The NSE Nifty 50 has established key support levels between 23,900 and 23,950, with resistance at 24,500 and 24,700, according to analysts. The volatility index, India VIX, rose 4.74% to 14.63, indicating increased market volatility.

"Technically, Nifty formed a bearish candle on both daily and weekly charts, indicating weakness. The 150-Days Exponential Moving Average is placed near 23,950, along with the previous swing low at 23,893. Thus, the index will find good support in the 23,900–23,950 range," according to Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd.

"On the upside, 24,500 and 24,700 are significant resistance levels, and traders should consider booking profits on any bounce, given the prevailing bearish sentiment," he said.

The broader market has seen a roughly 8% decline from its peak at 26,277, driven by weak global cues, softer Q2 results, and significant FII outflows. "We expect this weakness to continue in the near term amid cautiousness among investors ahead of the US presidential election on Nov. 5," Siddhartha Khemka, head of research, wealth management, at Motilal Oswal Financial Services Ltd., said.

Bank Nifty followed a similar trend, ending the day in a negative territory at 50,787. Technically, Bank Nifty breached a crucial support level at 51,000, forming a bearish candle. "(The) 150-DEMA is currently placed near 50,380. As long as Bank Nifty respects 50,380, a bounce to 51,000 is feasible, but it should be used for profit booking. Sustaining below 50,380 might push Bank Nifty to psychological thresholds of 50,000," said Yedve.

"In the coming weeks, key events include the US elections and the US FOMC meet. Stock-specific action will continue based on Q2FY25 financial performance and management commentary," Shrikant Chouhan, head of equity research at Kotak Securities.

FII/ DII Activity

Overseas investors remained net sellers of Indian equities for the 20th consecutive session on Friday, while domestic institutional investors stayed net buyers for the 24th straight session.

The FPIs offloaded stocks worth Rs 3,036.75 crore, while DIIs bought stocks worth Rs 4,159.29 crore, according to provisional data from the National Stock Exchange.

Market Recap

The benchmark equity indices fell for the fourth consecutive week, the longest streak since the five weeks ended Aug. 24. On a daily basis, they continued their downtrend for the fifth session.

The NSE Nifty 50 ended 218.60 points or 0.90% down at 24,180.80 and the BSE Sensex fell 662.87 points or 0.83% to close at 79,402.29. During the day, the Nifty fell as much as 1.3% and the Sensex fell as much as 1.2%.

On a weekly basis, the Nifty ended 2.7% lower and the Sensex lost 2.2%. All sectoral indices on the NSE ended lower, with the Realty and Metal losing the most.

Major Stocks In News

InterGlobe Aviation: IndiGo operator InterGlobe Aviation Ltd. swung into loss during the three months ended September. The carrier reported a loss of Rs 987 crore during the July-September period compared with a profit of Rs 189 crore clocked in the year-ago period.

Balkrishna Industries: The company reported a 7.4% rise in its revenue for the second quarter of fiscal 2025.

Shriram Finance: The company has announced a stock split of its equity shares, with a ratio of 1:5, following a board meeting held on Oct. 25, 2024.

Torrent Pharmaceuticals: The company posted consolidated net profit rose 17% in the second quarter of the current financial year, missing analysts' estimates.

Macrotech Developers: The Mumbai-based company which sells properties under the Lodha brand, saw its net profit for the September quarter increase 108% to Rs 423 crore.

Global Cues

Stocks in Japan bounced back after a lower open as traders weighed on the potential political instability after Shigeru Ishiba's coalition failed to win a majority in parliament for the first time since 2009. Meanwhile, yen fell to its lowest level in three months.

Equity benchmarks in South Korea and Australia were trading higher during the open. Australia's S&P ASX 200 was three points, or 0.04%, higher at 8,214, while the Japanese Nikkei 225 was up 345 points, or 0.89%, at 38,237 as of 5:40 a.m.

Ishiba's decision to call for a snap election backfired as a poll by public broadcaster NHK showed that the Liberal Democratic Party fell short of forming a majority government, Bloomberg News reported.

Japanese yen fell as much as 0.6% to 153.27 per dollar on Monday, the lowest level in almost three months.

On the commodity front, crude oil prices plunged after Israel retaliated to strike military targets across Iran early Saturday. The strike, however, avoided oil, nuclear and civilian infrastructure sites.

Brent crude was trading 4.09% lower at $72.94 a barrel as of 6:00 a.m. IST. West Texas Intermediate was down 4.22% at $68.75.

