The broader markets gained on Monday, with the NSE Nifty 50 hitting the 24,600-mark. Analysts expect the market to rise further and urged investors to use any dip as an opportunity to buy.

"From a technical standpoint, the zone encompassing the golden ratio, denoted by 24,610, is likely to be seen as the pivot zone, and a sustainable breakthrough could only boost further momentum," Osho Krishan, senior analyst-technical and derivatives at Angel One Ltd., told NDTV Profit.

The index has formed a doji candlestick pattern at a record level, according to Aditya Gaggar, director of Progressive Shares. This indicates a reversal but considering a strong uptrend if any correction takes place, then it will be considered as a buying opportunity, he said.

Looking at the "complete revival" in state-run banks, Hemen Kapadia, senior vice-president of institutional equity at KR Choksey Stocks and Securities Pvt., said that if this transfers to the private lenders, then it's not a "bad time" to go long on Nifty Bank index.

According to Hrishikesh Yedve, assistant vice-presidnet of technical and derivatives research at Asit C Mehta Investment Intermediates Ltd., a buy-on-dips strategy should be adopted in the Bank Nifty as long as the index holds above 51,750. He said, "52,800 and 53,000 will serve as strong resistance levels on the upside."

While all the major sectors were in the green, Nifty IT closed lower on Monday. Kapadia said the index is facing some resistance, but it's on the cusp of a breakout. He also said the technical set-up looks positive for the Nifty IT index and a close above the all-time high will help the index grow.

GIFT Nifty was trading 44.5 points, or 0.18%, higher at 24,607.5 as of 06:34 a.m.

F&O Action

The Nifty July futures are up 0.41% to 24,622 at a premium of 35 points, with open interest up 2.6%.

Nifty Bank July futures are up by 0.54% to 52,630 at a premium of 174 points, while its open interest is up by 4.42%.

The open interest distribution for the Nifty 50 July 18 expiry series indicated most activity at 25,000 call strikes, with 24,500 put strikes having maximum open interest.

For the Bank Nifty options July 16 expiry, the maximum call open interest was at 54,000 and the maximum put open interest was at 52,000.

FII/DII Activity

Overseas investors remained net buyers of Indian equities for the second consecutive session on Monday.

Foreign portfolio investors mopped up stocks worth Rs 2,865 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors stayed net sellers for the second session and sold equities worth Rs 331 crore, the NSE data showed.

Market Recap

India's benchmark stock indices ended at a fresh high on Monday, tracking sharp gains in State Bank of India, Oil and Natural Gas Corp., and NTPC Ltd.

The NSE Nifty 50 settled 0.33% higher at 24,583.90, and the S&P BSE Sensex gained 0.18% to close at 80,664.86. The Nifty and Sensex rose to record levels of 24,635.05 and 80,862.54.

Broader indices outperformed their larger peers, with the S&P BSE Midcap closing with a 0.95% gain and the S&P BSE Smallcap ending 0.21% higher on Monday.

Seventeen out of 20 sectoral indices on the BSE ended higher. BSE Oil & Gas was the top gainer.

Around 2,050 stocks advanced, 1,992 fell, and 126 stocks remained unchanged on the BSE.

Major Stocks In News

Hindustan Unilever: The company will divest its water purification business Pureit via a slump sale to AO Smith India at an enterprise value of Rs 601 crore. The FMCG giant said the sale is in line with its intent to focus sharply on core strategies.

Vedanta: The company opened its QIP and set the floor price at Rs 461.26 per share.

Zee Entertainment Enterprises: The shareholders of the company have approved plans to raise up to Rs 2,000 crore through a share sale as the struggling media company scouts for new investors after the collapse of the Sony merger deal.

Century Textiles: Unit Birla Estates bought a 5-acre land parcel in Gurugram, Haryana, with an estimated revenue potential of Rs 1,400 crore.

Lupin: The company divested its US commercial women's health specialty business to Evofem Biosciences for consideration of up to $84 million based on future contingent milestones. The drugmaker has set July 16 as the ex/record date for issue of dividend of Rs 8 apiece.

Dr. Reddy's Laboratories: The drugmaker has set July 16 as the ex/record date for issue of dividend of Rs 40 apiece.

Balkrishna Industries: The company completed setting up of a mould manufacturing plant at its Bhuj unit with a capex of Rs 300 crore.

Ujaas Energy: The company approved bonus issue one for every four held. It will also raise up to Rs 500 crore via equity.

Equitas Small Finance Bank: The bank approved the appointment of Narayanan NR, KS Sampath and Ramkumar Krishnaswamy as independent directors for three years effective July 16.

PC Jewellers: IndusInd Bank accepted a one-time settlement proposal from the company for unsettled dues in terms including cash, equity, release of securities, and mortgaged properties.

