.avif?downsize=773:435)

The NSE Nifty 50 will continue its uptrend with no signs of trend reversal as of now, according to analysts, as the benchmark index closed flat at the 24,836 level with positive bias, after making a fresh high of 24,999.75 levels intraday gains.

The immediate term supports for Nifty are placed around 24,620 and 24,500, while resistance as per retracement of recent correction is seen around 25,065, followed by 25,340, according to Ruchit Jain, lead, research, 5paisa.com. "The market breadth remains healthy while FIIs have continued to add fresh longs post expiry," Jain said.

Once the index crosses the psychological level of 25,000 mark, we believe sentiments will get a further boost. A slew of central bank monetary policy decisions globally this week will keep focus on interest rate-sensitive sectors, including banking, said Siddhartha Khemka, head of retail research, Motilal Oswal Financial Services Ltd.

"Overall, we expect the market to continue its gradual uptick. However, volatility cannot be ruled out ahead of key events," Khemka said.

"Technically, the index formed a small bearish candle on daily scale, but the trend remains upward. Immediate support for the index is placed near 24,770, followed by 24,600. On the upside, 25,000 will act as a key hurdle for Nifty in the short term," according to Hrishikesh Yedve, AVP, technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd.

The Bank Nifty ended flat around 51,340.

On daily scale, the index has found resistance near a short-term trend line, which is placed around 52,300 levels. Thus, 52,000-52,300 will serve as resistance zone for Bank Nifty. While on the downside, 51,000 will act as strong support, Yedve said.

"The 61.8% retracement level of the recent correction acted as a resistance during the up-move in the Nifty Bank index in Tuesday's session. The RSI readings hint at a weak momentum in the banking space and hence, there could be a relative underperformance in this index," according to Jain.

As of 7:16 am today, GIFT Nifty is trading 0.04%, or 10 points, lower at 24,868.50.

F&O Action

The Nifty August futures are up 0.03% to 24,910 at a premium of 74 points, with open interest up by 0.45%.

Nifty Bank July futures are up by 0.2% to 51,384 at a discount of 22 points, while its open interest is down by 15%.

The open interest distribution for the Nifty 50 Aug. 1 expiry series indicated most activity at 25,500 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options July 31 expiry, the maximum call open interest was at 53,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors turned net sellers on Monday after a day of buying on Friday last week.

Foreign portfolio investors offloaded shares worth Rs 2,474.5 crore, while domestic institutional investors remained net buyers for the fifth consecutive session and bought equities worth Rs 5,665.5 crore, the NSE data showed.

This comes after foreign investors had mopped up stocks worth Rs 2,546.4 crore on July 26, 2024.

Market Recap

The benchmark stock indices ended a volatile session with marginal gains on Monday as Bharti Airtel Ltd. and HDFC Bank Ltd. dragged.

The NSE Nifty 50 ended 1.25 points, or 0.01% higher at 24,836.10, and the S&P BSE Sensex settled up 23.12 points, or 0.03% at 81,355.84.

In early trade, Nifty rose as much as 0.66% to a fresh high of 24,999.75, and Sensex was up 0.71% to a record high of 81,908.43.

Broader markets outperformed the benchmark indices, as the BSE MidCap and SmallCap ended 0.80% and 1.17% higher, respectively.

On the BSE, 14 out of 20 sectors ended higher and six declined, with Capital Goods being the best-performing sector and BSE Teck declining the most.

Major Stocks In News

RVNL: The company emerged as the lowest bidder for order worth Rs 739 crore from Himachal Pradesh State Electricity Board. The order to be executed within 24 months.

Tata Steel: The company acquired 557 crore shares aggregating to Rs 7,324.4 crore in T Steel Holdings. Post Acquisition Tata Steel Holdings will continue to be wholly owned unit of company.

Dr Reddy's: The company received positive CHMP opinion from European Medicines Agency for proposed Rituximab biosimilar.

PNB Housing Finance: Carlyle Group entity Quality Investment Holdings Pcc plans to sell up to 6.4% stake in the company for Rs 1,255 crore via open market deals.

ITD Cementation: The company received order worth Rs 1,237 crore for constructing residential colony in New Delhi.

CESC: The company acquired 63.9% equity shares of stepdown subsidiary, Purvah Green Power for a consideration of 205 crore. Post acquisition, Purvah Green Power is now a direct subsidiary of company.

Aarti Drugs: The company's subsidiary Pinnacle Life Science's manufacturing unit received Establishment Inspection Report from US FDA.