On Wall Street, the S&P 500 saw its first weekly decline since early September as banks dragged down the broader market. The S&P 500 and Dow Jones Industrial Average slipped 0.03% and 0.61%, respectively, while the Nasdaq Composite advanced 0.56%.

Key Levels

US Dollar Index at 104.41

US 10-year bond yield at 4.28%.

Brent crude down 4.17% at $72.88 per barrel.

Bitcoin was up 0.19% at $67,816.56

Gold spot was down 0.50% at $2,733.96

Money Market

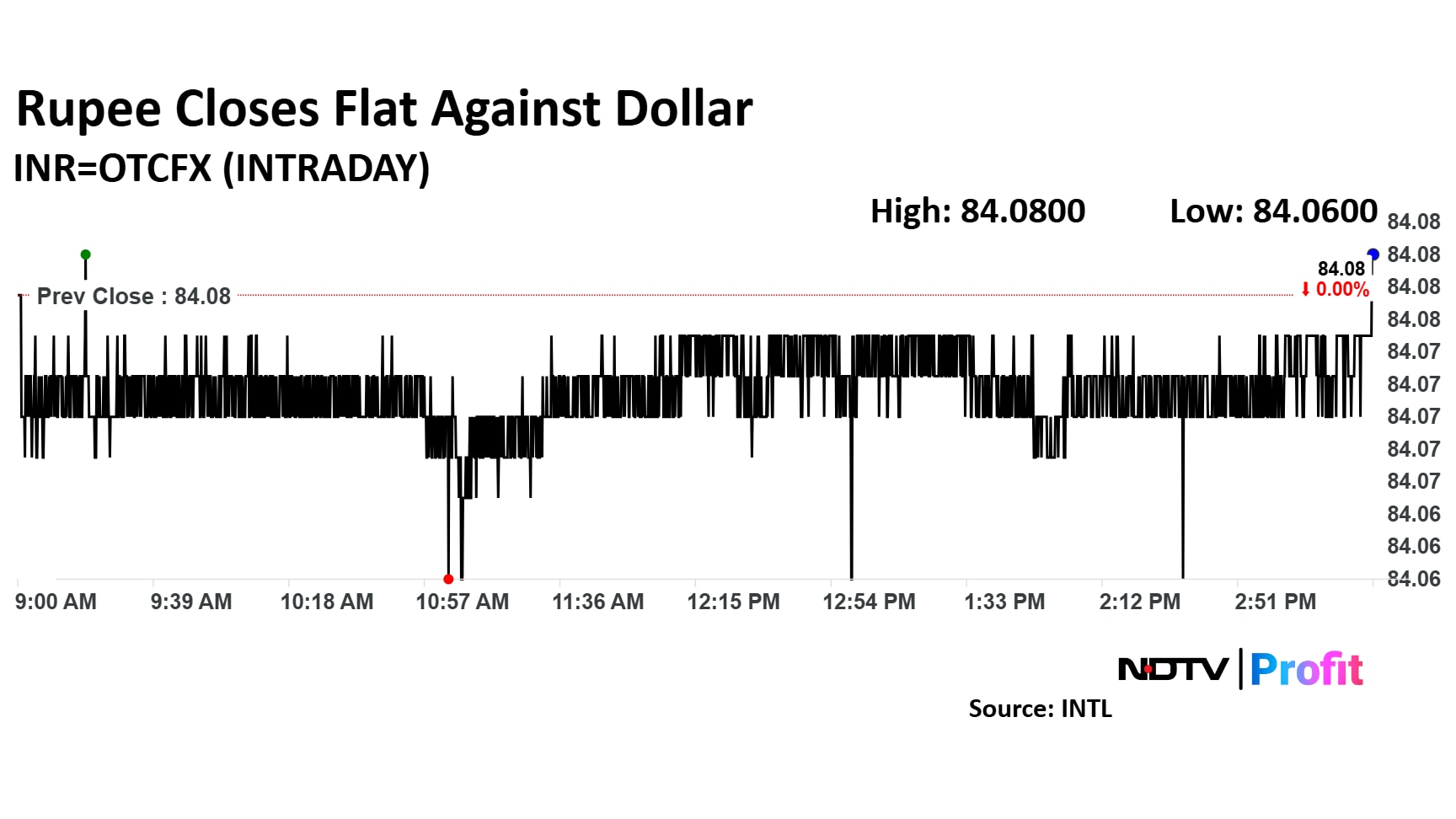

The Indian rupee closed flat against the US dollar on Friday. The local currency ended the trading day at Rs 84.081, compared to the previous day's close of 84.077.

The recent pressure on the rupee, trading near its all-time low, has come from foreign equity outflows from India and the greenback's strength globally.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.