Market analysts have revised the support and resistance zones for the benchmark indices after the NSE Nifty 50 and the BSE Sensex rose for the second consecutive day on Tuesday.

The Nifty 50 faces key support in the range of 24,400 to 24,300, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd. "As long as the market is trading above the same, bullish sentiment is likely to continue," he said.

Further upside may also continue which could lift the index up to 24,700, he added. "On the flip side, traders may prefer to exit out from the trading long positions if the index dips below 24,300."

The Nifty 50 has formed a bullish candle, pointed out Aditya Gaggar, director of Progressive Shares Brokers Pvt. "A level of 24,570 will be considered a breakout point while the index managed to defend yesterday's low of 24,140, which will serve as immediate support," he said.

If the index sustains above 24,493, it may extend gains to the 24,600–24,700 range, with strong support at 24,070, according to Hrishikesh Yedve, assistant vice president for technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd.

For Bank Nifty, the immediate resistance is placed near 52,580, with support at 51,900, Yedve said. "Thus, a buy on dips strategy should be employed in Bank Nifty," he added.

F&O Cues

The Nifty October futures were up by 0.5% to 24,477 at a premium of 11 points, with the open interest down by 17.7%.

The Nifty Bank October futures were up by 1.9% to 52,294 at a premium of 26 points, while its open interest was down 27%.

The open interest distribution for the Nifty 50 Oct. 31 expiry series indicated most activity at 25,000 call strikes, with the 24,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Oct. 30, the maximum call open interest was at 53,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors have been net sellers for the last 22 sessions and offloaded stocks worth Rs 1.15 lakh crore, domestic institutional investors stayed net buyers for the 26th straight session.

The foreign portfolio investors offloaded stocks worth approximately Rs 548.7 crore, according to provisional data from the National Stock Exchange. The DIIs bought stocks worth Rs 730.1 crore.

Stocks In The News

NTPC: The company announced the commercial operationalisation of its 32.9 MW capacity solar plant in Rajasthan's Bikaner with effect from Oct. 31.

Shriram Properties: The company has signed a joint development pact for a six-acre land parcel in Pune. The project carries a revenue potential of around Rs 700-750 crore.

Rites: The public sector firm has inked an agreement with SAIL-Bokaro Steel Plant for consultancy works.

Colgate Palmolive: The company received income tax order of Rs 254 crore for assessment year 2021-22.

Linc: The company has received board nod for splitting each share into two, and for a bonus issue in the ratio of 1:1.

360 ONE WAM: The financial services provider raised 2,250 crore through its QIP issue. It allotted 2.22 crore shares at Rs 1,013 apiece.

Market Recap

The Nifty 50 settled 0.52% or 127.7 points higher at 24,466.85, whereas the BSE Sensex gained 0.45% or 363.99 points to close at 80,369.03. The indices settled in the green despite falling around 0.7% to 0.8% in intraday trade.

Notably, Nifty and Sensex extended their recovery for a second consecutive session as bank stocks led the gains. However, shares of automobile companies capped the upside.

During the five-session fall before the last two sessions of gains, Nifty had fallen 2.7% and Sensex lost 2.2%.

Global Cues

Most Asian indices were lower in the early trade but Japan's Nikkei extended its gains to another day after the country's jobs data. As of 6:30 a.m., Australia's ASX 200 and South Korea's Kospi fell around 0.4% when Nikkei was 1% higher.

Except for Dow Jones, Wall Street indices closed in the green on Tuesday after opening lower. The S&P 500 rose 0.2%, Nasdaq 100 added 1%, while Dow Jones Industrial Average fell 0.4%.

A potential return of Trump in the White House will weigh on Asian exporters like China and South Korea as the Republican candidate has vowed to raise import tariffs in the US.

Key events on the Asia-Pacific economic calendar for Wednesday include Australian inflation data and a monetary policy forum hosted by the Bank of Thailand, while the Bank of Japan kicks off its two-day policy meeting, according to Reuters.

Brent crude was trading 0.2% higher at $71.24 a barrel at 6:34 a.m. when Gold was also higher by 0.1% at $2,778.68 an ounce.

