.jpg?downsize=773:435)

Indian equities are expected to consolidate at higher levels, after achieving a five-week winning streak, marking the best series of weekly gains in over six months. The rally was driven by gains in shares of Reliance Industries Ltd., State Bank of India, and Larsen & Toubro Ltd.

The defence sector also experienced a significant surge, after data revealed that the industry experienced 16.8% year-on-year growth in FY24, the highest production value ever recorded in India.

"In the coming week, we expect stock and sector-specific action, as the market starts taking cues from Q1 FY25 earnings," said Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd.

Though there is a generally positive outlook, Religare Broking Ltd.'s Ajit Mishra expects the index to continue consolidating. "Traders should concentrate on stock selection and trade management, keeping in mind the potential for increased volatility," the senior vice-president of research at the brokerage said.

Amid the positive market momentum, most of the sectoral indices reported positive gains this week. BSE IT services performed strongly ahead of the upcoming Q1 FY25 earnings season. Over the past one month, oil prices have been gradually inching upwards.

"Over the next few weeks, the key events for the market includes macro factors, Union budget and the Q1 FY25 earnings. Individual stocks will be in focus on Q1 FY25 earnings and management commentary over coming few weeks," said Shrikant Chouhan, head of equity research at Kotak Securities.

The Bank Nifty opened with a gap down and remained under pressure throughout the day, led by HDFC Bank. From a technical standpoint, the index is consolidating in the 52,000–53,200 band. "A breakout from either side will give further direction to the index," according to Hrishikesh Yedve, assistant vice-president of technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd.

The GIFT Nifty was trading 24.5 points, or 0.1%, lower at 24,383.5 as of 07:50 a.m.

F&O Action

The Nifty July futures are up by 0.11% to 24,379.4 at a premium of 55.55 points, with open interest down by 2.55%.

The Nifty Bank July futures were down by 0.86% to 52,724.10 at a premium of 63.75 points, while open interest was down by 6.62%.

The open interest distribution for the Nifty 50 July 11 expiry series indicated most activity at 25,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options July 10 expiry, the maximum call open interest was at 55,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors remained net buyers of Indian equities for the second consecutive session on Friday.

Foreign portfolio investors mopped up stocks worth Rs 1,241.3 crore, while domestic institutional investors stayed net sellers for the third session and sold equities worth Rs 1,651.4 crore, the NSE data showed.

Market Recap

Indian benchmarks rose for the fifth week to record the best streak of weekly gains in over six months. Gains in the shares of Reliance Industries Ltd., State Bank of India, and Larsen & Toubro Ltd. helped the indices erase losses during the last leg of trade on Friday.

The NSE Nifty 50 settled 21.70 points, or 0.1%, higher at 24,323.85, and the S&P BSE Sensex ended 53.07 points, or 0.1%, lower at 79,996.60.

Intraday, the Nifty 50 declined 0.55% to 24,168.85, and the Sensex fell 0.71% to 79,778.98.

The S&P BSE Midcap ended 0.75% higher while the S&P BSE Smallcap gained 0.7%.

Of the 20 sectors on the BSE, 14 advanced and six declined. The S&P BSE Oil & Gas rose the most, and the S&P BSE Financial Services declined the most.

Major Stocks In News

Tata Motors: The company reported a 5% year-on-year increase in JLR wholesales, reaching 97,775 units, and a 9% rise in JLR retail sales, totalling 1.11 lakh units, by the end of Q1 FY25.

Bank of Baroda: The company approved raising up to Rs 10,000 crore via long-term bonds and approved raising additional capital up to Rs.7,500 crore.

Marico: The company's international business delivered double-digit constant currency growth, consolidated revenue grew in high single digits, expecting consolidated revenue growth to trend upwards during the year for the end of Q1 FY25.

Indusind Bank: The company reported net advances up 16% year-on-ear at Rs 3.48 lakh crore, deposits up 15% year-on-year at Rs 3.98 lakh crore, CASA ratio at 36.7% vs 37.9% QoQ.

Titan Co.: The company's jewellery business grew 9% year-on-year, watches and wearables business grew 15% year-on-year, eye care business grew 3%, Carat Lane business grew 18%, emerging businesses grew 4%, and TCL business grew 9% for the end of Q1 FY25.

Adani Wilmar: The company saw volume growth of 13% year-on-year, and branded exports volume grew 36%, Food & FMCG business volume grew 23% after normalisation.

Power Grid Corp.: The company to borrow funds up to Rs 16,000 crore funds during the FY 2025-26 through various sources including domestic bonds.

