India's benchmark stock indices, Nifty and Senex, as long as it stays above the 20-day average or 24,800 and 81,000, respectively, the pullback trend will keep going, according to the analyst.

"On the higher side, the indices (Nifty/Sensex) could move till 25,000/81,800 and 25,125/82,200," said Shrikant Chouhan, head equity research at Kotak Securities. "On the other side, below 24,800/81,000, the uptrend would be vulnerable; traders may prefer to exit from their long positions."

NSE Nifty 50 remains a sell-on rise as long as it remains below 25,100, according to Rupak De, senior technical analyst at LKP Securities.

"On the higher end, the 25,000-25,100 range may act as crucial near-term resistance, where sellers could re-enter. On the lower end, support is placed at 24,800-24,785, below which selling might increase," he said.

A zone of 24,730-24,780 will be considered a strong support area, while on the higher side, it needs to clear the hurdle of 25,000-25,100 to resume an uptrend, said Aditya Gaggar, director of Progressive Share Brokers Pvt.

The GIFT Nifty, an early indicator of the Nifty 50's performance in India, was up 71.5 points or 0.29% at 25,051.5 as of 6:23 a.m.

F&O Action

Nifty September futures rose by 0.35% to 24,985 at a premium of 48.6 points, while open interest fell by 3.92%.

Nifty Bank September futures rose by 1% to 51,267.4 at a premium of 149.6 points, while open interest fell by 6.18%.

The open interest distribution for the Nifty 50 Sept. 12 expiry series indicated most activity at 26,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Sept. 11, the maximum call open interest was at 52,900 and the maximum put open interest was at 46,000.

FII/DII Activity

Overseas investors turned net buyers of Indian equities on Monday after being net sellers for two consecutive sessions.

Foreign portfolio investors mopped up equities worth Rs 1,176.6 crore; domestic institutional investors stayed net buyers for the sixth consecutive session and purchased equities worth Rs 1,757 crore, the NSE data showed.

Market Recap

The benchmark stock indices reversed losses to close higher on Monday, buoyed by financial stocks.

The NSE Nifty 50 closed 84.25 points or 0.34% higher, at 24,936.40 to snap a three-session fall. The S&P BSE Sensex closed 375.61 points or 0.46%, up at 81,559.54, reversing a four-day decline.

Major Stocks In News

Pharma Companies: The GST rate on cancer drugs, namely Trastuzumab, Deruxtecan, Osimertinib, and Durvalumab, will be reduced from 12% to 5%. Abbott India, Zydus Lifesciences, Alkem Laboratories, Cipla, Biocon, and AstraZeneca Pharma India are the stocks likely to be impacted.

Snack-making companies: The GST rate for extruded or expanded savoury snacks will be reduced from 18% to 12%. Prataap Snacks, Bikaji Foods International, and Gopal Snacks will likely be impacted.

Bharat Seats: The GST rate for car seats will increase from 18% to 28%. The company will be impacted by this move.

PNB Housing Finance: The board has approved the issuance of non-convertible debentures up to Rs 2,500 crore on a private placement basis, in tranches over the next six months.

Ahluwalia Contracts: The company has received two contracts worth Rs 1,307 crore from SignatureGlobal for housing projects in Gurugram.

Easy Trip Planners: The board of directors of the company is scheduled to meet on Sept. 13 to consider the proposal for multiple acquisitions.

Piccadily Agro Industries: The company has allotted 28.49 lakh compulsory convertible debentures. The company has also allotted 6.72 lakh convertible warrants at an issue price of Rs. 744 each.

Paisalo Digital: The company's board will meet on Sept. 12 to consider the issuance of listed commercial papers through a private placement basis and allotment of commercial papers through a private placement basis.

Hindustan Aeronautics: The Ministry of Defence has signed a Rs 26,000 crore contract with HAL for 240 AL-31FP Aero Engines for Su-30MKI aircraft.

GMR Airports: The company will acquire a 10% stake in Delhi International Airport from Fraport AG for $126 million. The company's stake in the airport will increase to 74%.

Awfis Space Solutions: The company is selling its Facility Management division, ‘Awfis Care,' to SMS Integrated Facility Services Private Ltd. for a total consideration of Rs 27.50 crore.

Action Construction: The company has received an order for 99 forklifts from the Defence Ministry.

BF Utilities: Toll operations of the company's arm, Nandi Highway Developers, ceased with effect from Sept. 7.

