NSE Nifty 50, which settled lower on Wednesday, faces key support in the range of 24,900 to 24,700, according to analysts.

"Immediate support is placed near 24,900, followed by 24,700. In the short term, the index is expected to consolidate within the range of 24,700–25,400," said Hrishikesh Yedve, assistant vice president for technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

On the upside, the 21-day exponential moving average is positioned near 25,230, which is expected to act as an immediate hurdle, followed by 25,400, he added.

Rajesh Bhosale, equity technical analyst at Angel One Ltd., said that a "break below 24,900 could open doors for further weakness, potentially testing the 24,700 level."

On the upside, resistance is observed around 25,100, with additional resistance at 25,250, Bhosale said. Only a move beyond this range may spark some bullish momentum on the hourly charts, he added.

The Bank Nifty, which formed a shooting star candle on a daily scale, will face resistance near 52,030, according to Yedve. If the index maintains its position above this level, it could reach the higher range of 52,500 to 52,800, he added.

"On the downside, 51,000 offers strong support, where the 100-days exponential moving average is placed. As long as the index holds above 51,000, a 'buy on dips' strategy is advisable," Yedve said.

Market Recap

The NSE Nifty 50 and the S&P BSE Sensex recorded a two-day losing streak, tracking a sell-off across the globe. Most share indices in the Asia–Pacific and Europe plunged on cues from overnight moves on Wall Street.

The Nifty 50 closed 86.05 points or 0.34%, down at 24,971.30, and the Sensex settled 318.76 points or 0.39%, down at 81,501.36.

F&O Action

The Nifty October futures were down 0.34% to 25,048 at a premium of 77 points, with the open interest up by 0.85%.

The Nifty Bank October futures were down by 0.16% to 52,042 at a premium of 241 points, while its open interest was down 0.63%.

The open interest distribution for the Nifty 50 Oct. 17 expiry series indicated most activity at 25,500 call strikes, with the 24,500 put strikes having maximum open interest.

For the Bank Nifty options expiry on Oct. 23, the maximum call open interest was at 52,000 and the maximum put open interest was at 49,000.

FII/DII Action

Overseas investors, commonly known as foreign portfolio investors, remained net sellers of Indian equities for the 13th consecutive session on Wednesday, while domestic institutional investors stayed net buyers for the 17th straight session.

The FPIs offloaded stocks worth Rs 3,435.9 crore, according to provisional data from the National Stock Exchange. Domestic institutional investors bought stocks worth approximately Rs 2,256.3 crore.

Major Stocks In The News

Reliance Industries: The firm announced Oct. 28 as the record date for the issuance of bonus shares in the ratio of 1:1. Shareholders of the firm okayed the bonus issue with more than the required majority on the same day. RIL had announced the 1:1 bonus issue during its annual general meeting on Aug. 29, 2024. The board approval for the issue was granted on Sept. 5.RIL had announced the 1:1 bonus issue during its annual general meeting on Aug. 29, 2024. The board approval for the issue was granted on Sept. 5.

Bajaj Auto: The firm reported its highest ever quarterly revenue in July-September 2024, primarily due to premiumisation and electrification. The standalone net profit of the automotive company rose 9% year-on-year to Rs 2,005 crore in the three months ended Sept. 30., because of revenue that surged 22% to Rs 13,127 crore. Analysts polled by Bloomberg had estimated the topline at Rs 13,253 crore and the bottomline at Rs 2,201 crore.

L&T Technology Services: The firm posted a profit of Rs 320 crore in the quarter ended Sept. 30, as compared to a Rs 333 crore estimate by Bloomberg analysts.

In the previous quarter, the company posted a profit of Rs 314 crore. LTTS revenue during the quarter under review rose 4.5% to Rs 2,573 crore from Rs 2,462 crore in the first quarter of this fiscal, according to an exchange filing on Wednesday. The Bloomberg estimate for the company's revenue was Rs 2,570 crore. The earnings before interest and taxes rose 1% to Rs 388 crore against Bloomberg's estimate of Rs 413, whereas the EBITDA margin contracted to 15.1% from 15.6% against the Bloomberg estimate of 16.1%.

Global Cues

Stocks in Asia advanced in early trade following Wednesday's slump as Wall Street traders rotated money away from large technology stocks and into small companies.

Australian benchmark S&P ASX 200 was 82 points, or 1% higher at 8,367, while the South Korean Kospi was up 4 points, or 0.13%, at 2,613 as of 5:40 a.m. The gauge of US-listed Chinese stocks rose almost 1% Wednesday.

