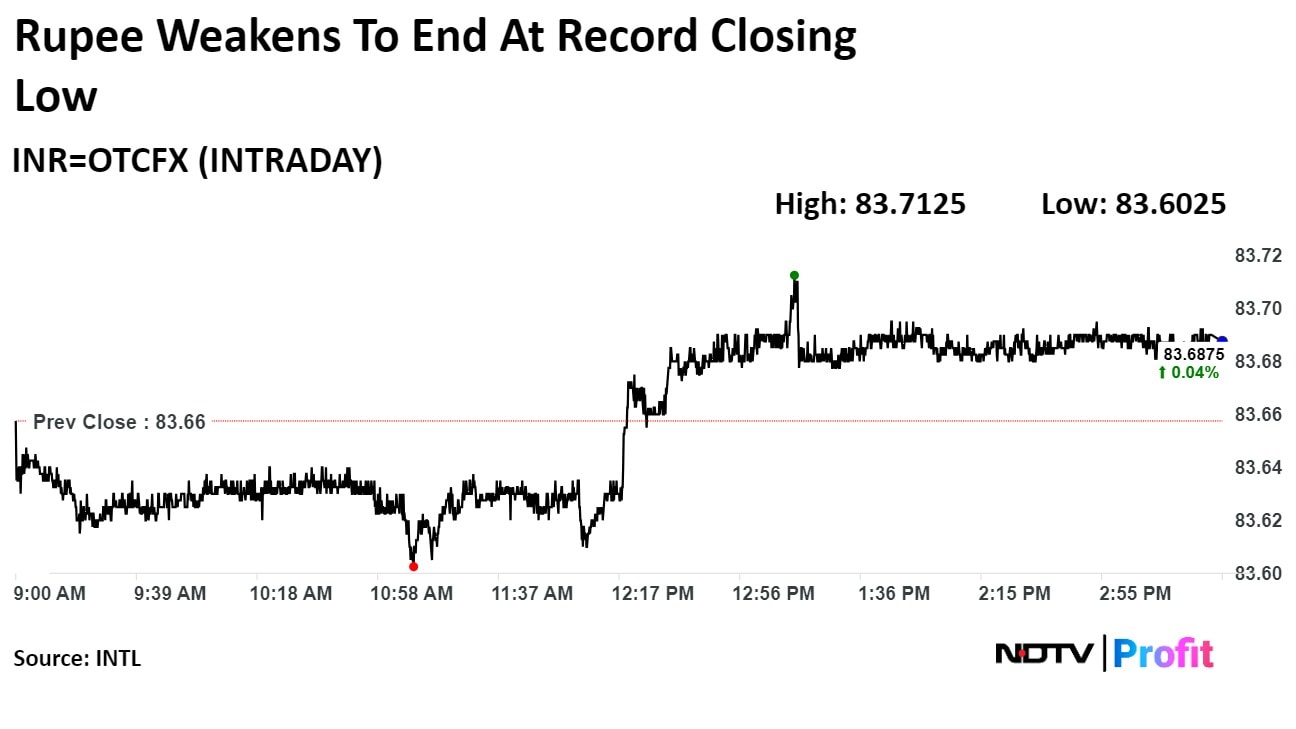

The Indian rupee weakened to a fresh record low against the US dollar on Tuesday after the government proposed a higher capital gains tax.

The local currency weakened 3 paise to close at a record low of Rs 83.69 against the US dollar after opening at Rs 83.64 on Tuesday. It closed at a record low of Rs 83.67 on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.