The Nifty is now a tad away from another milestone of 24,000 as it ended just below the 23,900 mark, according to analysts, as the 50-stock index extended its record run led by gains in Reliance Industries Ltd. and Bharti Airtel Ltd.

The buying momentum in the index heavyweights have led to further up-move in the indices and thus, the broader uptrend continues, according to Ruchit Jain, lead researcher at 5paisa. "The immediate support for Nifty has now shifted to 23,600, while 23,900 and 24,125 will be the levels to watch out on the higher side on the expiry day," he said.

The index broke out of the short-term consolidation zone of 23,330-23,670 in yesterday's session, and today it found support near the breakout point of 22,670, according to Hrishikesh Yedve, AVP Technical and Derivatives Research, Asit C Mehta Investment Interrmediates Ltd.

"Based on this breakout, the rally may extend towards the 24,000 level. Therefore, it is advisable to adopt a buy-on-dips strategy for Nifty. On the downside, 23,670 will serve as immediate support for the index," he said.

The NSE Nifty Bank index can scale closer to 53,000 and will act as an immediate hurdle for Nifty Bank. If the index sustains above the 53,000 level, the rally could extend towards 54,000, he said.

The GIFT Nifty was trading 5 points or 0.02% higher at 23,795 as of 06:50 a.m.

F&O Action

The Nifty June futures were up 0.55% to 23,867.95 at a discount of 0.85 points, with open interest down by 26%.

The Nifty Bank June futures were up by 0.24% to 52,877.10 at a premium of 6.6 points, while its open interest was up by 42% ahead of its monthly expiry.

The open interest distribution for the Nifty 50 June 27 expiry series indicated most activity at 23,000 put strikes, with 24,000 call strikes having maximum open interest.

For the Bank Nifty options July 3 expiry, the maximum call open interest was at 53,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors turned net sellers on Wednesday after a day of buying.

Foreign portfolio investors offloaded stocks worth Rs 3,535.4 crore, while domestic institutional investors turned net buyers after two sessions of selling and mopped up equities worth Rs 5,103.7 crore, the NSE data showed.

Market Recap

The benchmark equity indices extended their record run for the second consecutive day on Wednesday, ahead of the expiry of their monthly derivative contracts. The Nifty Bank, whose monthly contracts also expired in the day, recorded its highest close as well.

The NSE Nifty 50 closed 147.50 points, or 0.62%, higher at 23,868.80 points, while the S&P BSE Sensex ended 620.73 points up, or 0.8%, at 78,674.25.

The broader markets ended on a mixed note as the BSE MidCap settled 0.29% lower and SmallCap ended 0.15% higher.

On the BSE, 11 sectors advanced and nine declined. The BSE Telecommunication rose the most, while Metal declined the most.

Major Stocks In News

Dr Reddy's Laboratories: The company's Switzerland subsidiary will acquire NorthStar Switzerland and related portfolio from Haleon for upfront cash consideration of £458 million. The company will pay for additional performance-based contingent cash payments of £42 million in CY25 and CY26.

Telecom Stocks: Bharti Airtel acquired 97 MHz spectrum in 900 MHz, 1,800 MHz and 2,100 MHz frequency bands for Rs 6,857 crore for a period of 20 years. Reliance Jio bought 14.4 MHz of spectrum worth Rs 974 crore and Vodafone Idea bagged 30 MHz of spectrum worth Rs 3,510 crore.

JSW Energy: JSW Neo Energy, a wholly owned subsidiary of company, has signed a power purchase agreement through its subsidiaries for 1,325 megawatts of renewable energy projects that will be commissioned in the next 21–24 months.

ITD Cementation: The company secured a new Marine Contract worth Rs 1,082 crore for constructing Third Berth (Jetty) and specified additional works in Gujarat.

KEC International: The company received a new order worth Rs 1,025 crore for its Transmission and Distribution and cables business.

Patanjali Foods: Baba Ramdev and Acharya Balkrishna received notice from Kozhikode court over advertisements relating to ayurvedic medicines of Divya Pharmacy. Ramdev and Balkrishna asked to appear in person or through counsel before the court on July 6.

Global Cues

Most Asia-Pacific stocks were trading lower on Thursday after volatile US tech stocks fell in late trading hours, while the benchmarks inched higher. Meanwhile, the Japanese currency rebounded after touching a 38-year low again the dollar in the previous session.

