Heading into Friday's session, markets will closely watch whether the Nifty can sustain its recent momentum after closing above the 25,100 mark for the fourth day in a row. Analysts suggest that the next target could be 25,370, with downside protection around the 25,000 level, indicating a continuation of the bullish trend.

Despite reaching an all-time high of 25,192, a recovering dollar index, particularly in the metal sector, led to some profit booking on the Nifty. However, positive sentiment was bolstered by gains in key stocks like the Bajaj twins and announcements from Reliance Industries' AGM, according to Hashim Yacoobali, Director of South Gujarat Shares and Sharebrokers Ltd.

The broader market trend remains positive, though traders are advised to be cautious of range-bound activity due to temporary overbought conditions, said Shrikant Chouhan, Head Equity Research of Kotak Securities.

"The Nifty moved up to achieve its highest-ever closing following a volatile session. Besides, the index has undergone a brief consolidation breakout. The RSI is in a bullish crossover, indicating strong price momentum. In the short term, the index might move towards 25,300, with support on the lower end placed at 25,000," said Rupak De, Senior Technical Analyst, LKP Securities.

With Nvidia's revenue forecast falling short of expectations and leading to an 8% drop in after-hours trading, global cues could introduce volatility.

The GIFT Nifty, an early indicator of the Nifty 50's performance in India, was up 32 points or 0.13% at 25,272.5 as of 6:35 a.m.

FII/DII Activity

Overseas investors turned net buyers of Indian equities on Thursday after a day. Foreign portfolio investors bought stocks worth Rs 3,259.6 crore and domestic institutional investors remained net buyers and bought equities worth Rs 2,690.9 crore, the NSE data showed.

Market Recap

India's benchmark stock indices ended at a fresh record high on Thursday, with the NSE Nifty 50 posting the best winning streak in nearly 17 years, tracking gains in Reliance Industries Ltd. and Tata Motors Ltd.

The NSE Nifty 50 settled 99.60 points, or 0.40%, higher at 25,151.95, and the BSE Sensex ended 349.05 points, or 0.43%, higher at 82,134.61. Intraday, the Nifty hit a fresh high of 25,192.90, and the Sensex rose to a lifetime high of 82,285.83.

The Nifty 50 closed higher for 11 consecutive sessions to record its best winning streak since Oct. 3, 2007. The Sensex ended higher for eight days and posted the best winning streak since Sept. 15, 2023.

Major Stocks In News

Infosys: The company expands collaboration with Nvidia to introduce high-performance generative AI-powered telco solutions based on Nvidia NIMs.

Great Eastern Shipping: The company has contracted to sell its 2011-built Supramax dry bulk carrier Jag Rani to an unaffiliated third party. The vessel will be delivered to the new buyer by the third quarter of fiscal 2025.

NLC India: The company to enter JV with Rajasthan Rajya Vidyut Utpadan Nigam for setting up of lignite-based thermal power station in Rajasthan. The JV is for developing renewable power projects of capacity up to 2,000 MW.

Sammaan Capital: The board approved raising up to Rs 30,000 crore via NCDs.

Life Insurance Corporation of India: The company received GST demand and penalty order worth Rs 606 crore from Mumbai tax authority.

Poonawala Fincorp: The company approved the appointment of Bhaskar Pandey as Chief Risk Officer for five years.

Lemon Tree Hotels: The company signed a license agreement for a 72-room hotel in Ayodhya.

GE Power: The company appointed Puneet Bhatla as MD effective Sept. 1.

Steel Strip Wheels: The company has called off discussions for establishing JV in India with Israel's Redler Technologies due to the ongoing Israel war, which has raised uncertainties.

NTPC: The company's unit commenced commercial operations for 160 MW capacity out of the 320 MW Jaisalmer solar project.

Rallis India: Bhaskar Bhat ceased to be Chairman effective Aug. 30 as per retirement age policy.

Technocraft Industries (India): Buyback to open on Sept. 2, close on Sept. 6.

Shipping Corporation of India: The company received GST demand and penalty order worth Rs 160 crore from Mumbai tax authority.

3M India: NCLT approved the merger of the company with 3M Electro & Communication.

Jai Corporation: The company approved buyback of 1.65% stake at Rs 400 per share. Record date for buyback set as Sept.10.

Global Cues

Most Asian stocks bounced back in trade on Friday as an upbeat economic print in the US reinforced soft landing bets, triggering broader gains on Wall Street.

South Korean and Australian benchmarks climbed higher while the Japanese gauge was marginally higher. The Nikkei 225 was 0.19% higher at 38,436, and the S&P ASX 200 was 0.43% up at 8,080 as of 6:21 a.m.

As traders await the US inflation print on Friday, the MSCI Asia Pacific index was on track for a fourth month of gains, according to Bloomberg.

The second quarter US gross domestic product expanded at a revised 3%, against the previous estimate of 2.8%. Further, the weekly jobless claims fell by 2,000 to 2,31,000 in week ending Aug. 24.