Hero MotoCorp: Ather Energy Ltd., an associate company of the company, has filed a draft red hearing prospectus with SEBI, BSE, and NSE Ltd. The IPO will consist of a fresh issue of equity shares aggregating up to Rs 3,100 crore along with an offer for sale of 2.20 crore equity shares by certain existing and eligible shareholders of Ather Energy.

IRB Infra Developers: The company's August toll collection was up 20% year-on-year at Rs 503 crore.

Arvind: The company has made a further investment of Rs 48 crores by way of subscribing to equity shares of its wholly owned subsidiary, Arvind Technical Products Pvt Ltd., on a rights basis.

Dixon Technologies: The company has signed a MoU with HP India Sales for manufacturing notebooks, desktops, and all-in-one PCs.

HG Infrastructure: The company gets a letter of approval for a road project worth Rs 781 crore from the Transport Ministry.

Premier Energies: The company has received an order worth Rs 215 crore for solar water pumping systems from the Uttar Pradesh Agriculture Department.

Tata Power: The company has commenced production of solar cells at its 4.3 GW manufacturing plant in Tamil Nadu.

Religare Enterprises: Mumbai Police registers an FIR against three senior officials, including Executive Chairperson Rashmi Saluja, based on an ED complaint. FIR also mentions Group CFO Nitin Aggarwal and Group General Counsel Nishant Singhal. The FIR was filed alleging offences under sections 420 and 120B of IPC and the concerned officials have denied the allegations made in the FIR. Financial impact on the company is not quantifiable at this stage.

Aarti Drugs: Buyback worth Rs 60 crore to open on Sept. 11 and close on Sept. 18.

Mastek: SMALLCAP World Fund Inc. has sold a 5.9% stake in Mastek Ltd., thereby reducing its holding in the company to 1.8%.

IREDA: The company signs an MoU with SJVN and GMR for a 900 MW hydropower project in Nepal.

Sona BLW: The company raises Rs 2,400 crore via QIP and allots 3.5 crore shares to QIBs at an issue price of Rs 690 per share.

Brigade Enterprises: Unknown persons have circulated letters to the general public by copying or imitating the letterhead of the company. These letters relate to buying opportunities of the company's equity shares at a discount through a third party.

AU Small Finance Bank: India Ratings and Research Private has reaffirmed the rating of IND AA/Stable for the long-term debt instruments (Tier-II Bonds) of the bank. The bank has entered into a corporate agency agreement with Kotak Mahindra Life Insurance Company Ltd. to provide life insurance solutions to the bank's customers. This tie-up will enable the bank's customers to access a wide range of life insurance products from Kotak Mahindra Life Insurance.

Zaggle Prepaid Ocean Services: The company has agreed with HDFC ERGO General Insurance Company Ltd. for the reward platform 'Zaggle Propel'.

Lemon Tree Hotels: The company has signed a new property in Nashik through its subsidiary Carnation Hotels Private. The property will open in the financial year 2026.

Kalpataru Projects: The allotment of equity shares of Kalpataru Power Do Brasil Participacoes S.A., Brazil, a wholly owned subsidiary of the company, pursuant to the conversion of the outstanding loan granted to KPBPSA.

Global Cues

Asian stocks recovered Monday's losses to open higher, ahead of the US inflation print which could provide cues to the size of September rate cuts.

The Australian and the Japanese benchmarks climbed while that of South Korea declined. US equity futures contracts edged lower early Tuesday. The Nikkei 225 was 0.14% higher at 36,221, and the S&P ASX 200 was up 0.66% at 8,040 as of 6:13 a.m.

Traders will shift focus to the upcoming CPI data in the US due on Sept. 11, hoping that it may aid the Fed in shifting focus to a soft landing.

China's trade data will be released on Tuesday while Germany is set to publish CPI data. Analysts will also be eyeing the presidential debate between Donald Trump and Kamala Harris during the day.

The S&P 500 and Dow Jones Industrial Average rose 1.16% and 1.20%, respectively. The Nasdaq Composite advanced 1.16%.

Meanwhile, oil prices recovered after dropping to the lowest in over a year last week. Brent crude was trading 0.07% higher at $71.89 a barrel as of 8:16 a.m. IST. Gold was up 0.08% at $2,534.70 an ounce.

Global Cues

US Dollar Index at 101.68

US 10-year bond yield at 3.70%

Brent crude up 0.07% at $71.89 per barrel

Bitcoin was down 0.61% at $56,675.77

Gold was up 0.08% at $2,534.70 an ounce.

