.avif?downsize=773:435)

The NSE Nifty 50 closed Monday on a bullish note, with 24,700 likely to serve as the next important resistance and 24,385 being the strong support in the short term, according to analysts.

Sector-wise performance was mixed, with gains observed in metals, public-sector banks, and oil & gas stocks, while private banks and autos saw some profit-booking. On the volatility index, India VIX has been on a downtrend, declining 12% in the past five sessions.

Technically, the Nifty formed a small red candle on the daily chart, indicating some hesitation at higher levels. The 21-day exponential moving average near 24,385 will act as a strong support, according to Hrishikesh Yedve, assistant vice president, technical and derivatives research, at Asit C Mehta Investment Intermediates Ltd.

"As long as the index stays above 24,380, bullish momentum is expected to continue. On the upside, key resistance levels are at 24,690 and 24,960," he said.

Osho Krishan, senior analyst-technical and derivatives at Angel One Ltd., forecasts that 24,700 would be the next major resistance level, with potential hurdles around 24,800–24,850. He identified the 20-day EMA at around 24,390 as a support level to watch for any minor corrections.

"We expect Nifty to consolidate at higher levels with sectorial rotation," Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd., said.

The Bank Nifty ended the day lower at 50,368. Yedve said the Bank Nifty formed a red candle on the daily chart, signalling weakness. "A sustained move above 50,830 could push the index towards 51,200–51,500. Until then, it is likely to consolidate within the range of 49,650–50,830."

"Close monitoring of the banking index as sector momentum could significantly impact market sentiment, with global developments also likely influencing market conditions in the absence of domestic triggers," Krishan advised.

The GIFT Nifty, an early indicator of the Nifty 50 Index's performance in India, was up 10.5 or 0.04% at 24,669.5 as of 6:35 a.m.

F&O Action

The Nifty August futures were up 0.04% to 24,595 at a premium of 23 points, with open interest down 3%.

The Nifty Bank August futures were down by 0.27% to 50,485 at a premium of 117 points, while its open interest was up by 3%.

The open interest distribution for the Nifty 50 Aug. 22 expiry series indicated most activity at 25,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 21, the maximum call open interest was at 53,000 and the maximum put open interest was at 51,900.

FII/DII Activity

Overseas investors turned sellers of Indian equities on Monday after a session of buying.

Foreign portfolio investors offloaded stocks worth Rs 2,667.5 crore, while domestic institutional investors stayed net buyers for the 11th consecutive session and bought equities worth Rs 1,802.9 crore, the NSE data showed.

Market Recap

The Indian benchmarks ended with little change on Monday, while shares of Tata Consultancy Services Ltd., and Reliance Industries Ltd. rose. The NSE Nifty 50 ended 31.50 points or 0.13% higher at 24,572.65, and the BSE Sensex settled 12.16 points or 0.02% lower at 80,424.68.

During the day, the Nifty rose as much as 0.40% to 24,638.80, and the Sensex rose 0.36% to 80,475.90.

The broader indices outperformed as the BSE MidCap ended 0.53% higher and SmallCap gained 1.3%.

Three out of the 20 sectoral indices on the BSE ended lower and 17 advanced. BSE Auto fell the most and BSE Metal was the top gainer.

Major Stocks In News

Vedanta: The company's shareholding in arm Hindustan Zinc reduced to 63.42% after it offloaded a 1.51% stake through an offer for sale.

Tata Motors: The company sets Sept. 1 as record date for determining shareholders eligible for DVR share swap.

Motilal Oswal Financial Services: The company approved the proposal to raise Rs 200 crore through non-convertible debentures on private placement basis.

Bajaj Auto: The company will make Rs 211 crore provision in Q2 due to withdrawal of indexation benefit and change in tax rate.

Indusind Bank: The bank received RBI nod for undertaking mutual funds business via new subsidiary.

Share India Securities: The company has rescinded its investment by way of acquisition of equity shares of DSM Fresh Foods Pvt. Ltd., considering the negative feedback received from the company's investors and stakeholders.

Poly Medicure: The company opened its QIP, sets floor price at Rs 1,880.69 per share.

Hazoor Multi Projects: The company emerged as lowest bidder for Maharashtra State Infra Development Corp project worth Rs 274 crore.

Hi-Tech Pipes: The company approved raising up to Rs 600 crore via QIP or other means.

Global Cues

Stocks in the Asia-Pacific region powered ahead on Tuesday following a rally in Wall Street that saw the benchmark gauge S&P 500 rise to record its longest rally in 2024 ahead of the rate cut confirmation later this week.