Money Market

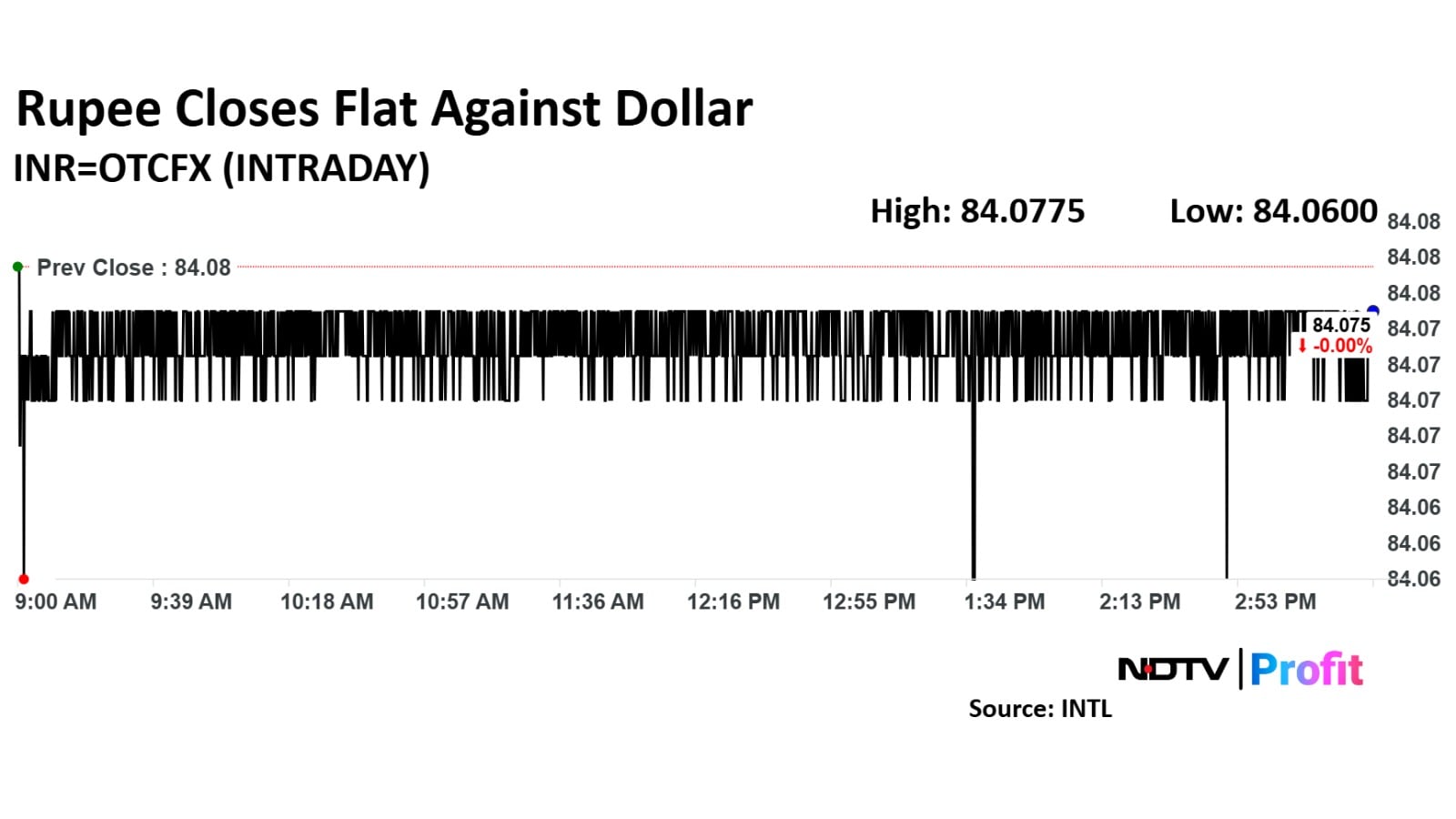

The Indian rupee closed little changed against the US dollar on Tuesday, mirroring the relatively steady greenback. The local currency ended trading at Rs 84.079 per dollar, compared to the previous close of Rs 84.076, as per Bloomberg data.

The rupee traded in a very narrow range through the day, with likely Reserve Bank of India interventions providing crucial support on the downside.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.