Global Cues

Most Asian markets opened lower ahead of major interest rate decisions by Japan and the UK alongside US technology company earnings.

Equities slipped in Japan and Australia in early trading. The Nikkei 225 was trading 167.89 points or 0.44% lower at 38305.56, while the S&P ASX 200 was 65.04 points or 0.81% down at 7924.90 as of 06:39 a.m.

US stocks ended mixed ahead of major central bank decisions, economic data and earnings from Microsoft, Meta, Apple and Amazon. The Federal Reserve is scheduled to announce its key interest rate decisions on Wednesday.

The S&P 500 Index and Nasdaq Composite advanced 0.08% and 0.07%, respectively as of Monday. The Dow Jones Industrial Average fell 0.12%.

Brent crude was trading 0.25% lower at $79.58 a barrel. Gold was 0.15% down at $2,380.50 an ounce.

Key Levels

US Dollar Index at 104.5950.

US 10-year bond yield at 4.18%.

Brent crude down 0.25% at $79.58 per barrel.

Bitcoin was down 0.89% at $66,768.6300.

Gold spot was down 0.15% at $2,380.50 an ounce.

Money Market Update

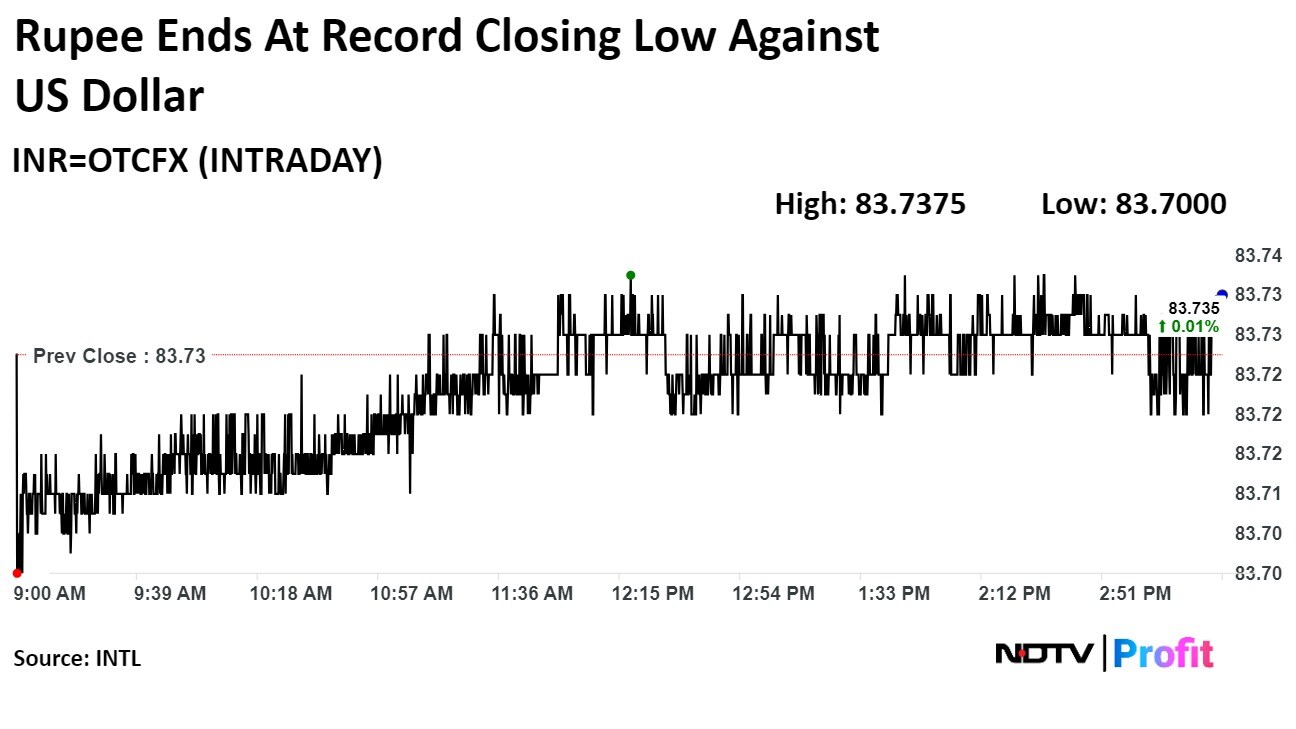

The Indian rupee depreciated to a fresh record low on Monday amid a month-end dollar demand from importers.

The local currency weakened one paisa to close at Rs 83.73 against the greenback. It had closed at Rs 83.72 on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.