Market analysts revised their estimates of the support and resistance zones for India's benchmark stock index Nifty 50 after the index fell on Wednesday, following two consecutive days of gains.

For traders, 24,250–24,200 would act as a key support zone, and 24,500–24,550 would be the key resistance area (for Nifty), according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

"With Nifty monthly expiry tomorrow, 24,000 is an important level to watch on the downside," said Vikram Kasat, head advisory at Prabhudas Lilladher Pvt.

Nifty 50 is oscillating in a broad range, trading between the resistance of 24,480 and the support of 24,200, according to Aditya Gaggar, director of Progressive Shares Brokers Pvt.

For Bank Nifty, "the 100-day exponential moving average support positioned near 51,140 and resistance at the previous swing high of 52,580", said Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

"In the near term, Bank Nifty is likely to consolidate within the 51,000-52,580 range," he said.

F&O Cues

The Nifty October futures were down by 0.45% to 24,371 at a premium of 31 points, with the open interest down by 27.2%.

The Nifty Bank November futures were up by 0.64% to 52,260 at a premium of 453 points, while its open interest was up 44%.

The open interest distribution for the Nifty 50 Oct. 31 expiry series indicated most activity at 25,000 call strikes, with the 24,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Nov. 6, the maximum call open interest was at 60,500 and the maximum put open interest was at 55,700.

FII/DII Activity

Overseas investors remained net sellers of Indian equities for the 23rd consecutive session on Wednesday and offloaded stocks worth a total of Rs 1.19 lakh crore during the period, while domestic institutional investors stayed net buyers for the 27th straight session.

Foreign portfolio investors offloaded stocks with an approximate value of Rs 4,613.6 crore, according to provisional data from the National Stock Exchange. The DIIs bought stocks worth Rs 4,518.3 crore.

In the last five sessions, the FPIs have sold equities valued at Rs 16,489.6 crore, while the DIIs have purchased shares worth Rs 14,429 crore.

Market Recap

Indian frontline indices resumed decline after a two–day rally, amid a jump in the market volatility as Infosys Ltd. and ICICI Bank Ltd. share prices declined.

The Nifty 50 ended 126 points, or 0.51% lower at 24,340.85, and the Sensex ended 426.85 points, or 0.53% down at 79,942.18.

The India Volatility Index jumped 8.16% to 15.70, the highest level since Aug. 14. The index ended 6.85% higher at 15.51.

Stocks In The News

RVNL: The public sector firm has received letter of acceptance from East Coast Railway for construction work worth Rs 284 crore.

Adani Green Energy: A unit of the company has entered into a pact with Maharashtra State Electricity Distribution company for supply of 5 GW solar power.

Ujjivan Small Finance Bank: The private lender announced that S Balakrishna Kamath will take charge as its chief financial officer, with effect from Dec. 5.

Zydus Wellness: The company has received board nod to acquire 100% stake in Naturell (India), in a move aimed at taking a strategic leap into healthy consumer snacking space.

Sonata Software: The company announced a partnership with a Fortune 50 American multinational technology conglomerate for global retail operations.

Money Market

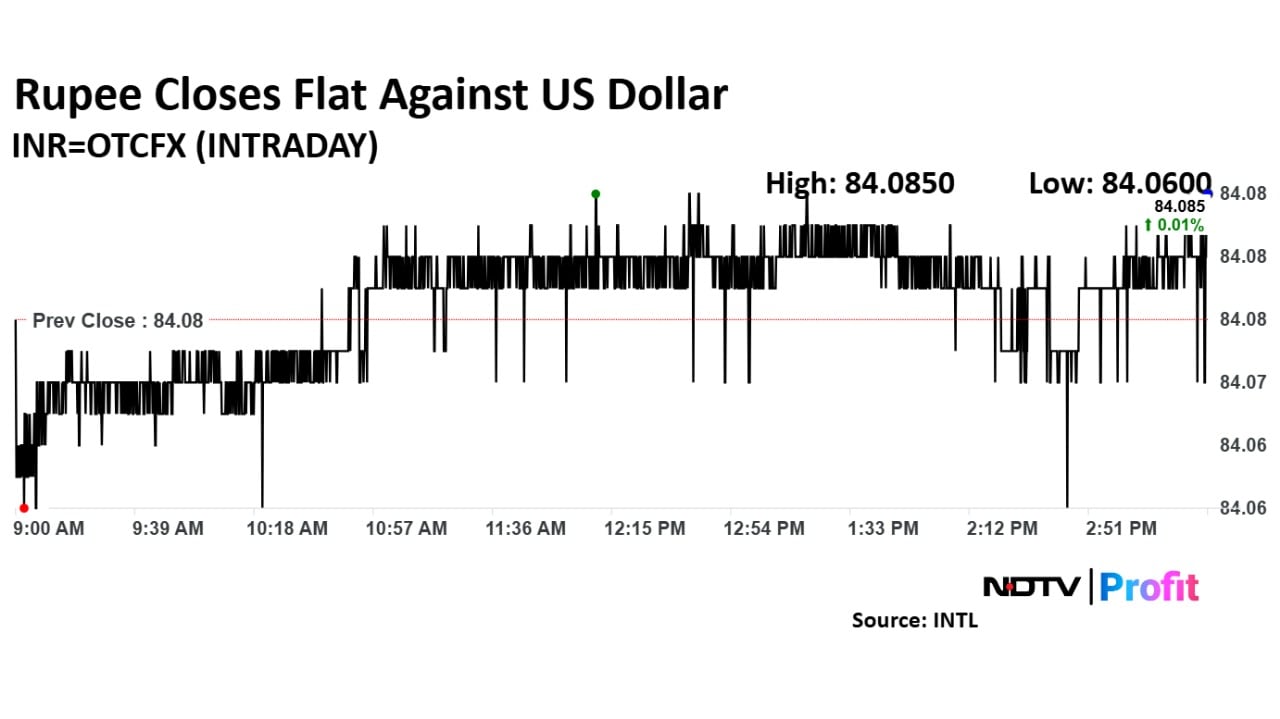

The Indian rupee closed little changed against the US dollar on Wednesday, aided by likely intervention by the Reserve Bank of India amid continued overseas fund outflows from domestic stocks.

The local currency ended trading at Rs 84.086, compared to the previous day's close of Rs 84.075, according to Bloomberg data.

According to Nirmal Bang Securities, the rupee has been consolidating in a narrow range of Rs 84.08-84.06 level over the past week.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.