Meanwhile, the gauge of smaller firms in the US—Russell 2000—rose to the highest level in almost three years after large caps took a backseat technology shares saw selling.

The tech companies are wary after the semiconductor bellwether ASML suffered its worst day since 1998, booking only about half the orders analysts expected from chipmakers. The sentiment in the tech space was further dampened by concerns of capping sales of AI chips from US companies, which could potentially hurt the top line.

However, Morgan Stanley climbed 6.5%, the most in four years after it better-than-expected earnings results for the third quarter.

The S&P 500 and Nasdaq Composite climbed 0.47% and 0.28%, respectively, while the Dow Jones Industrial Average rose 0.79%. The Russell 2000 surged 1.6%.

Key Levels

US Dollar Index at 103.52

US 10-year bond yield at 4.03%.

Brent crude up 0.63% at $74.69 per barrel.

Bitcoin was up 0.26% at $67,797.06

Gold spot was up 0.11% at $2,676.70

Money Market

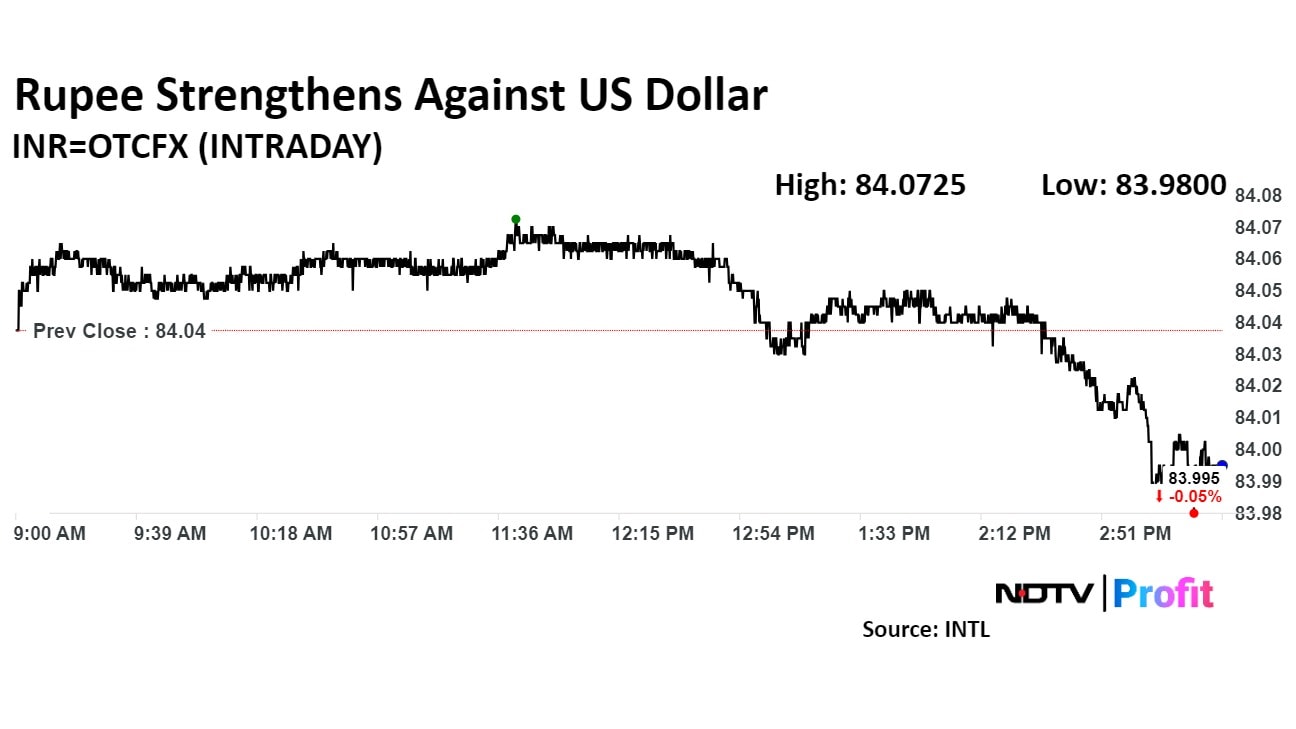

The Indian rupee closed 4 paise stronger as relentless intervention by the Reserve Bank of India offset the impact from consistent selling of stocks by foreign investors. Inflows into the slew of IPOs including Hyundai Motor India Ltd. too supported the rupee.

The rupee closed at Rs 84 against the US dollar, according to Bloomberg data. The currency closed at Rs 84.04 against the greenback on Tuesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.