Analysts have raised their estimates of key support and resistance zones for the benchmark indices as the Indian equities market finds cheer back ahead of Deepavali.

The NSE Nifty 50, which rose 0.65% on Monday, can move up till 24,525–24,600 levels, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

For the traders now, 24,200 to 24,100 will act as a key support zone. Below this level, the sentiment can change as "traders may prefer to exit out from the trading long positions", Chouhan added.

The Nifty 50 has made a "spinning-top candlestick pattern", which suggests indecisiveness, according to Aditya Gaggar, director of Progressive Shares Brokers Pvt. "We will wait for a convincing move above 24,600 where it will give a breakout from two different patterns—first, a change in polarity; and second, falling wedge."

On the lower side, the zone of 24,100–24,180 will act as a strong support area, Gaggar said.

For Bank Nifty, 50,382 will serve as an immediate support. If the index sustains above 51,590, an upmove toward 52,000–52,500 levels can unfold, according to Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C Mehta Investment Intermediates Ltd.

Market Recap

The Nifty 50 and the BSE Sensex snapped a five–session losing streak, with banking sector stocks turning the tides. The benchmark indices recorded the best session in one month.

The Nifty 50 ended 158.35 points or 0.65% higher at 24,339.15, and the Sensex ended 602.75 points or 0.76% higher at 80,005.04.

All the 12 sectors of NSE ended higher, with the Nifty PSU Bank emerging as the day's top performer.

The rise in Indian markets was also supported by gains in its Asian peers, which logged gains on account of a slip in oil prices and a plunge in the Japanese Yen to its lowest since July 31.

FII/DII Activity

Overseas investors remained net sellers of Indian equities for the 21st consecutive session on Monday, while domestic institutional investors stayed net buyers for the 25th straight session.

The foreign portfolio investors offloaded stocks worth approximately Rs 3,228.1 crore, according to provisional data from the National Stock Exchange. The DIIs bought stocks worth Rs 1,400.9 crore.

In the last five sessions, the FPIs have sold equities valued at Rs 20,990.5 crore, while the DIIs have purchased shares worth Rs 21,089.6 crore.

F&O Cues

Nifty October futures rose by 0.71% to 24,348.45 at a premium of 9.3 points, while open interest went down by 15.37%.

Nifty Bank October futures rose by 1.08% to 51,327.35 at a premium of 68.05 points, while open interest went down by 8.07%.

The open interest distribution for the Nifty 50 Oct. 31 expiry series indicated most activity at 25,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Oct. 30, the maximum call open interest was at 62,000 and the maximum put open interest was at 50,000.

Major Stocks In The News

NTPC: The stock will remain in focus as the company's arm—NTPC Green Energy—received nod from the Securities and Exchange Board of India for its Rs 10,000-crore initial public offering. The IPO comprises only a fresh issuance of shares, with no offer-for-sale component.

Suzlon Energy: The company, post market hours on Monday, posted a 96% increase in its bottom line for the quarter ended Sept. 30. The net profit came in at Rs 200.6 crore, compared to Rs 102.29 crore in the year-ago period.

Tata Technologies: The company has signed a pact with Air India—another Tata Group entity—to redo the interiors of the erstwhile national carrier. The collaboration follows regulatory approval granted to the airline for in-house modifications to the aircraft.

Kalpataru Projects International: The company has received board nod to raise up to Rs 1,000 crore via qualified institutional placement. The amount is to be raised in one or more tranches, it said.

Prestige Estates Projects: The real estate firm announced the acquisition of 17.45-acre land In Bengaluru's Whitefield for Rs 462 crore. The acquired land will be "planned for residential development spanning approximately 2.68 million sq ft of developable area", it said.

Global Cues

Stocks in the Asia-Pacific region were trading mixed as uncertainties across Japanese political arena to US presidential election kept traders on their toes, along with the key economic data that will set the tone for Federal Reserve's rate cuts.

Equity benchmarks in South Korea and Japan traded lower during the opening. Australia's S&P ASX 200 was 29 points, or 0.35%, higher at 8,250, while the Japanese Nikkei 225 was down 140 points, or 0.38%, at 38,513 as of 5:40 a.m.

Unemployment data from Japan and Singapore, and minutes of the Bank of Korea's policy meeting will be closely watched among traders in the Asian markets. Thailand's finance minister and central bank governor will discuss next year's inflation target, Reuters reported.

