Indian equities might move towards 24,500, according to analysts, as the 50-stock index settled at fresh closing highs riding on the rally in private banks on Wednesday. The rally was driven by heavyweights HDFC Bank Ltd. and ICICI Bank Ltd.

The benchmark index's rise above 24,300 represents a shift in sentiment towards long trades in the market, according to Rupak De, senior technical analyst at LKP Securities. The momentum might remain strong in the near term as long as it stays above 24,000, he said.

On the higher end, the index might move towards 24,500. However, a fall below 24,000 could lead the index into consolidation, he said.

The Bank Nifty index witnessed strong momentum and surpassed the hurdle of 53,000 on a closing basis. "The immediate support now stands at 52,500, and a dip towards this support would be an ideal opportunity to initiate fresh long positions," said Kunal Shah, senior technical and derivative analyst at LKP Securities.

The bullish trend in the banking sector will continue to be led by the heavyweights, according to Ruchit Jain, lead research analyst at 5Paisa Ltd. "Private sector banks and many information technology companies have recovered from lower levels."

With the drop in Indian banks' gross non-performing assets to a 12-year low, the sector is anticipated to outperform in the near-term, according to Vinod Nair, head of research at Geojit Financial Services.

The GIFT Nifty was trading 13.5 points, or 0.06%, lower at 24,457 as of 06:52 a.m.

F&O Action

The Nifty July futures are up 0.68% to 24,350 at a premium of 63.5 points, with open interest down by 0.85%.

Nifty Bank July futures are up by 1.39% to 53,091 at a premium of 2.4 points, while its open interest is up by 13.73%.

The open interest distribution for the Nifty 50 July 4 expiry series indicated most activity at 25,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options July 10 expiry, the maximum call open interest was at 55,000 and the maximum put open interest was at 53,000.

FII/DII Activity

Overseas investors turned net buyers on Wednesday after three days of selling.

Foreign portfolio investors mopped up stocks worth Rs 5,483.6 crore, while domestic institutional investors turned net sellers after three sessions and offloaded equities worth Rs 924.4 crore, the NSE data showed.

Market Recap

Indian benchmarks settled at fresh closing highs on Wednesday, tracking sharp gains in heavyweight HDFC Bank Ltd. and ICICI Bank Ltd.

The NSE Nifty 50 settled 162.65 points, or 0.67%, higher at 24,286.50, and the S&P BSE Sensex ended 545.34 points, or 0.69%, up at 79,986.80.

Intraday, the Nifty 50 rose 0.76% to a fresh high of 24,307.25. The Sensex gained 0.80% to a historic high of 80,074.30. The NSE Nifty Bank index also scaled a fresh high of 53,256.70 during the day.

Broader indices outperformed. Both S&P BSE Midcap and Smallcap ended 0.86% higher.

Except BSE Oil and Gas, which ended flat, all sectoral indices on the BSE ended higher. The S&P BSE Bankex rose the most.

Major Stocks In News

Bajaj Finance: New loans grew by 10% year-on-year to 10.97 million, AUM grew by 31% year-on-year to 3.54 lakh crore, and deposit book at up 26% year-on-year at 62,750 crores for Q1 FY25.

Tata Steel: Received NCLT nod for merger of Angul Energy with itself.

Vedanta: Aluminium production up 3% year-on-year at 596 kilo-tonnes, while saleable zinc production up 1% year-on-year at 262 KT.

Bandhan Bank: Loans and advances reported to be up 21.8% year-on-year at Rs 1.03 lakh crore, deposits up 22.8% year-on-year at Rs 1.08 lakh crore.

Brigade Enterprises: Signed joint development agreement for 1.2 million square-feet residential project in Bengaluru. The project to be spread over 8 acres, with Gross Development Value of Rs 1,100 crore.

L&T Finance: Reports portfolio realisation at 95%, retail disbursements up 33% year-on-year at Rs 14,830 crore, retail loan book up 31% year-on-year at Rs 84,440 crore.

Suryoday Small Finance Bank: Gross advances up at 42% year-on-year at Rs 9,037 crore, deposits up 42% year-on-year at Rs 8,137 crore.

ITD Cementation: Promoter Italian Thai Development Public company exploring potential divestment of investment in the company.

Global Cues

Stocks in the Asia-Pacific region climbed on Thursday tracking overnight gains in the Wall Street as the latest economic data reinforced expectations of rate cuts this year.