The Nikkei 225 was 395 points or 0.99% lower at 39,280 and the S&P ASX 200 was 100 points or 1.29% lower at 7,683 as of 06:44 a.m.

Yen, after falling as low as 160.87 on Wednesday, was trading at 0.12% higher at 160.6.

Wall Street's tech stocks which have led the rally recently, fell during closing after Micron Technology Inc.'s outlook failed to meet the expectations for the industry.

The S&P 500 Index and Nasdaq Composite rose 0.16% and 0.49%, respectively as of Tuesday. Dow Jones Industrial Average advanced 0.04%.

Brent crude was trading 0.41% lower at $84.90 a barrel. Gold was flat at $2,298.27 an ounce.

Key Levels

US Dollar Index at 106.07

US 10-year bond yield at 4.34%

Brent crude down 0.34% at $84.96 per barrel

Bitcoin was up 0.02% at $60,966.06

Money Market Update

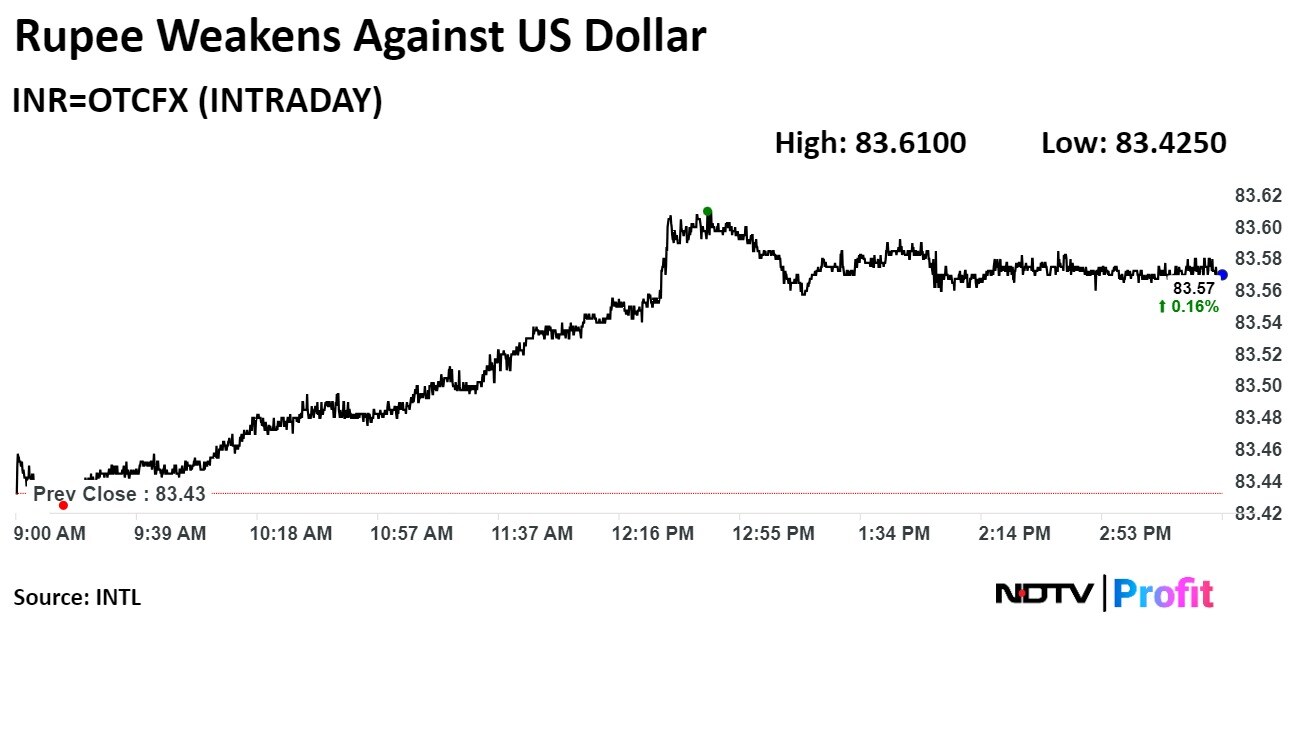

The Indian rupee weakened sharply on Wednesday as the US dollar index rose and banks continued to buy the greenback for oil marketing companies and importers.

The local currency weakened 14 paise against the dollar to close at Rs 83.57.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.