As the markets head into Tuesday's session, the Nifty, which extended its remarkable winning streak to 13 sessions and closed at 25,279 on Monday, will be watched closely.

Despite registering a new all-time high of 25,333.65, the index experienced some profit booking, indicating potential fatigue in the market, according to analysts.

The index, while forming a red candle on the daily chart, continues to hold well above the breakout from a rounding bottom pattern, signalling underlying strength, said Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd. However, the rise in the volatility index by nearly 5%, settling at 14.06, suggests that market volatility could increase, he added.

Despite the Nifty's continued upward momentum, options data indicates heavy call writing at the 25,300 level, which could act as resistance during the weekly expiry, said Kush Bohra, founder of KushBohra.com. He advised traders to consider booking profits and reinvesting at a dip, as the current bullish trend might face headwinds.

The market breadth ended on a negative note despite a positive start, with mixed action across sectors, said Avdhut Bagkar, technical and derivatives analyst at StoxBox. He warned that the price action, which showed a lower high pivotal structure, could indicate potential selling pressure in the coming sessions.

While the market sentiment remains bullish, the Nifty struggled to cross the resistance zone of 25,286 after hitting its intraday high, said Aiyub Yacoobali, chairman and managing director of South Gujarat Shares and Sharebrokers Ltd. He also said that profit booking at higher levels and the muted performance of banking stocks, coupled with a relief rally in the dollar index, could influence market direction.

As we head into one of the most challenging months for stocks with the Fed rate cut on the horizon, the overall sentiment suggests that investors should approach Tuesday's session with caution.

The GIFT Nifty, an early indicator of the Nifty 50's performance in India, was down 10.5 points or 0.04% at 25,346.5 as of 6:57 a.m.

F&O Action

The Nifty September futures were down 0.15% to 25,340.45 at a premium of 61.75 points, with open interest up by 7.23%.

The Nifty Bank September futures were down 0.05% to 51,650.7 at a premium of 211.15 points, while its open interest was up by 0.06%.

The open interest distribution for the Nifty 50 Sept. 5 expiry series indicated most activity at 26,000 call strikes, with 25,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Sept. 4, the maximum call open interest was at 59,000 and the maximum put open interest was at 51,000.

FII/ DII Activity

Overseas investors remained net buyers of Indian equities for the third consecutive session on Monday.

Foreign portfolio investors mopped up stocks worth Rs 1,735.5 crore and domestic institutional investors turned net buyers after one day of selling and offloaded equities worth Rs 356.4 crore, the NSE data showed.

Market Recap

The benchmark stock indices recorded their best closing on Monday, with the NSE Nifty 50 extending gains for the 13th consecutive session—its longest run in decades—and the S&P BSE Sensex rising for the 10th consecutive session.

The Nifty closed 42.80 points, or 0.17%, higher at 25,278.70, and the Sensex closed 194.07 points, or 0.24%, up at 82,559.84. Intraday, the Nifty hit a new record high of 25,333.60 and the Sensex touched a fresh lifetime high of 82,725.28.

Major Stocks In News

Hindustan Aeronautics: The Cabinet Committee on Security approved a proposal for procurement of 240 aero-engines (AL-31FP) for the Indian Air Force's Su-30 MKI aircraft for Rs 26,000 crore from HAL under the buy (Indian) category.

Vedanta: Approves a third interim dividend of Rs 20 per share, totaling a payout of Rs 7,821 crore.

Kaynes Technology: Cabinet approves proposal for a new manufacturing plant with a capacity of 6.3 million chips per day. The total cost of the project is Rs 3,300 crore.

Hindustan Composites: To purchase 150,000 Swiggy shares for Rs 5 crore.

NMDC: Receives a penalty order of Rs 1,620 crore for alleged transport of iron ore without a Railway Transit Pass. The company also reported a 10% decrease in total production to 3.07 MT and an 11.3% drop in total sales to 3.14 MT for August.

Welspun Corp: Board approves a $100 million investment by its subsidiary, Welspun Pipes, for upgrading HFIW pipe manufacturing capabilities in the USA.

Maruti Suzuki: Reports a 2% increase in total production for August, reaching 1,69,000 units year-over-year.

Adani Green Energy: Approves the execution of binding documents, including a joint venture agreement with ARE64L and TotalEnergies Renewables. TotalEnergies will invest an additional $444 million to form a 50:50 JV with Adani Green. The new JV will manage a 1,150 MWac portfolio, including both operational and under-construction solar assets.

Tata Motors: Receives a penalty order of Rs 2 crore from the assistant commissioner, Jamshedpur. The penalty is not expected to have a material financial impact.

Shriram Finance: Board approves a fund raise through debt securities via private placement. The issue size is Rs 500 crore, with a greenshoe option of Rs 1,500 crore.

Global Cues

Most stocks in the Asia Pacific region were trading higher and shrugged off any concerns about a jittery September for US markets while the prospects of rate cuts this month aided sentiments.