Japan's TOPIX index was trading above a record-high closing level, while stocks in South Korea and Australia also inched higher. The NIKKEI 225 was 155 points or 0.38% higher at 40,734 while the S&P ASX 200 was 74 points or 0.97% up at 7814 as of 06:30 a.m.

US stocks hit another record after a weaker-than-expected bolstered the case for Federal Reserve rate cuts. The S&P 500 hit a fresh high on bets lower rates while the yield on the 10-year benchmark US bonds fell to 4.36%.

The S&P 500 Index and Nasdaq Composite advanced 0.51% and 0.88%, respectively as of Wednesday. Dow Jones Industrial Average also declined 0.06%.

Brent crude was trading 0.37% lower at $87.02 a barrel. Gold was 0.15% up at $2,359.72 an ounce.

Key Levels

U.S. Dollar Index at 105.31

U.S. 10-year bond yield at 4.36%

Brent crude down 0.37% at $87.02 per barrel

Bitcoin was up 1.38% at $60,363.9

Gold spot was up 0.15% at $2,359.72

Money Market Update

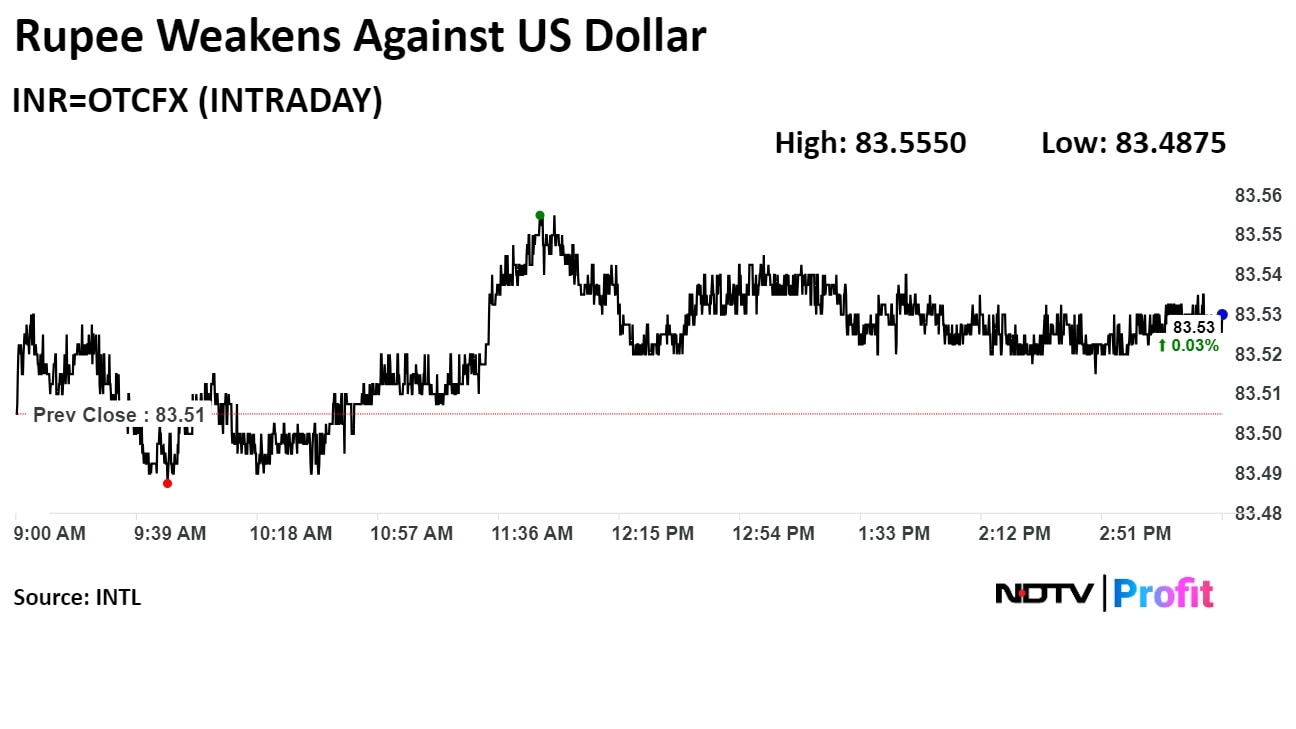

The Indian rupee closed weaker against the dollar on Wednesday amid elevated U.S. bond yields and rising oil prices after U.S. crude stockpiles reportedly shrank.

The local currency weakened by 3 paise to close at Rs 83.53 per U.S. dollar. It had closed at Rs 83.50 on Tuesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.