Wall Street closed the previous session with gains as traders gear up for the US election and GDP print with Donald Trump-related stocks gaining the most. The S&P 500 and Dow Jones Industrial Average climbed 0.27% and 0.65%, respectively, while the Nasdaq Composite advanced 0.26%.

Meanwhile, crude oil prices edged higher after plunging over over 4% on Monday as Israel's Benjamin Netanyahu indicated that he is open to a short truce in Gaza in exchange for the release of a small number of hostages.

Brent crude was trading 0.77% higher at $71.97 a barrel as of 6:00 a.m. IST. West Texas Intermediate was up 0.77% at $67.90.

Key Levels

US Dollar Index at 104.28

US 10-year bond yield at 4.27%.

Brent crude up 0.62% at $71.86 per barrel.

Bitcoin was up 0.21% at $69,755.81

Gold spot was up 0.12% at $2,745.71

Money Market

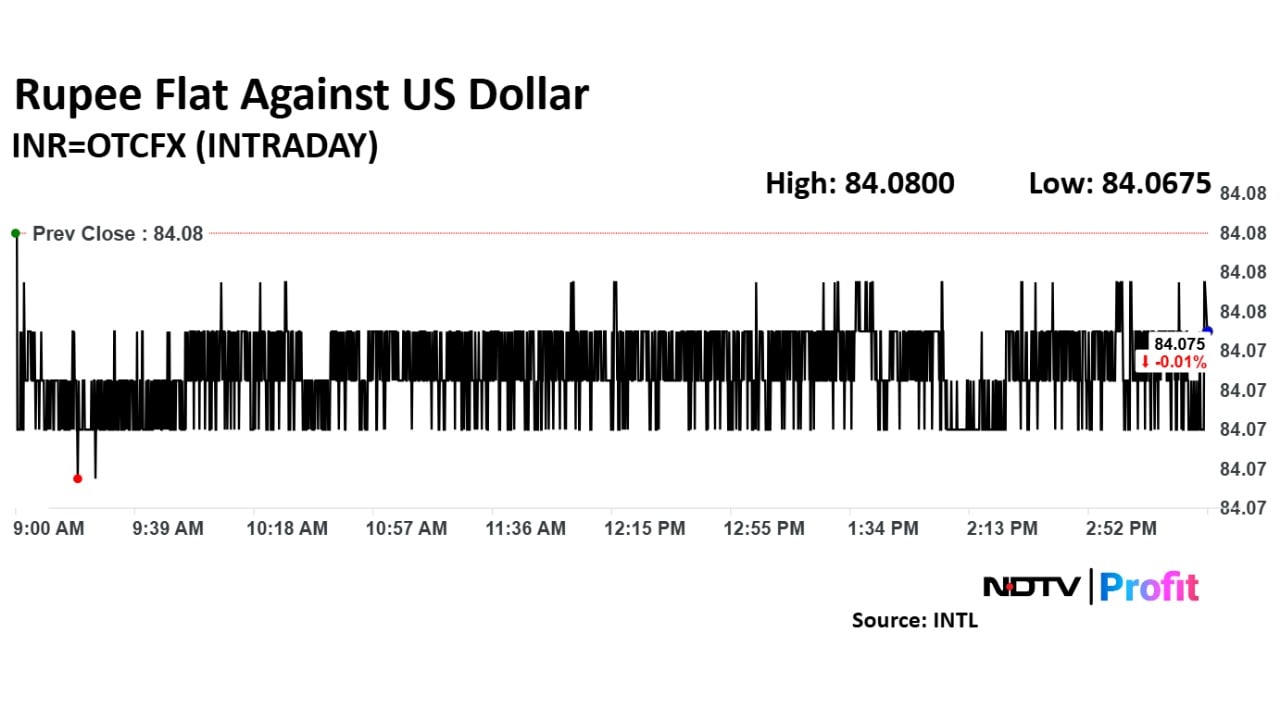

The Indian rupee closed at Rs 84.07 per US dollar, compared to the previous close of Rs 84.081.

The local currency was little changed against the greenback amid uncertainty about the Middle East tensions and the US election, even as market participants kept track of any action from the Reserve Bank of India.

The RBI is expected to keep the rupee in the Rs 84.00–84.20 range and protect it from any further fall, according to Anil Bhansali, executive director at Finrex Treasury Advisors LLP.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.