Analysts expect that if the Nifty surpasses 24,383, it could potentially rise to 24,686. On Aug. 7, the index closed at 24,298, marking a recovery after two consecutive declines.

The Nifty formed a small bullish doji pattern, and support at 24,051 may be crucial in the near term, they said. Additionally, the India Vix fell 14% to approximately 16.17, indicating reduced market volatility.

"Technically, the index has been finding support near the 24,000 levels and maintaining the 50-day exponential moving average (DEMA) support despite recent turbulence, resulting in a relief rally. The 50-DEMA is currently near 23,980, and as long as the index remains above this level, the relief rally is likely to continue," said Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

Yedve added, "On the upside, immediate resistance for the index is around 24,430, where the 21-DEMA hurdle is located, followed by 24,700.

"If the Nifty opens on Aug. 8 with an up-gap (above 24,383) and does not fill it, it could form a bullish island reversal pattern. Buying on Aug. 7 was observed across index heavyweights. However, with fund activity seeming to have decreased compared to recent times, an increase in volumes will be crucial for sustaining the uptrend," said Deepak Jasani, head of retail research at HDFC Securities Ltd.

"Global factors and headwinds are likely to persist, which could continue to impact Indian markets over the next few days. While the Nifty experienced a relief rally today, volatility cannot be ruled out," said Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd.

The upcoming RBI policy outcome on Thursday will be closely watched, with expectations of maintaining the interest rate. According to Khemka, interest-sensitive sectors and stocks will be in focus.

In other news, the Bank Nifty closed positively at 50,119.

Yedve noted, "Technically, the Bank Nifty has formed a homing pigeon candlestick pattern, a bullish reversal signal. If the Bank Nifty sustains above yesterday's high of 50,690, it may experience new bullish momentum. On the downside, 49,650 will act as key support in the short term."

The GIFT Nifty was up 0.11%, or 26.50 points at 24,2666.50 at 6:41 a.m.

F&O Activity

The Nifty August futures are up 1.31% to 24,366 at a premium of 69 points, with open interest down by 5.26%.

Nifty Bank August futures are up by 1.29% to 50,340 at a premium of 221 points, while its open interest is up by 0.18%.

The open interest distribution for the Nifty 50 Aug. 8 expiry series indicated most activity at 25,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 14, the maximum call open interest was at 60,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Foreign portfolio investors remained net sellers for the fourth consecutive session on Wednesday. FPIs offloaded equities worth Rs 3,314.8 crore, according to provisional data from the National Stock Exchange.

Domestic investors remained net buyers for the fourth consecutive session and mopped up equities worth Rs 3,801.2 crore, the NSE data showed.

Market Recap

Indian benchmark stock indices snapped a three-day losing streak on Wednesday and posted the best session in eight days as heavyweights HDFC Bank Ltd. and Infosys Ltd. led gains.

The NSE Nifty 50 ended 322.70 points, or 1.34%, higher at 24,315.25, and the S&P BSE Sensex ended up 874.94 points, or 1.11%, at 79,468.01.

Intraday, Nifty rose as much as 1.44% to a high of 24,337.70, and Sensex rose 1.335% to a high of 79,565.40.

Broader markets outperformed. BSE Midcap ended 2.6% higher and BSE Smallcap closed up 2.4%.

All 20 sectoral indices on the BSE rose. BSE Oil & Gas was the top gainer.

Market breadth was skewed in favour of the buyers. As many as 2,988 stocks rose, 945 declined, and 98 remained unchanged on the BSE.

Major Stocks To Watch

Rate-sensitive stocks: The Reserve Bank of India's monetary policy committee will announce its decision on the repo rate on Thursday. Banks and financial services, automobiles, and real estate sectors will be in focus.

Godrej Consumer Products: The board has approved the entry into the pet care business via its arm and will invest Rs 500 crore over five years for venturing into the pet care business. The company plans to start producing pet care products in the second half of FY26.

Marico: The company said the operating conditions in the Bangladesh market are gradually improving and will remain watchful of the evolving situation. The medium-term prospects of Bangladesh business remain intact, and we are expecting manufacturing operations to resume soon.

Maruti Suzuki: The company recalls 2,555 Alto K10 vehicles over possible defects in steering gearbox assembly. The defect may affect vehicle steerability. Customers affected vehicles are advised not to use the vehicle till the part is replaced.

LIC: The company clarified that the report on the government diluting up to 5% stake in the company in the financial year 2025 is incorrect.

SBI: The Department of Financial Services appointed CS Setty as chairman of the bank for three years effective August 28.

Phoenix Mills: The company's unit Astrea Real Estate acquired 5 land-owning entities in Coimbatore for Rs 370 crore.

Adani Enterprises: The company incorporated a subsidiary Global Airports Operator in Abu Dhabi to carry out acquisition and investment operations for operating airports outside India.

TVS Supply Chain Solutions: The company secured a new business contract from JCB in India for managing their in-plant warehousing and logistics operations at their facility in Vadodara, Gujarat, for three years.

UPL: Australia High Court rules in favor of unit Advanta in litigation over seed quality.

