The Nifty's volatile swing on its weekly expiry indicates a bearish mood, with the market consistently facing selling pressure at higher levels, but there is no clear directional headway for the end of the week, according to analysts.

"A bearish candle on daily charts and a double-top formation on intraday charts indicate further weakness from the current levels. For day traders, intraday texture is non-directional; hence, level-based trading would be the ideal strategy," said Shrikant Chouhan, head of equity research at Kotak Securities Pvt.

For the benchmark Nifty 50 index, 24,100 and 24,250 are important support levels, he said. Selling pressure will likely accelerate if it dips below the support level of 24,000.

The index is oscillating in a wide range, where the downside seems to be protected at 23,965 while the upside is capped at 24,330, and a breakout on either side is a must for a clear picture, said Aditya Gaggar, director of Progressive Shares.

The weakness in the global market led to a sharp spurt in the India VIX and CBOE VIX during the week. However, the peak out in VIX suggests some stability and support-based buying at lower zones, according to Chandan Taparia, senior vice president of equity derivatives & technical at Motilal Oswal Financial Services Ltd.

The GIFT Nifty, an early indicator of the Nifty 50 Index's performance in India, was up 22.5 or 0.09% at 24,349 as of 06:44 a.m.

F&O Activity

The Nifty August futures are down 1.01% to 24,136 at a premium of 19 points, with open interest down by 1.01%.

Nifty Bank August futures are down by 0.3% to 50,205 at a premium of 49 points, while its open interest is down by 0.4%.

The open interest distribution for the Nifty 50 Aug. 8 expiry series indicated most activity at 25,000 call strikes, with 23,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 14, the maximum call open interest was at 60,000 and the maximum put open interest was at 50,000.

Market Recap

India's benchmark equity indices on Thursday erased initial gains after the RBI monetary policy committee maintained the status quo to end lower as market participants found Governor Shaktikanta Das' commentary hawkish. Losses in European and some Asian indices supported the downside trend.

The NSE Nifty 50 ended 180.50 points, or 0.74%, lower at 24,177, and the S&P BSE Sensex closed 581.79 points, or 0.73%, lower at 78,886.22. During the day, the Nifty fell 0.90% and the Sensex fell 0.84%.

Broader markets outperformed the benchmark indices, with the BSE MidCap and the SmallCap ending 0.44% and 0.16% lower, respectively, on Thursday.

On the BSE, all sectoral indices ended lower, except healthcare. BSE Metal declined the most and was the worst-performing sector. Market breadth was skewed in favour of sellers. Around 2,113 stocks declined, 1,787 stocks rose, and 107 stocks remained unchanged on the BSE.

FII/DII Activity

Overseas investors remained net sellers for the fifth consecutive session on Thursday. FPIs offloaded equities worth Rs 2,626.73 crore, according to provisional data from the National Stock Exchange.

Domestic investors remained net buyers for the fifth consecutive session and mopped up equities worth Rs 577.3 crore, the NSE data showed.

Major Stocks To Watch

Wipro: The company entered into a pact with Cyble for AI-driven cybersecurity risk management solutions. The collaboration integrates Cyble's AI and machine learning-driven platforms into Wipro's cybersecurity risk frameworks.

Life Insurance Corp: The country's largest insurer saw its net profit rise 9% year-on-year to Rs 10,544 crore in the quarter-ended June. Net premium income advanced 16% to Rs 1.14 lakh crore.

Cochin Shipyard: The shipbuilder's net profit rose 75.7% year-on-year to Rs 174 crore for the quarter ended June 2024. Revenue increased by 62% to Rs 771 crore.

Ola Electric Mobility: The company will list its shares on the stock exchanges on Friday. The Rs 6,145.6 crore IPO was subscribed 4.27 times.

Paramount Communications: The board of directors approved raising funds up to Rs 400 crore via QIP or other means.

ABB India: The company's net profit rose 49.7% to Rs 443 crore in the June quarter, while revenue increased 12.8% to Rs 2,831 crore.

Biocon: Net profit grew over fivefold for the first quarter of this financial year and surpassed analysts' estimates. The biopharmaceutical company recorded a net profit of Rs 861.80 crore for the quarter-ended June. The profit Jumped on account of other income of Rs 1,135 crore.

Global Cues

Most stocks in the Asia-Pacific region rebounded on Friday taking cues from an overnight rally in Wall Street as their latest labor-market print eased recession fears.

Equity benchmarks in Japan and South Korea rallied over a percent in early trade while the Australian shares were marginally higher. The Nikkei 225 was trading 526 points, or 1.49% higher at 35,335, while the S&P ASX 200 was 55.5 points or 0.72% down at 7,737.5 as of 6:33 a.m.

