The trend for India's benchmark index remains upward even as stock-specific correction in the broader markets remains a likelihood, while banks will continue on an upward trajectory driven by private players, according to analysts.

A lot of buying interest is seen in the index heavyweights, especially such stocks which had relatively underperformed in the last few months. There could be some stock-specific correction in the mid and small caps, according to Ruchit Jain, lead researcher at 5paisa.

The Nifty 50 could rally up to 23,900-24,000 zone, which is the retracement level of the recent correction. The support base is shifting higher and immediate support is now placed around 23,550 followed by positional support at 23,350, he said.

The NSE Nifty Bank index can scale closer to 52,800 and there is room to hit the 53,000 mark, Aditya Agarwala, head of research and investments at Invest4edu, told NDTV Profit. "HDFC Bank is yet to breakout to an all-time high territory, and when it does, you can see an extended rally. Axis Bank Ltd. also looks strong on the chart."

While state-run banks haven't participated in the rally yet, banking and NBFCs are in a good spot and there is room on the upside, he said.

The bank index could continue the rally towards 54,000-54,200 in the near-term and the immediate support is now placed around 52,000 and 51,600, Jain said.

The GIFT Nifty was trading 13.5 points or 0.06% higher at 23,698 as of 06:43 a.m.

F&O Action

The Nifty June futures were up 0.81% to 23,731.25 at a premium of 10 points, with open interest down by 12.6%.

The Nifty Bank June futures were up by 1.73% to 52,626.85 at a premium of 21 points, while its open interest was down by 14.7% ahead of its weekly expiry.

The open interest distribution for the Nifty 50 June 27 expiry series indicated most activity at 23,000 put strikes, with 24,000 call strikes having maximum open interest.

For the Bank Nifty options June 26 expiry, the maximum call open interest was at 54,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors turned net buyers on Tuesday after two days of selling.

Foreign portfolio investors mopped up stocks worth Rs 1,175.9 crore, while domestic institutional investors stayed net sellers and offloaded equities worth Rs 149.5 crore, the NSE data showed.

Market Recap

A rally in banking and financial stocks pushed India's benchmark equity indices to another record on Tuesday amid strong domestic cues. The NSE Nifty 50 hit a fresh record for the 34th time this year, while the 1,000-point journey of the S&P BSE Sensex to cross the milestone of 78,000 was done in 11 sessions.

The Nifty closed 183.45 points, or 0.78%, higher at 23,721.30, while the Sensex ended 712.44 points, or 0.92%, up at 78,053.52. During the day, the Nifty rose as much as 0.92% to 23,754.1, while the Sensex advanced as high as 1.06% to 78,053.5.

On the BSE, seven sectors rose and 13 sectors declined. The BSE Bankex rose the most and Realty fell the most.

The broader markets underperformed the benchmark indices as the BSE MidCap and SmallCap ended 0.26% and 0.03% down, respectively.

Major Stocks In News

Sanghi Industries: Promoter Ambuja Cements and Ravi Sanghi will sell up to 3.52% stake via OFS. Ambuja Cements will sell up to 2.36% stake and Ravi Sanghi up to 1.16%. The floor price is Rs 90 per share and the issue will open on June 26 for non-retail investors and on June 27 for retail investors.

NTPC: The company will hold a board meeting on June 29 to consider raising of funds up to Rs 12,000 crore via NCDs subject to approval of shareholders.

Zee Entertainment: NCLT allowed withdrawal of implementation application filed for Sony India merger.

Mindspace Business Parks REIT: The company raised Rs 650 crore from International Finance Corp. via issuance of sustainability-linked bonds.

Vishnu Prakash R Punglia: The company received Rs 273.11 crore order from Uttar Pradesh Jal Nigam.

Global Cues

Stocks in Asia were mixed in early trade on Wednesday after Nvidia Corp. led the gains in Wall Street. Meanwhile, the US Federal Reserve's urge for patience to lower interest rates as they await more evidence of softening inflation also weighed investor sentiments.

The Nikkei 225 was 120 points or 0.31% higher at 39,297 and the S&P ASX 200 was 50 points or 0.65% lower at 7,788.2 as of 06:37 a.m.

A rebound by the chipmaker Nvidia Corp. after a three-day fall propelled the US stocks to end higher. The chipmaker behemoth claimed about 7% after a correction that wiped out over $400 billion in market capitilisation of the company.