Global Cues

Stocks in the Asia-Pacific region got off to a tepid start, on Tuesday, defying the US stocks' record climb after Donald Trump picked his running mate for the upcoming presidential election.

Scrips in Japan edged higher while that of South Korea and Australia were marginally lower. The Nikkei was 130 points or 0.32% higher at 41,321 while the S&P ASX 200 was 7.1 points or 0.09% down at 8010.5 as of 06:16 a.m.

While Asian stocks were cautious, its Wall Street peers powered ahead after Donald Trump picked Ohio senator and venture capitalist James David Vance as his running mate for the Presidential race. This comes a few days after the former President was shot in the ear by a 20-year-old during a campaign rally in Pennsylvania.

Further, traders were also optimistic after the Federal Reserve Chair's comments in an interview showed confidence that inflation is heading down to the 2% goal, setting the stage for a rate cut in the near term.

The S&P 500 Index and Nasdaq Composite advanced 0.28% and 0.40%, respectively as of Monday. Dow Jones Industrial Average also rose 0.53%.

Brent crude was trading 0.07% lower at $84.79 a barrel. Gold was 0.05% down at $2,421.18 an ounce.

Key Levels

U.S. Dollar Index at 104.26

U.S. 10-year bond yield at 4.22%

Brent crude down 0.07% at $84.79 per barrel

Bitcoin was up 1.34% at $64,633.28

Gold spot was down 0.05% at $2,421.18

Money Market Update

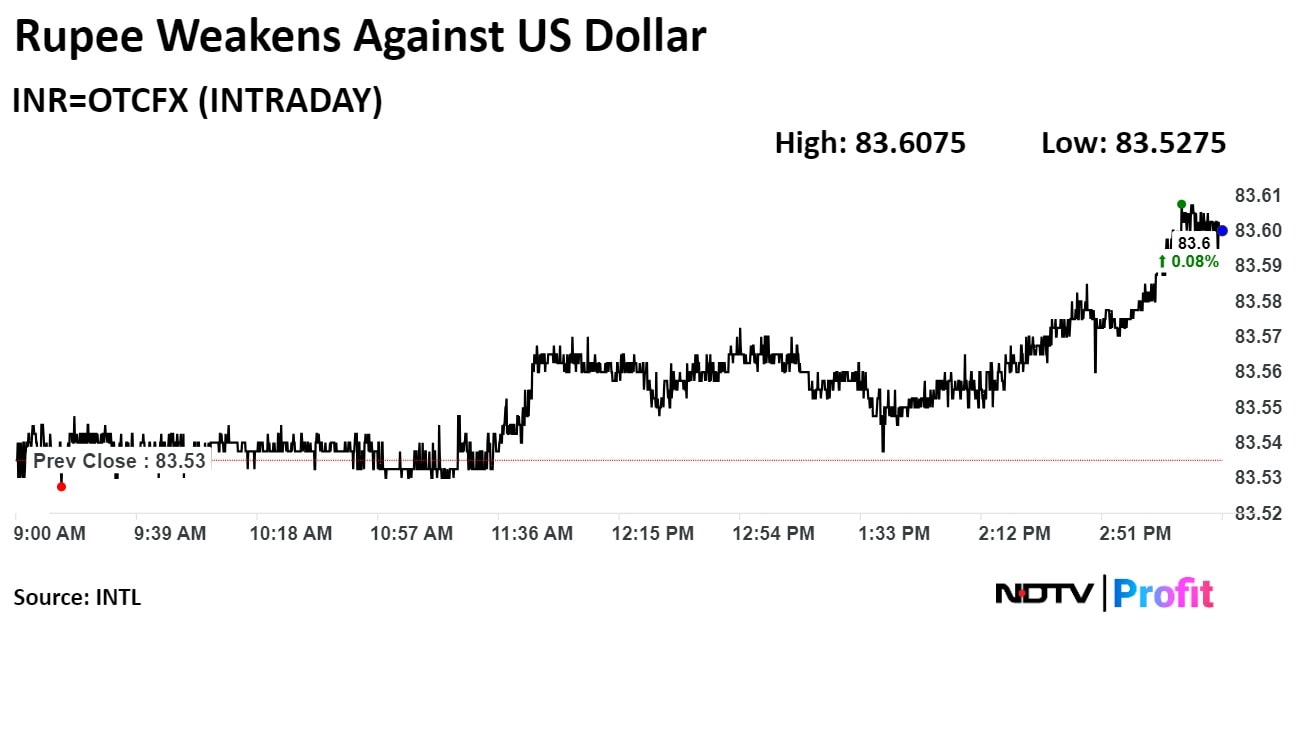

The Indian rupee closed weaker on Monday, as the US dollar gained following the assassination attempt on former President Donald Trump.

The local currency closed 7 paise weaker at Rs 83.60. It had opened at Rs 83.54 against the greenback, according to Bloomberg. It had closed at Rs 83.53 on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.