The equities in the US staged a strong comeback on a softer than expected jobs data, calming the rising recession fears. The weekly jobless claims were recorded at 2.33 lakh for the week ended Aug. 3 versus the estimate of 2.40 lakh, according to Bloomberg.

All major indices advanced with the S&P 500 recording its biggest rally since November 2022. The S&P 500 and Nasdaq Composite climbed 2.3% and 2.87%, respectively as of Thursday. The Dow Jones Industrial Average advanced 1.76%.

Brent crude was trading 0.21% lower at $78.99 a barrel. Gold was down 0.23% at $2,421.9 an ounce.

Key Levels

U.S. Dollar Index at 103.26

U.S. 10-year bond yield at 3.98%

Brent crude down 0.21% at $78.99 per barrel

Bitcoin was up 2.98% at $61,310.63

Gold spot was down 0.23% at $2,421.9 an ounce.

Money Market Update

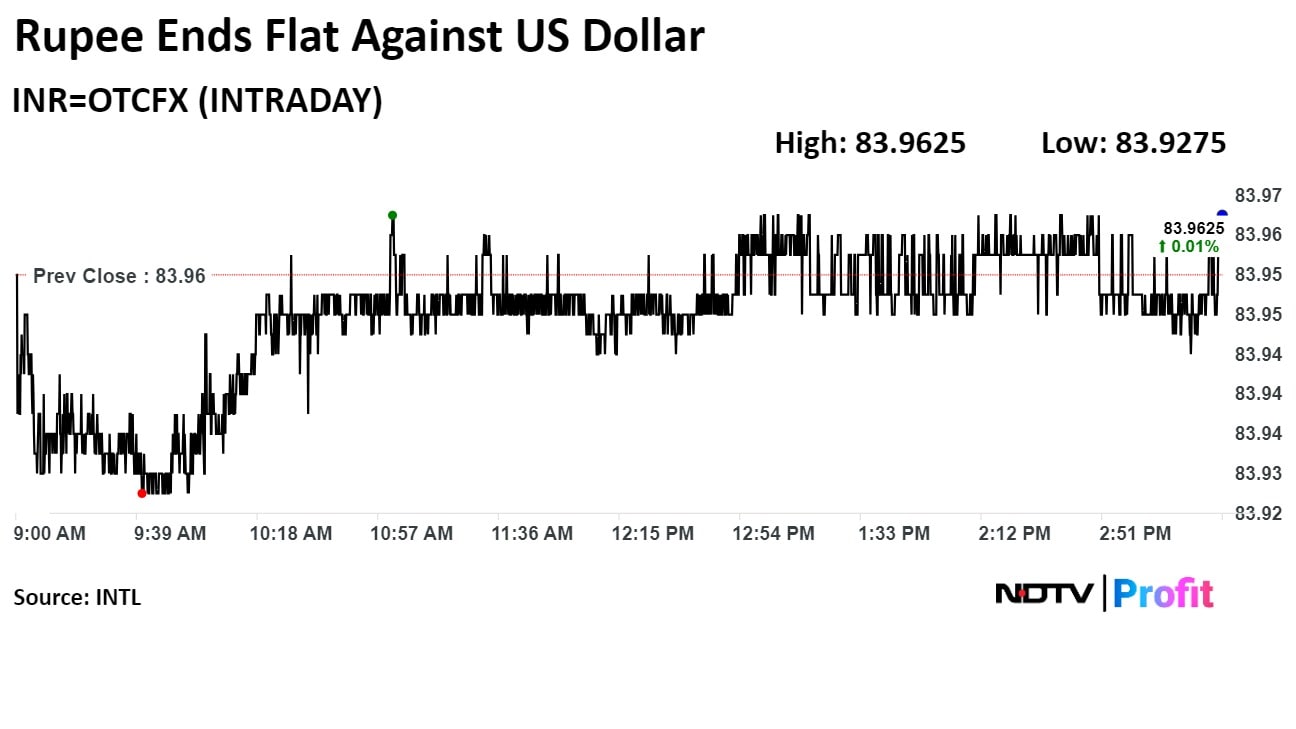

The Indian rupee closed flat after weakening to a record low of Rs 83.99 against the dollar. It had opened flat ahead of the release of the Reserve Bank of India policy statement.

The local currency ended little changed at Rs. 83.96 after having depreciated from the opening of Rs 83.94 against the greenback. The Indian unit had closed at Rs 83.95 on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.