Japanese stocks recorded the most gains in early trade, while Australian and South Korean scrips edged higher. The Nikkei 225 was 1.17% higher at 37,834, and the Kospi was 0.55% higher at 2,689 as of 6:24 a.m.

China will release its loan prime rates, and the Eurozone will release its CPI print during the day. Jerome Powell is expected to confirm if interest rate cuts are on the cards when he speaks at the Jackson Hole meeting later this week on Friday.

Amid bets that the Federal Reserve will signal it's ready to start cutting interest rates, US stocks rallied on Monday, with technology stocks leading the gains. The S&P 500 and Nasdaq Composite climbed 0.97% and 1.39%, respectively, on Monday. The Dow Jones Industrial Average advanced 0.58%.

Brent crude was trading 0.15% lower at $77.54 a barrel as of 06:33 a.m. Gold rose 0.04% to $2,505.37 an ounce.

Key Levels

US Dollar Index at 101.87

US 10-year bond yield at 3.87%

Brent crude down 0.15% at $77.54 per barrel

Bitcoin was up 2.30% at $60,460.68

Gold was up 0.04% at 2,505.37

Money Market

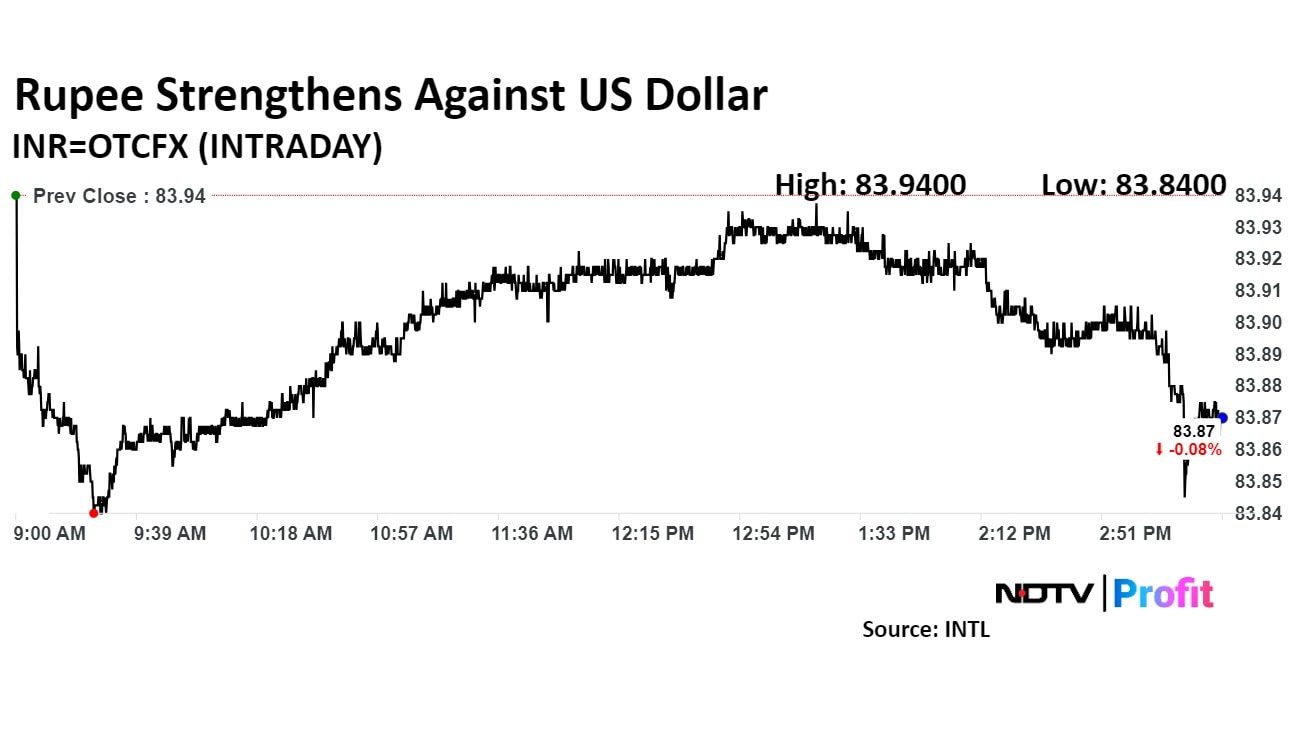

The Indian rupee closed stronger on Monday, supported by a weak US dollar and an easing in Brent crude oil prices following ceasefire talks between Israel and Iran-backed Hamas.

The rupee appreciated 8 paise to close at Rs 83.87 after opening at Rs 83.89 against the US dollar. The local currency closed at Rs 83.95 on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.