Dabur India: The company saw sequential improvement in demand trends with rural growth picking up, consolidated revenue expected to register mid to high single digit growth.

Global Cues

Most stocks in the Asia-Pacific region began the week lower as traders were cautious amid potential political instability in France as no party was able to claim the majority.

The S&P ASX 200 was 38 points or 0.48% lower at 7785 while the Kospi was 4 points or 0.14% down at 2,857 as of 07:43 a.m.

France looked poised for political troubles after a win by a left-wing coalition in the legislative election left no with a majority needed to govern. The euro fell after initial projections of the election result.

Meanwhile, the US markets ended ended the week at all-time highs, as traders weighed in on a potential rate cut by the US Federal Reserve. The S&P 500 Index and Nasdaq Composite advanced 0.54% and 0.90%, respectively as of Thursday. Dow Jones Industrial Average also rose 0.17%.

Brent crude was trading 0.28% lower at $86.30 a barrel. Gold was 0.25% down at $2,386.16 an ounce.

Money Market Update

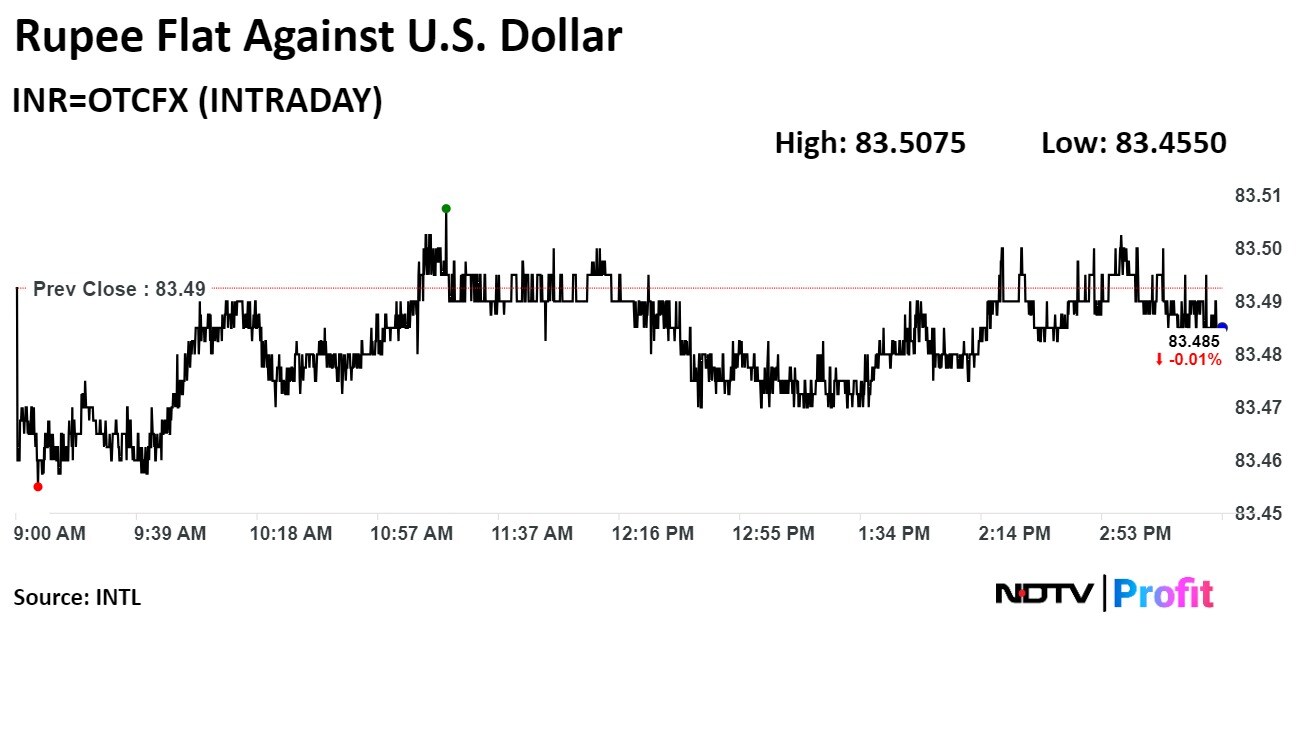

The Indian rupee pared gains to close flat against the greenback on Friday due to dollar demand from oil importers, who rushed to shore up their oil reserves.

The local currency closed little changed at Rs 83.49 after opening at Rs 83.47 against the US dollar. The currency closed at Rs 83.50 on Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.