A rally on Friday will help record the best month for US and global stocks since June, as the focus now shifts to rate cuts by the Fed in September. The S&P 500 closed flat while Nasdaq Composite climbed 0.23%. The Dow Jones Industrial Average advanced 0.59% on Thursday.

Brent crude was trading 1.64% higher at $79.94 a barrel as of 06:33 a.m. Gold fell 0.15% to $2,517.54 an ounce.

Key Levels

US Dollar Index at 101.34.

US 10-year bond yield at 3.86%.

Brent crude up 1.64% at $79.94 per barrel.

Bitcoin was down 0.31% at $59,345.26.

Gold fell 0.15% at $2,517.54.

Money Market

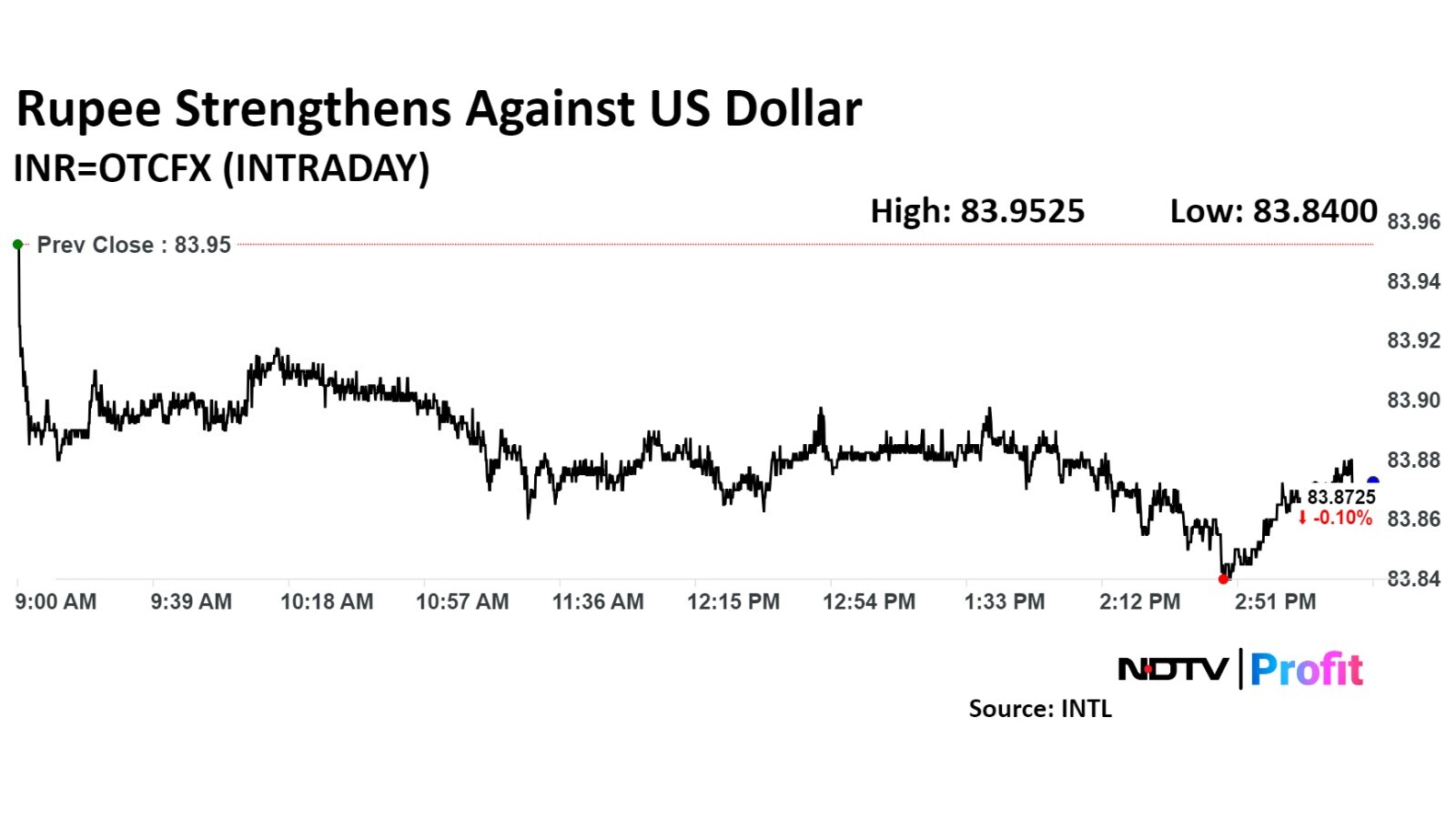

The Indian rupee strengthened against the US dollar on Thursday amid expectation of foreign fund inflows owing to a change in the MSCI index.

However, the broader decline among most Asian currencies and month-end dollar demand from importers continued to weigh on the rupee. But intervention by the Reserve Bank of India through dollar sales by state-run banks will keep the local currency from breaching the critical psychological level at Rs 84.

The local currency appreciated 8 paise to close at 83.87 after opening at Rs 83.92, according to Bloomberg data. It had closed at Rs 83.96 on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.