The S&P 500 Index and Nasdaq Composite rose 0.39% and 1.26%, respectively as of Tuesday. Dow Jones Industrial Average fell 0.76%.

Brent crude was trading 0.12% lower at $84.91 a barrel. Gold declined 0.07% to $2,318.01 an ounce.

Key Levels

U.S. Dollar Index at 105.67

U.S. 10-year bond yield at 4.25%

Brent crude down 0.13% at $84.90 per barrel

Bitcoin was down 0.21% at $61,781.74

Money Market Update

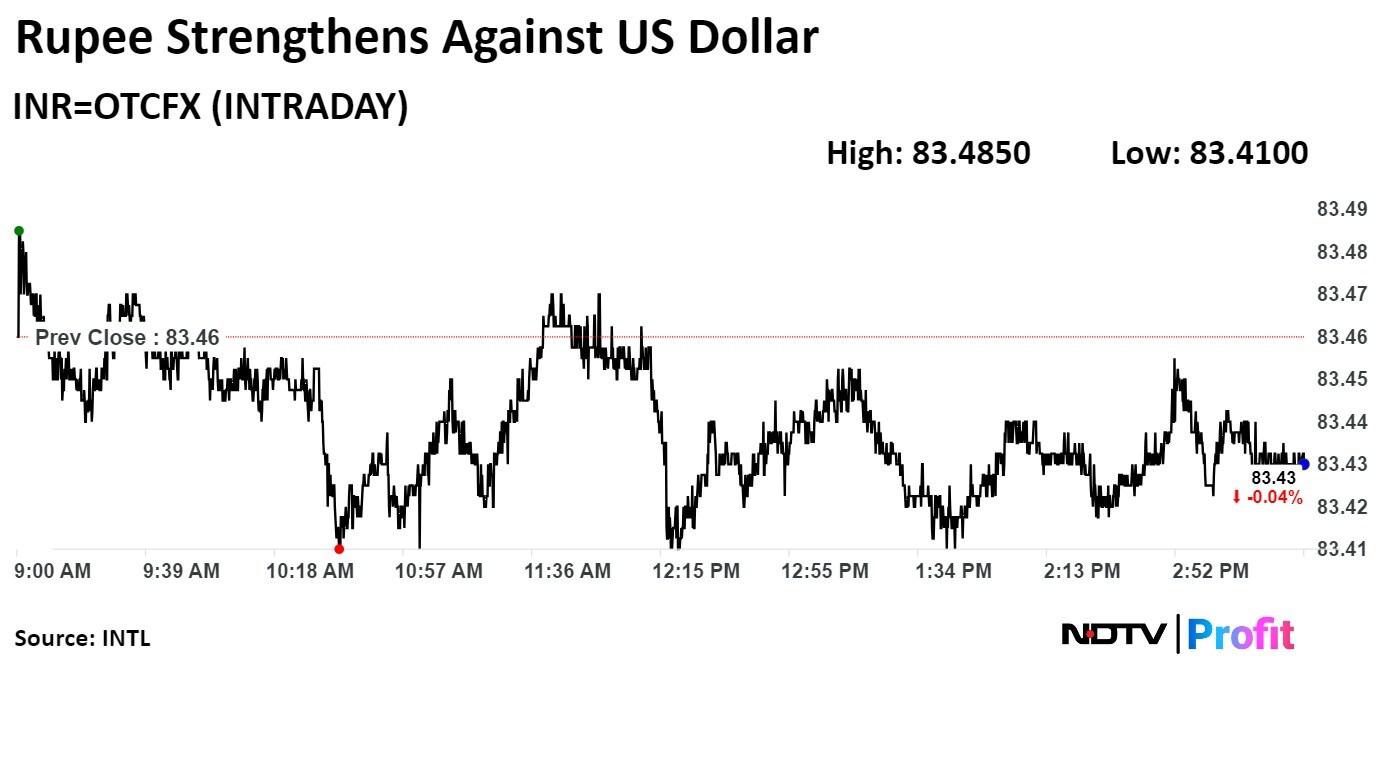

The Indian rupee closed stronger on Tuesday on likely foreign fund inflows into local stocks.

The local currency appreciated 3 paise to close at Rs 83.43 against the greenback after opening at Rs 83.49.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.