Nifty's range of 24,070–24,000 will act as a demand zone for the benchmark index in the short term, according to analysts. The index closed with a loss of 66 points at 24,415 on Wednesday, experiencing post-budget impact and trading in negative territory throughout the session.

"We expect the market to consolidate in the near term," said Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd. "The market is expected to swiftly move past the budget and refocus on corporate earnings growth. So far in Q1 FY25, earnings growth has been slightly below expectations," said Khemka.

This seems to be a time-wise correction for the index, as the broader markets have been doing well, while the RSI oscillator on the benchmark is hinting at a continuation of the corrective phase, according to Ruchit Jain, lead researcher at 5paisa.com.

"Traders are advised to trade with a stock-specific approach for the near term. The immediate support for the Nifty is placed around 24,200, followed by 24,000. While 24,700–24,800 is the resistance zone," Jain said.

On the upside, the high of the bearish engulfing candle is placed near 24,855. Until the index conquers these levels, a fresh rally appears difficult for the index in the short term, according to Hrishikesh Yedve, AVP technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

The Bank Nifty on a daily scale has retested its previous breakout from the rounding bottom pattern and managed to close above it.

"As long as the index holds above the 51,000–50,950 levels, a short-term relief rally cannot be ruled out. However, sustaining below 50,950 will trigger fresh weakness for the Bank Nifty," said Yedve.

GIFT Nifty was trading 8 points, or 0.03%, higher at 24,261 as of 06:49 a.m.

F&O Action

The Nifty July futures are down 0.17% to 24,388 at a discount of 95 points, with open interest down 19.8%.

Nifty Bank July futures are up by 0.65% to 51,401 at a premium of 84 points, while its open interest is down by 17.21%.

The open interest distribution for the Nifty 50 July 25 expiry series indicated most activity at 25,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options July 24 expiry, the maximum call open interest was at 51,400 and the maximum put open interest was at 51,300.

FII, DII Activity

Overseas investors remained net sellers of Indian equities on Wednesday for the second straight day.

Foreign portfolio investors offloaded stocks worth Rs 5,130.9 crore post-budget day, while domestic institutional investors stayed net buyers for the third session and mopped up equities worth Rs 3,137.3 crore, the NSE data showed.

Market Recap

Benchmark equity indices fell for a fourth consecutive session on Wednesday, logging their worst streak since five consecutive sessions of decline till May 30. Today's fall was due to a loss in the shares of financial services stocks.

The NSE Nifty 50 closed down 65.55 points, or 0.27%, at 24,413.50, while the S&P BSE Sensex ended 280.16 points or 0.35%, lower at 80,148.88. Intraday, the Nifty fell 0.70% and the Sensex declined 0.84%.

Market breadth was skewed in favour of buyers. Around 2,810 stocks advanced, 1,088 stocks declined, and 110 stocks remained unchanged on the BSE.

Broader markets outperformed benchmark indices. The S&P BSE Midcap and Smallcap indices ended 0.68% and 1.91% higher, respectively.

On BSE, 16 sectors advanced and four declined out of 20. The S&P BSE Oil and Gas rose the most, while the S&P BSE Bankex declined the most.

Major Stocks In News

SBI: The company signed a non-binding MoU worth £750 million joint investment with the UK's Foreign, Commonwealth & Development Office.

RBL Bank: Hong Kong-based Baring Private Equity Asia plans to exit the company Ltd. by divesting its entire 7.9% equity via open market transactions on Thursday. The foreign portfolio investor, through its vehicle Maple II BV, has offered to sell 4.78 crore shares at a floor price of Rs 226 per share, according to people in the know.

Shipping Corporation of India: The company will explore possible business collaborations with central and state enterprises and private entities.

Dish TV: The company approved setting up a new subsidiary for digital platforms and ancillary services.

Nestle India: The company and Dr Reddy's Laboratories have announced the formation of a joint venture, which will be called Dr. Reddy's and Nestlé Health Science Ltd. The partnership was reportedly made to combine the established reputed range of nutritional products of Nestlé Health Science with the nutraceuticals portfolios and established market share of Dr. Reddy's Laboratories in India.

BSE: The company received SEBI's nod to act as a research analyst and investment adviser administration body. The company is to undertake the business of administrative and supervisory body effective July 25.

RVNL: The company received a letter of acceptance from SouthEastern Railway for a Rs 192 crore construction project.

Global Cues

Asian stocks extended their losses on Thursday following a rout in artificial intelligence stocks in the US due to a disappointing start to their earnings.

