Its Union Budget 2024 time and all eyes will be on Finance Minister Nirmala Sitharaman on July 23 when she gets up in the Lok Sabha to read out India's economic roadmap for the ongoing fiscal. The Indian benchmarks, the Nifty and the Sensex are in a wait-and-watch mode with the SGX Nifty showing a flat opening is likely. Here is what the charts are showing.

The Nifty ended slightly lower at 24,509 on Monday, as the markets remained cautious a day before the Union budget announcement and with the growth forecast in the economic survey released during the day.

The broader market indices—Nifty Midcap 100 and Nifty Small Cap 100—outperformed the headline indices and closed higher by around 1%. Auto, metals, and pharma gained more than 1%, while IT, FMCG, realty and energy were the sectors that lost to the tune of 0.5%.

Technical Check

From a technical standpoint, the market (Nifty and Sensex) is currently exhibiting non-directional activity around the 24,500/80,400 level following a reversal formation. "With Budget Day looming, we anticipate heightened volatility. The 24,500/80,400 level serves as critical support for the bulls, while 24,850/81,600 could pose as the primary resistance zone for traders," according to Shrikant Chouhan, head of equity research at Kotak Securities.

Chouhan recommends reducing long positions during rallies, as long as the market (Nifty and Sensex) is trading below 24,850/81,600. "Buying is advisable only at major support levels (24,150/79,000 and 24,000/78,600) with a medium- to long-term perspective. If the market surpasses 24,850/81,600, it has the potential to advance towards 25,000/82,000 and 25,300/83,000 levels," he said.

"Though the budget is largely expected to be growth-oriented, with the announcement of some measures aimed at addressing rural economies, this is largely factored in by the market. Investors will look out for signs of further traction." He expects "some volatility, along with sector- and stock-specific actions," on Tuesday, according to Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd.

As long as the index remains below 24,855, a sell-on-rise strategy needs to be adopted in Nifty, said Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

The Bank Nifty index opened with a gap down, remained under pressure in the first half, but later witnessed buying interest and finally settled the day on a positive note at 52,280 levels. "Bank Nifty will find strong support near the 51,800–52,000 levels. On the upside, 52,800 and 53,000 will serve as strong resistance levels," Yedve said.

Kotak Securities' Chouhan said that the Bank Nifty has been consolidating between 52,800 and 52,000 for the last few days, and these same levels will act as trend decider levels on Tuesday.

GIFT Nifty was trading 2.5 points, or 0.01%, higher at 24,545.5 as of 06:41 a.m.

F&O Action

The Nifty July futures are down 0.05% to 24,509.1 at a discount of 0.15 points, with open interest down 0.66%.

Nifty Bank July futures are up by 0.07% to 52,286 at a premium of 6 points, while its open interest is down by 7.71%.

The open interest distribution for the Nifty 50 July 25 expiry series indicated most activity at 25,500 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options July 24 expiry, the maximum call open interest was at 56,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors remained net buyers of Indian equities for the sixth consecutive session on Monday.

Foreign portfolio investors mopped up stocks worth Rs 3,444 crore, while domestic institutional investors stayed net sellers for the sixth session and sold equities worth Rs 1,652 crore, the NSE data showed.

Market Recap

The benchmark equity indices closed lower for the second consecutive session on Monday as investors look forward to the Union Budget 2024–25 and more corporate earnings.

The NSE Nifty 50 ended 21.65 points, or 0.09%, down at 24,509.25, while the S&P BSE Sensex closed 102.57 points, or 0.13%, down at 80,502.08. Intraday, both indices rose over 0.2%.

The broader markets outperformed the benchmark indices, as the BSE MidCap and the SmallCap were 1.26% and 0.88% higher, respectively.

On the BSE, 14 out of the 20 sectors advanced, with power rising the most and energy declining the most.

The market breadth was skewed in favour of the buyers as 2,150 stocks rose, 1,845 declined and 151 remained unchanged on the BSE.

Major Stocks In News

Oil India: The company signed a contract with Norway's Dolphin Drilling to hire drilling unit called Blackford.

Reliance Industries: Reliance New Energy acquired balance 12.7% stake in Reliance Lithium for €3.7 million.

Gensol Engineering: The company becomes the preferred bidder for 116 MW solar projects with EPC revenue of 600 crore in Gujarat.

Power Mech: The Uttarakhand Government has revised the tender offer for hospital construction to Rs 594 crore from Rs 362 crore.

Punjab and Sind Bank: The company will be raising of up to Rs 800 crore on July 26.

Global Cues

Stocks in Asia advanced in early trade on Tuesday after US Stocks rebounded as investors brushed off concerns about Joe Biden ending his reelection campaign ahead of the big technology companies' earnings.

