While the benchmark indices opened lower on Thursday, they bounced back in the second session, with the Nifty 50 benchmark index reaching a new milestone of 24,800.

As the markets ended at a fresh record high for the fourth consecutive session, analysts expect the bulls to eye the 25,000-milestone for the Nifty index.

According to Osho Krishan, senior analyst of technicals and derivatives at Angel One Ltd., the 24,500 level is expected to provide strong support for the index.

He expects "some cushioning for upcoming blips" around the 24,650 subzones. "On the higher end, it's challenging to anticipate the exact resistance zone, but achieving the milestone of 25,000 is now seen as a significant target for the bulls," Krishan added.

Aditya Gaggar, director of Progressive Shares, said, "The Nifty has formed a big green candle, implying a strong comeback of bulls." According to him, 25,000 could be considered an immediate hurdle, while 24,500 will serve as strong support.

Krishan also voiced some caution due to divergences in the advance-decline ratio and the actual market movement. Traders are advised to stay fussy in stock selection with a thematical approach, the analyst added.

Nifty Bank opened the gap down on Thursday and also saw a strong recovery to close on a positive note of 52,621 levels. Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd., said that the index defended the 21-DEMA support of 52,020 levels. If the index holds above this level, then the ongoing bullish momentum of the index will continue, with 52,800 and 53,000 serving as strong resistance levels.

GIFT Nifty was trading 15 points, or 0.06%, higher at 24,833.5 as of 06:49 a.m.

F&O Action

The Nifty July futures are up 0.67% to 24,809 at a premium of 8.2 points, with open interest up 4.9%.

Nifty Bank July futures are up by 0.24% to 52,670.35 at a premium of 49.65 points, while its open interest is down by 0.68%.

The open interest distribution for the Nifty 50 July 25 expiry series indicated most activity at 25,500 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options July 24 expiry, the maximum call open interest was at 56,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors remained net buyers of Indian equities for the fourth consecutive session on Thursday. Foreign portfolio investors mopped up stocks worth Rs 5,485 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors stayed net sellers for the fourth session and sold equities worth Rs 2,904 crore, the NSE data showed.

Market Recap

India's benchmark stock indices ended at a fresh record high for the fourth consecutive session on Thursday amid volatility, led by gains in Tata Consultancy Services Ltd. and Infosys Ltd.

The NSE Nifty 50 gained 187.85 points, or 0.76%, to end at a new record closing high of 24,800.85. The S&P BSE Sensex gained 626.91 points, or 0.78%, to end at a fresh lifetime closing high of 81,343.46.

Intraday, the Nifty rose 0.91% to hit a fresh high of 24,837.75, and the Sensex gained 1% to a fresh high of 81,522.55.

Broader markets underperformed benchmark indices. The S&P BSE Midcap and Smallcap ended 0.99% and 1.15% lower, respectively.

On BSE, of the 20 sectors, 13 advanced and seven declined. S&P BSE Industrials was the worst-performing sector, and S&P BSE IT and TECK were the best-performing ones on Thursday.

Market breadth was skewed in favour of the buyers. Around 2,497 stocks declined, 1,426 stocks rose, and 93 stocks remained unchanged on the BSE.

Major Stocks In News

HAL: The company signed an MoU with the Aeronautical Development Agency for the completion of LCA AF Mk-2 development. Completion will lead to operational clearance for a value of Rs 2,970 crore.

GPT Infraprojects: NHAI and Eastern Railway enhanced the existing contract with the company to Rs 103 crore. The outstanding order book for the company now stands at Rs 3,775 crore with a total order inflow for Fiscal 2025 of Rs 803 crore.

Vodafone Idea: The company approved the first tranche allotment of shares worth Rs 615 crore to Nokia India and Ericsson India at an issue price of Rs 14.80 per share.

Tech Mahindra: The company approved the merger of its wholly-owned step-down subsidiary with its wholly-owned subsidiary in the Philippines.

Zydus Life: The US FDA inspected the Jarod manufacturing facility and closed with an 'Official Action Indicated' classification.

Tata Technologies: The company signed an MoU with Arm to develop automotive software and systems solutions for software-defined vehicles.

Dr Reddy's: The company has signed a non-exclusive patent licensing agreement with Takeda Pharma for Vonoprazan tablets in India.

Coromandel International: The company raised its stake in unit Coromandel Crop Protection Philippines to 93.2% from 40%.

JTL Industries: The company opened a Qualified Institutional Placement at a floor price of Rs 221.57 per share.

Global Cues

Stocks in the Asia-Pacific region came under pressure following the second day of losses on Wall Street as traders turned nervous with the weakening of the broader market.

