The NSE Nifty 50's immediate support level stands at 23,800, with further support near 23,650, while the key resistance is positioned around 24,100, followed by a stronger resistance at 24,125, according to analysts.

"Technically, the index has broken its 150-day exponential moving average support and formed a red candle, signaling weakness. Last week's low for the index was near 23,816. Thus, 23,800-23,820 will provide immediate support for the Nifty," said Hrishikesh Yedve, assistant vice president for technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

As long as the index remains over 23,800, a short-term pullback seems possible. If the index remains below it, losses may extend to 23,530, where the 200-DEMA support is located, Yedve added.

Aditya Gaggar, director of Progressive Shares Brokers Pvt., also believes that Nifty's immediate support is placed at 23,800. However, the index could be dragged further lower to 23,650, he noted.

"On the flip side, multiple resistance points are there with immediate being at 24,100 where the index will find selling pressure," Gaggar pointed out.

As long as Nifty will trade below 24,000 level, the weak texture is likely to continue, said Shrikant Chouhan, head of equity research at Kotak Securities Ltd. Below the same, the correction wave could continue till 23,800, he added.

If Nifty trades above 24,000, the sentiment could change and the index may bounce back till 24,100 to 24,125 level, Chouhan said.

Bank Nifty, which settled on Tuesday on a negative note, has been consolidating in the range of 50,500 to 52,580 from the last few weeks, Yedve said. "If the index sustains below 50,500, then only fresh selling pressure could be possible. Otherwise, the index will continue its consolidation.”

FII/DII Activity

Overseas investors remained net sellers of Indian equities for the 32nd consecutive session on Tuesday, while domestic institutional investors stayed net buyers.

Foreign portfolio investors sold stocks worth Rs 3,024.31 crore and DIIs mopped up stocks worth approximately Rs 1,854.46 crore, according to provisional data from the National Stock Exchange.

F&O Cues

Nifty November futures are down by 1.22% to 23,931 at a premium of 48 points, with the open interest up by 4.8%.

Nifty Bank November futures were down by 1.42% to 51,334 at a premium of 177 points, while its open interest was up 16%.

The open interest distribution for the Nifty 50 Nov. 14 expiry series indicated most activity at 53,000 and maximum put open interest at 49,000.

Market Recap

The Nifty 50 and the BSE Sensex declined on Tuesday, with HDFC Bank Ltd., and State Bank of India emerging as the major drags.

The Nifty, which ended at the lowest level in over four months, settled 257.85 points, or 1.07% down at 23,840.35. The BSE Sensex ended 820.97 points, or 1.03% down at 78,675.18, the lowest level since Aug. 6.

During the session, the Nifty 50 declined up to 1.25% to 23,839.15, and the Sensex fell up to 1.19% to 78,547.84.

Stocks In The News

Shree Renuka: NCLT approved the merger of its arms Monica Trading, Shree Renuka Agri and Shree Renuka Tunaport with the company.

Aurobindo Pharma: The company's subsidiary received good manufacturing practice certificate from European Medicines Agency for its biosimilars manufacturing unit in Hyderabad.

Varun Beverages: The company is making acquisitions in Africa region, which includes SBC Tanzania for approximately Rs 1,304 crore, and SBC Beverages Ghana for Rs 127 crore.

Tata Chemicals: The company's Europe-based arm TCEL will invest Rs 655 crore for new sodium bicarbonate plant in the UK.

UltraTech Cement: A proposal to raise funds of up to Rs 3,000 crore on private placement basis, on or after Nov. 15, is being considered, the cement maker said in an exchange filing.

Global Cues

Stocks in the Asia-Pacific region declined in early trade on Wednesday as the 'Trump trade' that powered Wall Street to new highs took a breather ahead of the key inflation data.

Equity benchmarks in Australia and South Korea led the declines during the session opening. The Nikkei was 70 points, or 0.15%, lower at 39,290, while the Kospi was down 12 points, or 0.47%, at 2,471 as of 5:35 a.m.

The US treasury 10-year yields rose by 12 basis points to 4.43% on Tuesday with traders now pricing in about two US rate cuts through June, trimmed down from four last week, according to Bloomberg News.

This comes as the inflation data due Wednesday is expected to show the overall consumer price index rose 0.2% for a fourth month. According to Bloomberg projections, the year-over-year indicator is expected to have advanced for the first time since March.

Stocks in the US paused the rally fueled by Donald Trump's victory in the presidential election which took the benchmark gauges to new highs in consecutive sessions.

The S&P 500 and the tech-heavy Nasdaq Composite slipped 0.29% and 0.09%, respectively, while the Dow Jones Industrial Average declined 0.86%.