Equity benchmarks in South Korea and Japan advanced the most while that of Australia was also trading higher. The Nikkei 225 was 240 points or 0.6% higher at 39,835, while the S&P ASX 200 was 40 points or 0.5% up at 7,971 as of 06:33 a.m.

While Joe Biden ending his reelection campaign for the November election did not deter investors, Kamala Harris' presidential campaign raised $81 million in its first 24 hours. This is the largest 24-hour fundraise of any candidate in history, according to Bloomberg.

Meanwhile, Tesla Inc. and Alphabet Inc. will announce their quarterly earnings on Tuesday as investors expect positive earnings to lift the equity benchmarks even higher.

The S&P 500 Index and Nasdaq Composite soared 1.08% and 1.58%, respectively as of Friday. Dow Jones Industrial Average rose 0.32%.

Brent crude was trading 0.13% lower at $82.29 a barrel. Gold was 0.07% up at $2,398.38 an ounce.

Key Levels

U.S. Dollar Index at 104.29

U.S. 10-year bond yield at 4.25%

Brent crude down 0.13% at $82.29 per barrel

Bitcoin was down 0.79% at $67,611.25

Gold spot was up 0.07% at $2,398.38

Money Market Update

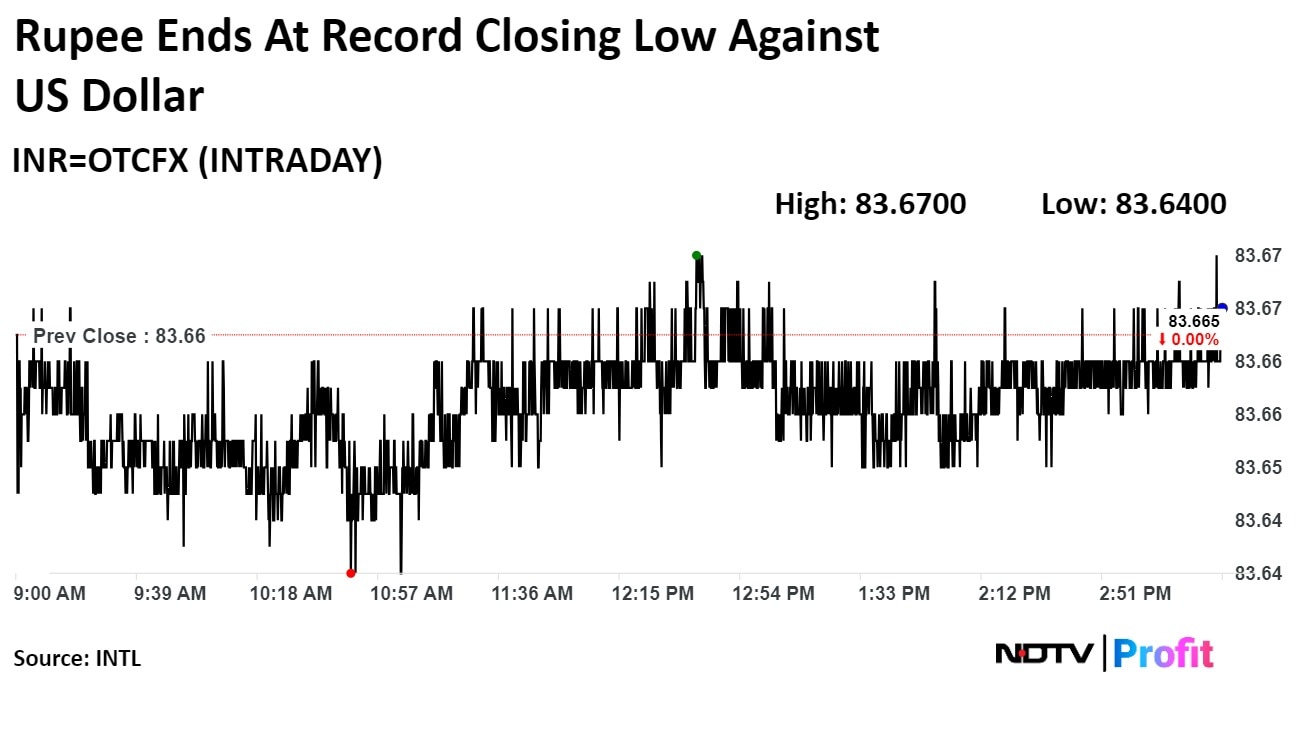

The Indian rupee hit a fresh record low on Monday, amid rising crude oil prices and a decline in the dollar index.

The local currency closed at Rs 83.665 against the greenback, according to Bloomberg. It had opened flat at Rs 83.66 during the day. It had closed at Rs 83.66 on Friday, a record closing low.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.