Equity benchmarks in Japan and South Korea climbed in early trade while those in Australia slipped. The Nikkei 225 was 0.62% higher at 38,940, and the S&P ASX 200 was 0.27% down at 8,088 as of 6:32 a.m.

Weak factory data in China took a toll on the nation's stocks as their benchmark gauge logged losses in the previous session.

The US markets were shut on Monday on account of Labor Day and will be in focus for the week ahead of the American job market due on Friday. The data will be closely watched out for as it will confirm the September rate cuts.

Meanwhile, futures contracts in the US pointed at a negative start for the week. The S&P 500 and Nasdaq Composite advanced 1.01% and 1.13%, respectively, on Friday. The Dow Jones Industrial Average rose 0.55%.

Brent crude was trading 0.40% lower at $77.21 a barrel as of 06:55 a.m. Gold fell 0.31% to $2,491.64 an ounce.

Key Levels

US Dollar Index at 101.67.

US 10-year bond yield at 3.92%.

Brent crude down 0.39% at $77.22 per barrel.

Bitcoin was up 0.29% at $59,173.44.

Gold fell 0.31% at $2,491.64.

Money Market

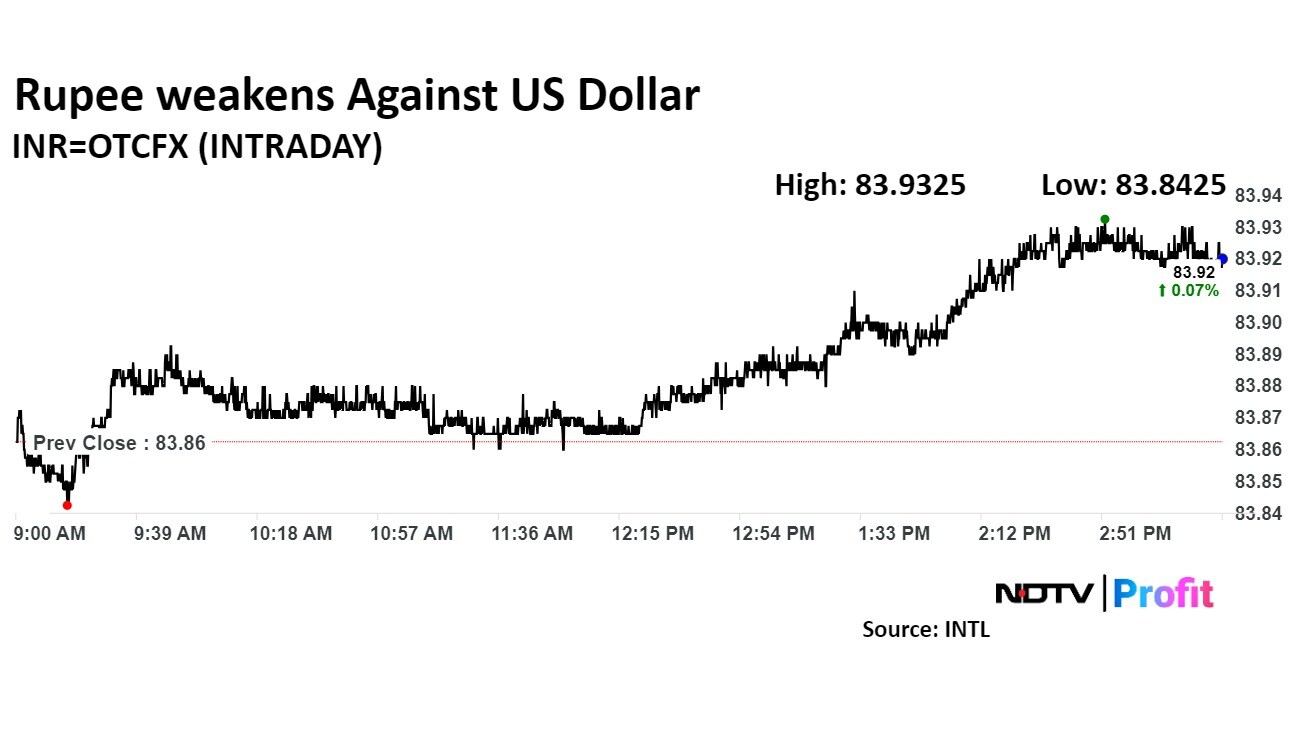

The Indian rupee weakened against the US dollar by 5 paise on Monday.

The rupee closed at Rs 83.92 after opening unchanged at Rs 83.87 against the US dollar, according to Bloomberg data. It closed at Rs 83.87 on Friday.

Oil prices extended losses on Monday against a sharp drop in output from Libya and sluggish demand from China and the US—the world's two biggest oil consumers—as indications emerged that OPEC+ plans to lift output starting in October, according to Anil Kumar Bhansali, head of Treasury and executive director at Finrex Treasury Advisors LLP.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.