Money Market

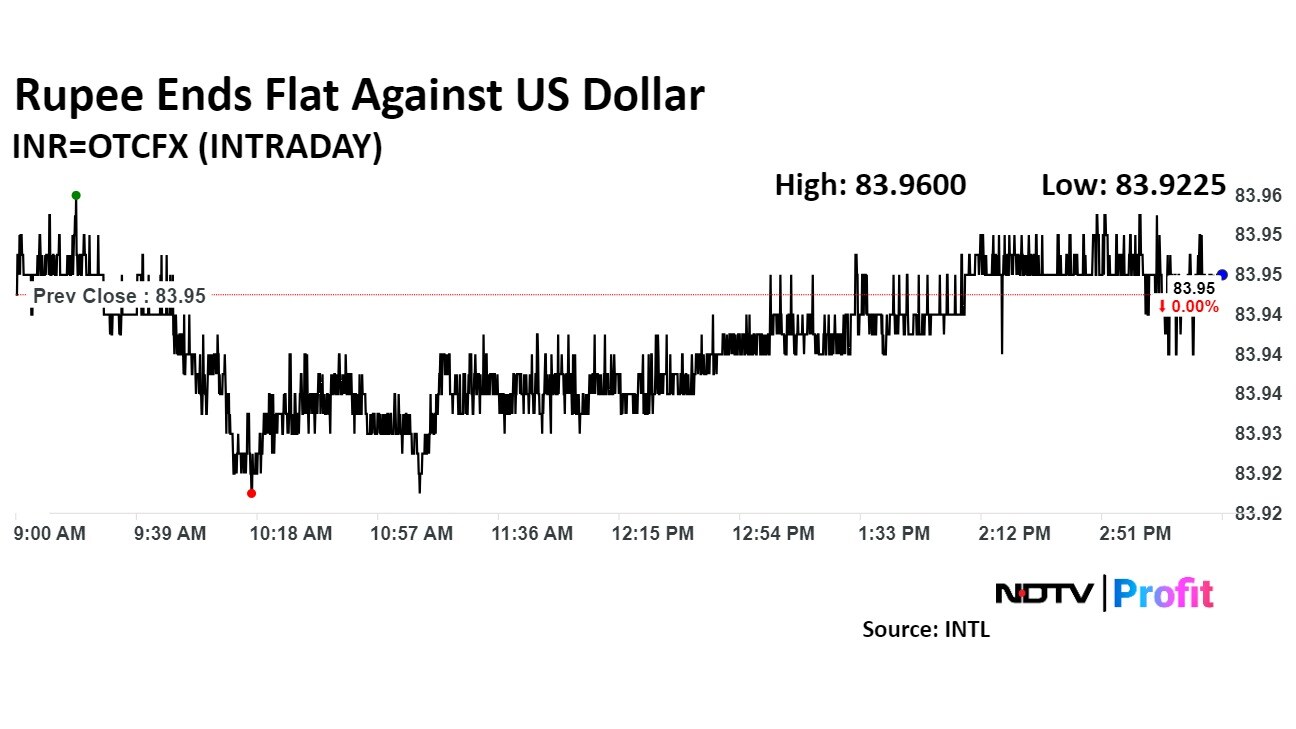

The Indian rupee closed little changed against the US dollar on Monday amid expectations of continued intervention from the Reserve Bank of India.

The rupee closed flat at 83.95 against the US dollar after opening at Rs 83.96 against the US dollar, according to Bloomberg data. The domestic currency had closed at Rs 83.95 on Friday.

Research Reports

Kross IPO - Issue Details, Peer Comparison, Financials, Strategies, Risks And More: Anand Rathi

Kross IPO - Issue Details, Financials, Strengths, Risks, Investment Rationale And More: DRChoksey

VA Tech Wabag - ‘Riding The Wave'; Axis Securities Initiates Coverage With A 'Buy' Rating

RR Kabel - Wired For Growth; Yes Securities Initiates Coverage With A 'Buy' Rating

Karur Vysya Bank - Well Placed On LDR, Growth, Asset Quality, RoA Superiority: ICICI Securities

Persistent Systems - Worries On Margins To Recede: Motilal Oswal

AU SFB - Applies For Universal Bank License; Merger Integration With E-Fincare On Track: Nirmal Bang

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.