Most counters in South Korea and Australia fell over 1%, while those in Japan were trading marginally lower. The Nikkei 225 was 17.7 points or 0.03% lower at 40,115, while the S&P ASX 200 was 98 points or 1.2% down at 7,939.5 as of 06:43 a.m.

The declines in the big technology and semiconductor stocks in the US shifted to the broader markets including smaller firms and financial shares. Almost every major group in the S&P 500 fell while megacaps ended mixed, according to Bloomberg.

The S&P 500 Index and Nasdaq Composite plunged 0.78% and 0.70%, respectively as of Wednesday. Dow Jones Industrial Average fell 1.29%.

Brent crude was trading 0.66% lower at $84.55 a barrel. Gold was 0.64% down at $2,429.38 an ounce.

Key Levels

U.S. Dollar Index at 104.19

U.S. 10-year bond yield at 4.18%

Brent crude down 0.66% at $84.55 per barrel

Bitcoin was down 0.33% at $63,610.

Gold spot was down 0.64% at $2,429.38

Money Market Update

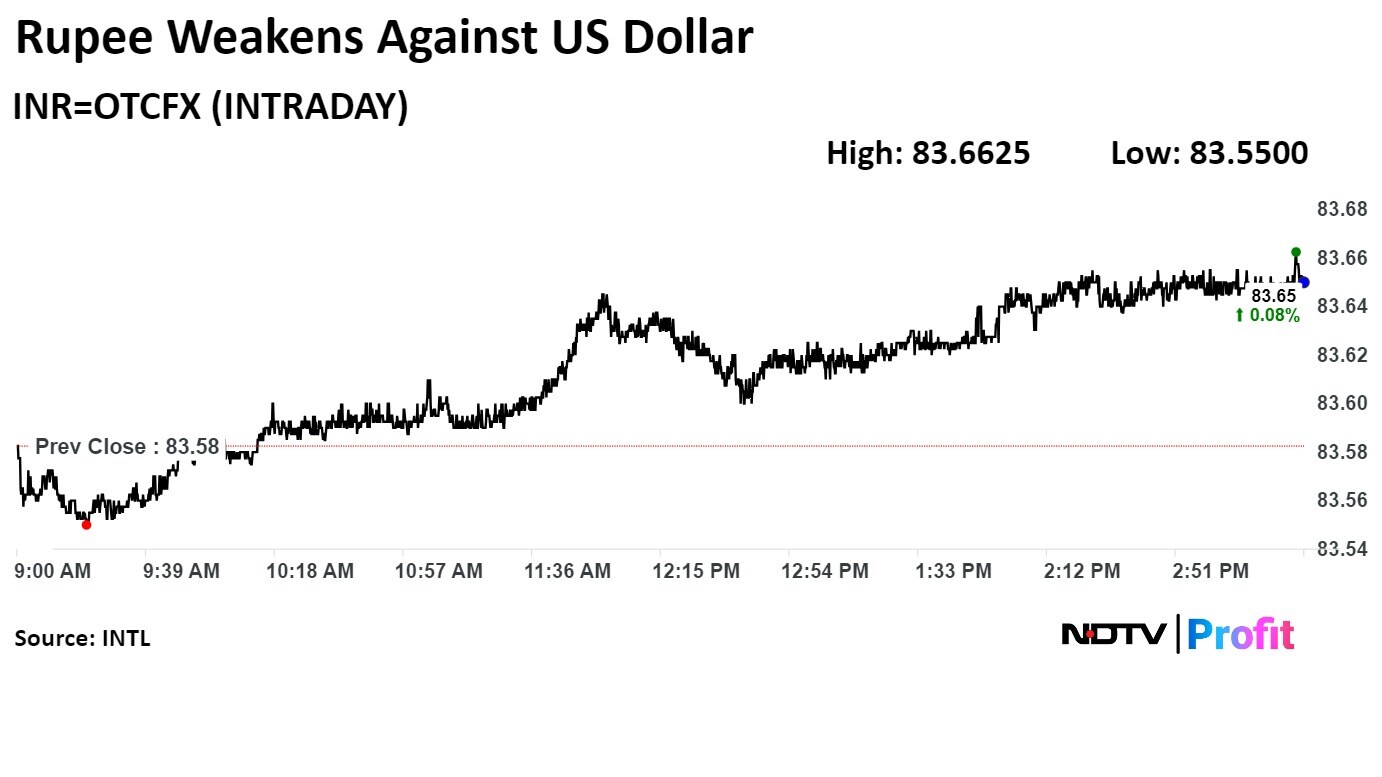

The Indian rupee closed weaker on Thursday on dollar demand by oil importers amid rising oil prices.

The local currency depreciated 7 paise to close at Rs 83.66 after it opened at Rs 83.58, according to Bloomberg. It had closed at Rs 83.59 on Tuesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.