NTPC: The company's unit commenced commercial operations of 60 MW capacity at its solar PV Project in Gujarat.

General Insurance Corporation of India: The company received Rs 1,112 crore GST show cause notice from Mumbai South Commissionerate.

GTL Infrastructure: The company received Rs 894 crore GST show cause notice from GST authority for FY18.

Global Cues

Asian stocks continued their volatile run after major indices were trading lower on Thursday, following the previous day's recovery. The Japanese and South Korean benchmarks were down over a percent, while Australia's was marginally lower.

The Nikkei 225 was trading 517.50 points, or 1.47% lower at 34,602.50, while the S&P ASX 200 was 39.90 points, or 0.52% down at 7,659.90 as of 6:36 a.m.

Shares in Wall Street ended lower on Wednesday after sentiments were hurt by a weak sale of treasuries worth $42 billion. This comes post a rebound in the world's largest economy after a rout early this week.

The S&P 500 and Nasdaq Composite declined 0.77% and 1.05%, respectively as of Wednesday. The Dow Jones Industrial Average fell 0.60%.

Brent crude was trading 0.01% higher at $78.26 a barrel. Gold was up 0.28% at $2,389.82 an ounce.

Key Levels

US Dollar index was down 0.13% at 103.07.

US 10-year bond yield down at 1.29%.

Brent crude was up 0.01% at $78.26 per barrel.

Bitcoin was down 1.47% at $5,5578.

Gold spot was up 0.28% at $2,389.82 an ounce.

Money Market Update

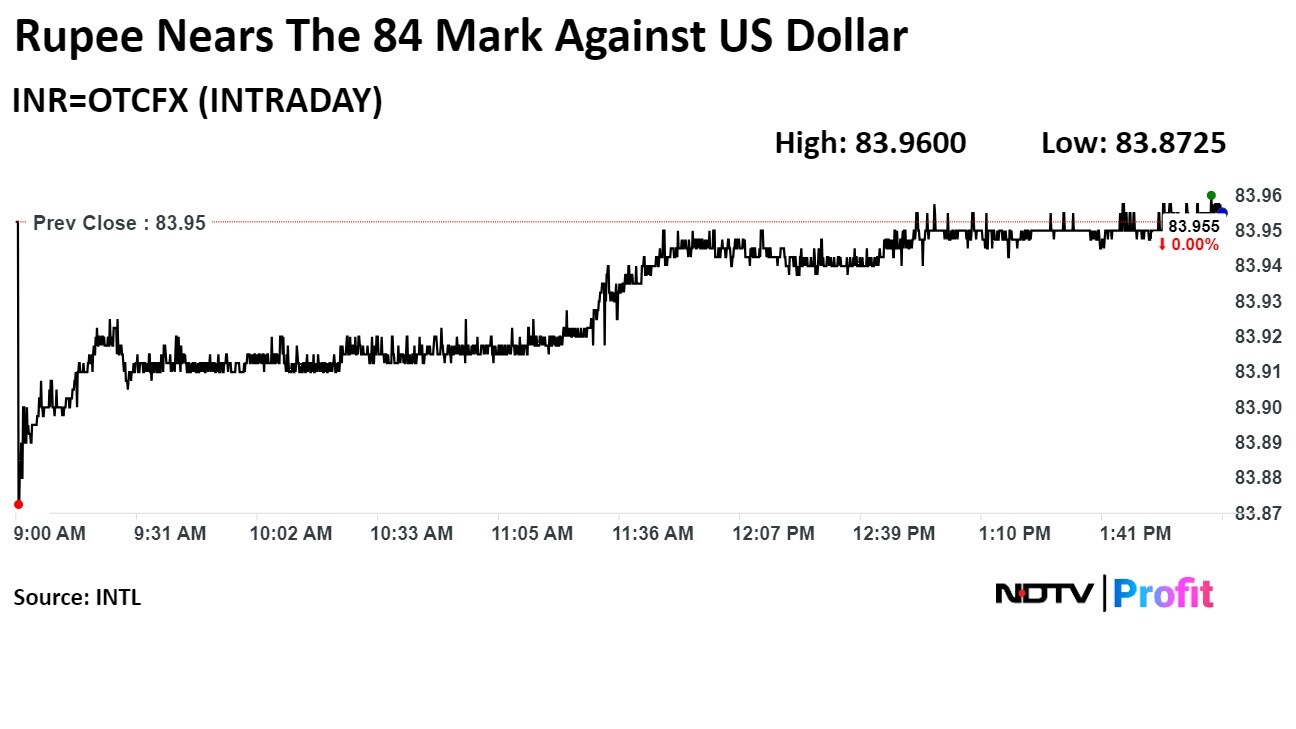

The rupee ended flat at Rs 83.95 after erasing morning gains during the last hours of trade on Wednesday. It had hit a fresh low of Rs 83.98 against the US dollar during the session.

The local currency had opened at Rs 83.89 against the US dollar amid expectations of likely dollar selling by the Reserve Bank of India to support the rupee after its steep fall in the previous session.

Disclaimer: New Delhi Television is a subsidiary of AMG Media Networks Ltd., an Adani Group company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.