The Nifty 50 resistance levels are at 24,450, with key support around 24,200, according to analysts, as the market continues to consolidate. Analysts remain cautious, particularly due to the upcoming Diwali week.

"For day traders, the 24,450/80,200 zone will be a critical resistance point. If the market breaks above this, it could rise to 24,600–24,625/80,500–80,800," according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

"On the downside, falling below 24,350/79,850 could lead to accelerated selling pressure, potentially pushing the index down to 24,250–24,200/79,500–79,300," said Chouhan.

The Nifty has been hovering in a narrow range of 24,400–24,500 over the last two sessions, weighed down by persistent foreign outflows and lacklustre earnings, according to Siddhartha Khemka, head of research at Motilal Oswal Financial Services Ltd. "This range-bound move is likely to continue unless a major trigger emerges, with sectoral rotation driven by the ongoing earnings season."

"Nifty is expected to remain within a tight range, with 24,350 and 24,200 (the bullish gap from August) acting as immediate support due to oversold conditions on the intraday charts. The resistance at 24,500–24,600, aligned with the 89 DEMA, remains key. With the 20 DEMA breaching the 50 DEMA, we advise caution. A sustained move above 25,000 would shift the outlook to bullish, but until then, any upward movement should be seen as a relief rally," noted Rajesh Bhosale, equity technical analyst at Angel One Ltd.

Amid the cautious sentiment, individual stocks have shown resilience. "Several stocks have bounced back from key support levels, providing trading opportunities. However, traders should be selective in their approach," warned Bhosale.

F&O Action

The Nifty October futures were down by 0.04% to 24,452 at a premium of 53 points, with the open interest down by 0.7%.

The Nifty Bank October futures were up by 0.66% to 51,605 at a premium of 74 points, while its open interest was down 8.7%.

The open interest distribution for the Nifty 50 Oct. 31 expiry series indicated most activity at 25,000 call strikes, with the 24,500 put strikes having maximum open interest.

For the Bank Nifty options expiry on Oct. 30, the maximum call open interest was at 52,500 and the maximum put open interest was at 51,000.

FII/DII Activity

Overseas investors remained net sellers of Indian equities for the 19th consecutive session on Thursday, while domestic institutional investors stayed net buyers for the 23rd straight session.

The FPIs offloaded stocks worth Rs 5,062.5 crore, according to provisional data from the National Stock Exchange. The DIIs bought stocks worth Rs 3,620.5 crore.

Market Recap

The NSE Nifty 50 and BSE Sensex settled at an over two-month low on Thursday for a third consecutive session, as earnings reports failed to uplift the sentiments of investors. Moreover, a decline in Asian shares and overnight losses on Wall Street also put pressure on the Indian benchmarks.

The Nifty 50 ended 36.10 points, or 0.15%, down at 24,399.40. The Sensex ended 16.82 points, or 0.02%, lower at 80,065.16.

In Thursday's choppy session, the benchmark indices recovered briefly. Intraday, the Nifty 50 rose 0.18% to 24,480.65, and Sensex rose 0.22% to 80,259.82. And, intraday, the Nifty 50 also fell 0.39% to 24,341.20, while the Sensex declined 0.34% to 79,813.02.

Major Stocks In The News

ITC: ITC reported a revenue increase of 16%, reaching Rs 19,327.72 crore compared to Rs 16,550 crore, surpassing Bloomberg's estimate. EBITDA grew by 5% to Rs 6,335.17 crore, up from Rs 6,042 crore, though it fell short of Bloomberg's estimate.

IndusInd Bank: The company reported a 5% increase in net interest income, reaching Rs 5,347 crore compared to Rs 5,077 crore. However, net profit fell by 39% to Rs 1,325 crore, down from Rs 2,181 crore.

Godrej Consumer Prodcuts: The company reported a revenue increase of 1.77%, reaching Rs 3,666 crore compared to Rs 3,602 crore. Its net profit saw a significant increase of 13.39%, totalling Rs 491 crore compared to Rs 433 crore.

Kansai Nerolac: The company will sell its lower parel land and building for Rs 726 crore.

Global Cues

Stocks in the Asia-Pacific region were trading mixed in early Friday trade after Tesla Inc.'s surge helped Wall Street post its first session of gains this week.

Australia's S&P ASX 200 was 33 points, or 0.41%, higher at 8,240, while the Japanese Nikkei 225 was down 277 points, or 0.74%, at 37,912 as of 5:40 a.m. Futures contracts pointed to a negative start in Hong Kong while an index of US-listed Chinese shares fell on Thursday.

Stocks in the US snapped their losses to end higher buoyed by a rally in Tesla shares. The Elon Musk-owned EV maker gained as much as 22% on strong earnings and forecast, the biggest rally since May 2013, according to Bloomberg News.

Recent data showed that US jobless claims fell and were recorded at 2.27 lakh for the week ended Oct. 19 week against the estimate of 2.42 lakh. Following this, the US 10-year yields fell four basis points to 4.20%.