Key Levels

US Dollar Index at 106.02

US 10-year bond yield at 4.42%.

Brent crude up 0.08% at $71.89 per barrel.

Bitcoin was up 0.12% at $88,423.38

Gold spot was up 0.03% at $2,599.27

Money Market

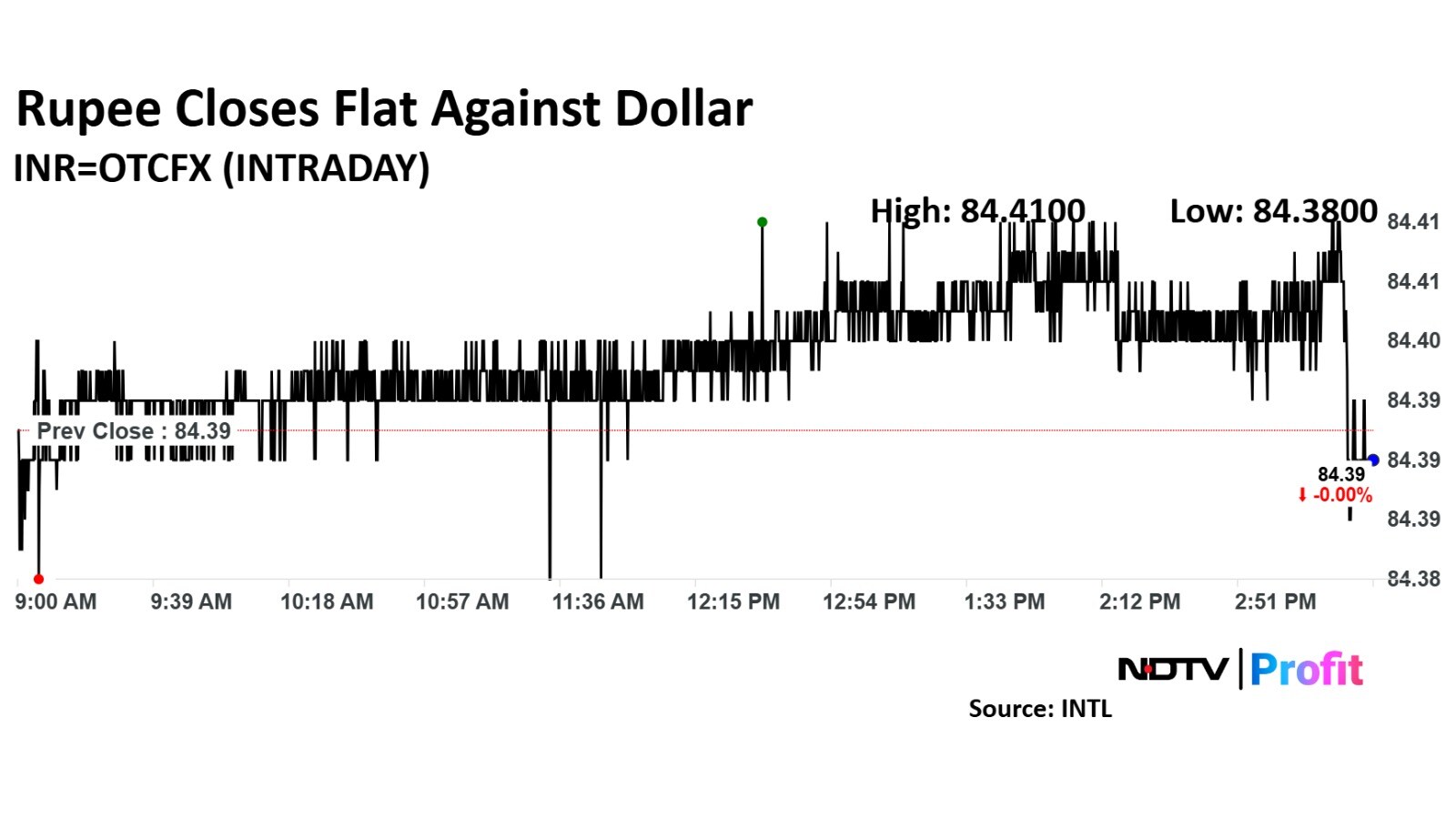

The Indian rupee closed flat at 84.39 against the US dollar on Tuesday. It is nearly unchanged from Monday's close of 84.388, as per Bloomberg data.

"Exporters should wait with a stop loss at 84.25, as the rupee remains on a weakening trajectory, while importers should consider buying on dips," said Anil Kumar Bhansali, Head of Treasury and Executive Director at Finrex Treasury Advisors LLP.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.