Japan's equity benchmark plunged nearly 3% in early trade while those in Australia and South Korea were trading lower. The Nikkei 225 was 1,056 points or 2.69% lower at 38,099, while the S&P ASX 200 was 75.5 points or 0.95% down at 7,887.5 as of 06:34 a.m.

Meanwhile, South Korea will report its GDP print on Thursday while the US will also report GDP data along with its initial jobless claims.

Wall Street brought an end to the AI frenzy after the megacaps began earnings season on a disappointing note. The tech-heavy Nasdaq witnessed the worst fall among the indices with the S&P 500 seeing the worst day since December 2022, according to Bloomberg.

The S&P 500 Index and Nasdaq Composite declined 2.31% and 3.64%, respectively as of Wednesday. Dow Jones Industrial Average fell 1.25%.

Brent crude was trading 0.38% lower at $81.40 a barrel. Gold was 0.04% up at $2,398.59 an ounce.

Key Levels

U.S. Dollar Index at 104.32

U.S. 10-year bond yield at 4.26%

Brent crude down 0.38% at $81.40 per barrel

Bitcoin was down 0.77% at $65,535.78

Gold spot was up 0.04% at $2,398.59

Money Market Update

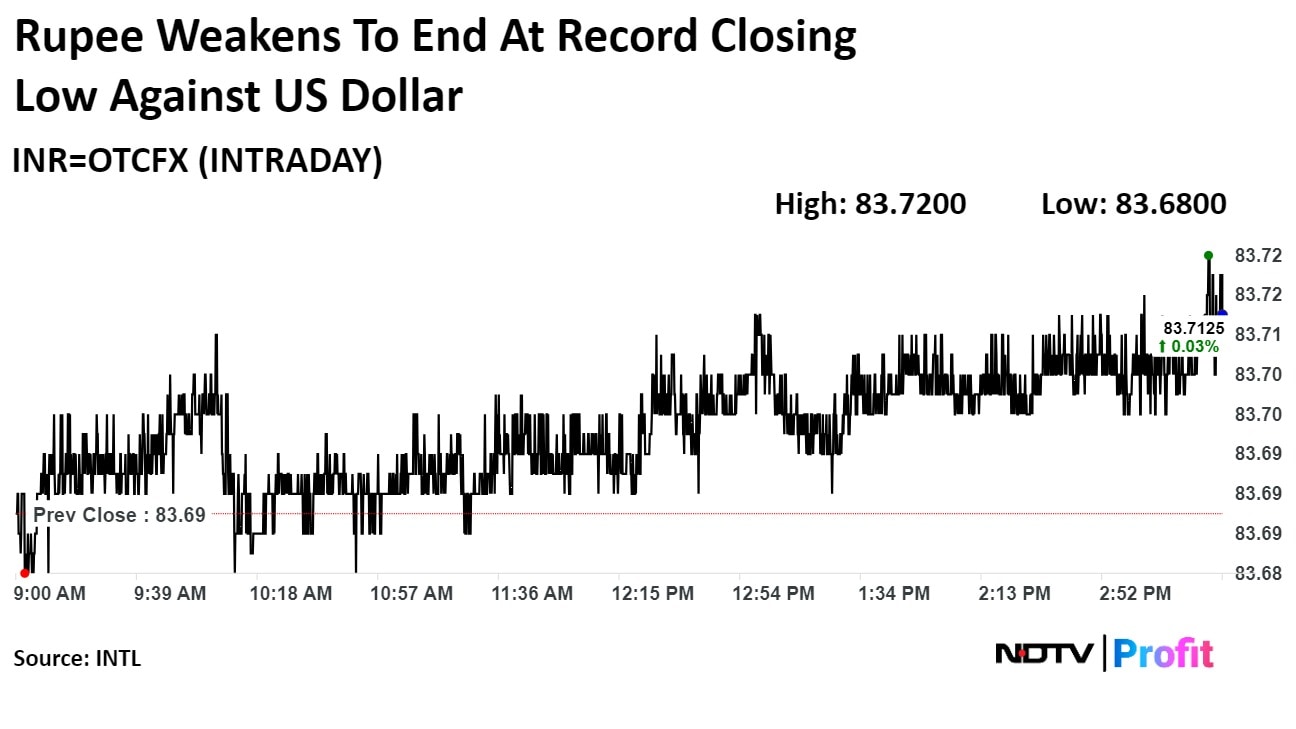

The Indian rupee ended at a record low for the second day in a row on Wednesday on likely foreign fund outflows from stocks after the government hiked capital gain tax in Budget 2024.

The local currency closed at Rs 83.71 after opening at Rs 83.69 against the greenback on Wednesday. On Tuesday, it closed at a record low of Rs 83.69.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.