As the markets head into Monday's session, investors will be watching closely to see if the Nifty can maintain its upward momentum following a significant breakout from a rounding bottom pattern.

This technical move suggests that the index could advance towards the 25,500 level in the short term, with the potential to rally further to 26,000-26,250 if it sustains above this key threshold, according to Hrishikesh Yedve, AVP of Technical and Derivatives Research at Asit C. Mehta Investment Intermediates Ltd.

"The Nifty extended its gains for the twelfth consecutive session, marking the strongest rally since its inception in 1996. The Sensex also rose for the ninth consecutive session. Both indices closed at all-time highs," said Avdhut Bagkar, Technical and Derivatives Analyst at StoxBox.

The markets are expected to continue their northbound journey. However, global macroeconomic data expected next week, including inflation and employment reports, could provide crucial cues for domestic equities, said Siddhartha Khemka, Head of Research and Wealth Management at Motilal Oswal Financial Services.

Analysts like Khemka also anticipate continued stock-specific action, while Vikram Kasat of Prabhudas Lilladher warns of potential volatility, depending on how these economic indicators play out.

Investors should also be prepared for increased market fluctuations, as corporate earnings and any unexpected global developments could influence trading sentiment, warned analysts.

The GIFT Nifty, an early indicator of the Nifty 50's performance in India, was down 12 points or 0.05% at 25,419.5 as of 6:44 a.m.

FPI/DII Data

Overseas investors remained net buyers of Indian equities for the second successive day on Friday.

Foreign portfolio investors bought stocks worth Rs 5,318.1 crore and domestic institutional investors turned net sellers after two days of buying and offloaded equities worth Rs 3,198.1 crore, the NSE data showed.

Market Recap

India's benchmark stock indices ended at a record closing high on Friday, with the Nifty 50 extending gains for the 12th consecutive session, marking the best rally since its launch in 1996. Similarly, Sensex rose for the ninth consecutive session.

The NSE Nifty 50 ended 0.40%, or 100.55 points, higher at 25,252.50, and the Sensex closed 0.28%, or 231.16 points, up at 82,365.77. Intraday, the Nifty hit a new record high of 25,263.20 and the Sensex touched a fresh lifetime high of 82,637.03.

Major Stocks In News

Navratna Status: Solar Energy Corporation of India, RailTel Corporation of India, SJVN Ltd. and NHPC Ltd received Navratna status from Government of India.

Adani Energy Solutions: The company signed share purchase agreement with REC Power Development and Consultancy to buy Khavda IVA power transmission.

Fortis Healthcare: The company is set to buy entire 31.52% stake held by PE Investors in arm Agilus Diagnostics. It will fund this acquisition via issuance of NCD's.

Century Textiles: The company's unit Birla Estates is in co-development pact with LGCPL Group for 131-acre land parcel in Noida, Uttar Pradesh.

Canara Bank: Credit Agency Moody's assigned Baa3 rating with stable outlook to the issue of up to $500 million notes.

Insecticides (India): The board approved Rs 50 crore buyback at Rs 1,000 per share. Record date set as Sept. 11.

HDFC Asset Management Co.: Life Insurance Corporation of India reduced stake in HDFC AMC to 2.88% from 4.9% from July 1 to Aug. 29.

Biocon: The company approval from the US FDA and will now commence commercial supplies for its greenfield active-pharmaceutical-ingredient facility. It has also received the nod for its new drug called Daptomycin.

Reliance Industries: The NCLT, Mumbai, has approved the media merger between Viacom18 and Star India on Friday. Recently, the Competition Commission of India also sanctioned the merger.

Aditya Birla Capital: The company completed 50% stake sale of Aditya Birla Insurance Brokers to Samara Capital arm Edme Services for upfront consideration of Rs 252 crore.

Global Cues

Asia-Pacific stocks began the week mixed as concerns linger over China's growth following the decline in factory activity. Mixed expectations of September rate cuts by the US Federal Reserve also called for an early caution.

Equity benchmark in Japan climbed while those in Australia and South Korea were trading lower. The Nikkei 225 was 0.80% higher at 38,995, and the S&P ASX 200 was 0.37% down at 8,062 as of 6:27 a.m.

Factory activity in China declined for the fourth straight month in August to 49.1 from 49.4 in July. This came while the South Asian country's slump in home sales also contracted, deepening its economic troubles.