The S&P 500 and Nasdaq Composite advanced 0.21% and 0.76%, respectively, while the Dow Jones Industrial Average slipped 0.33%.

Crude oil prices rose after a two-day fall as traders look out for any potential Israel retaliatory strike on Iran. Brent crude was trading 0.70% lower at $74.90 a barrel as of 6:00 a.m. IST. West Texas Intermediate was up 0.68% at $70.67.

Key Levels

US Dollar Index at 104.09.

US 10-year bond yield at 4.20%.

Brent crude up 0.59% at $74.82 per barrel.

Bitcoin was down 0.22% at $67,997.25.

Gold spot was down 0.12% at $2,732.81.

Rupee Market

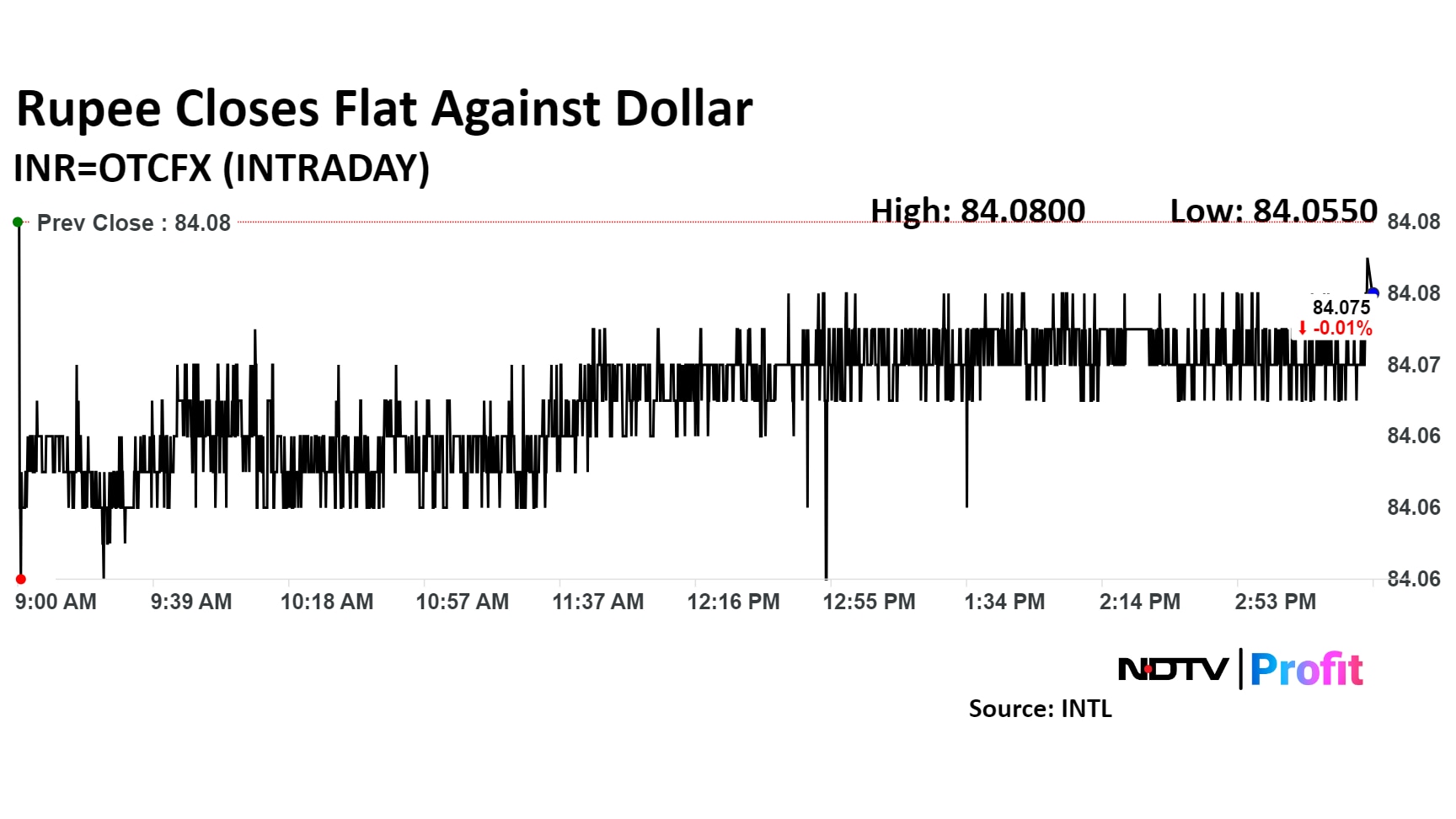

The Indian rupee closed flat against the US dollar on Thursday. The local currency ended at Rs 84.075, compared to the previous day's record low close of 84.082. The rupee traded within the range of 84.08–84.055.

The recent pressure on the rupee has come from foreign outflows from India and the greenback's strength globally. A rise in international oil prices also influenced the local currency.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.