Asian stocks will be in focus as Israel's largest labour group is poised for a nationwide strike on Monday adding pressures to secure the release of hostages held by Hamas.

Meanwhile, global stocks are poised for a volatile September — a historically volatile month — ahead of the potential rate cut by the US Fed, according to Bloomberg.

US stocks ended the previous week with gains in the last stretch of trading on Friday. The S&P 500 and Nasdaq Composite advanced 1.01% and 1.13%, respectively. The Dow Jones Industrial Average rose 0.55%.

Brent crude was trading 0.38% lower at $76.64 a barrel as of 06:40 a.m. Gold rose 0.02% to $2,503.94 an ounce.

Key Levels

US Dollar Index at 101.72

US 10-year bond yield at 3.90%

Brent crude down 0.38% at $76.64 per barrel

Bitcoin was down 1.52% at $57,533.82

Gold rose 0.02% at $2,503.94.

Money Market

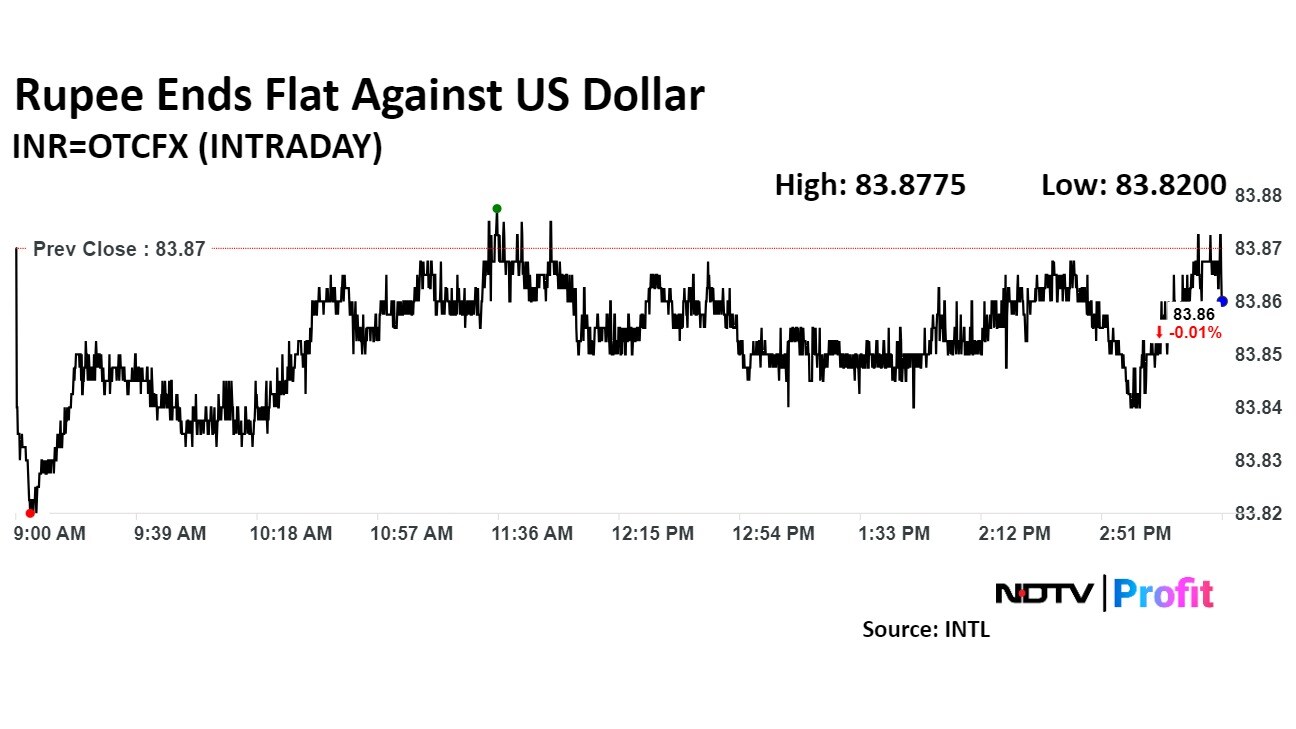

The Indian rupee closed flat after strengthening for the second consecutive day against the US dollar on Friday, ahead of expected foreign inflows aided by the August MSCI rejig.

The rupee closed flat at Rs 83.87 after opening strong at Rs 83.84 against the US dollar, according to Bloomberg data. The currency closed at Rs 83.87 on Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.