Indian stock markets kicked off August with strong gains, as the Nifty 50 soared past the 25,000 mark for the first time and the Sensex broke through 82,000 for the first time. Analysts predict that this bullish sentiment is likely to persist. However, the Nifty Media and Realty indices saw a notable decline among sectors.

"We are of the view that as long as the index is trading above 24,950, the bullish sentiment is likely to continue," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the higher side, the market could rally up to 25,100–25,200. On the flip side, below 24,950, the selling pressure is likely to accelerate. Below the same level, the market could retest the level of 24,850-24,800."

The negative divergence in RSI pulled the index lower to settle the trade at 25,010.90, with gains of 59.75 points, according to Aditya Gaggar, director of Progressive Shares.

"The benchmark index has formed a spinning top candlestick pattern, which represents indecisiveness where the downside seems to be protected at 24,930, while the immediate resistance is placed at 25,100," said Gaggar.

It's recommended for investors to stay in the market, maintain liquidity, and consider investing in high-quality companies with strong earnings visibility over a 12- to 18-month horizon, said Neeraj Chadawar, head of fundamental and quantitative research at Axis Securities.

GIFT Nifty was trading 90 points, or 0.36%, lower at 24,807.5 as of 06:43 a.m.

F&O Action

The Nifty August futures are up 0.09% to 25,032 at a premium of 22 points, with open interest up by 1.72%.

Nifty Bank August futures are down by 0.08% to 51,753 at a premium of 189 points, while its open interest is up by 3.46%.

The open interest distribution for the Nifty 50 Aug. 8 expiry series indicated most activity at 26,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 7, the maximum call open interest was at 52,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors turned net buyers of Indian equities on Thursday after three days of selling.

Foreign portfolio investors mopped up stocks worth Rs 2,089.3 crore, while domestic institutional investors turned net sellers after seven sessions of buying and offloaded equities worth Rs 337 crore, the NSE data showed.

Market Recap

India's benchmark equity indices continued their record run for the fourth consecutive session on Thursday, with the Nifty 50 crossing the key psychological level of 25,000 for the first time as sentiment brightened after US Federal Reserve Chair Jerome Powell hinted of a possible rate cut in September.

Both indices closed at their highest levels. The Sensex closed 0.15%, or 126.21 points, higher to end at a fresh record high of 81,867.55, and the Nifty added 59.75 points, or 0.24%, to end at a fresh lifetime high of 25,010.90.

The Nifty hit an intraday high of 25,078.30, and the Sensex hit an intraday high of 82,129.49.

Broader markets underperformed benchmark indices. The S&P BSE Midcap and Smallcap indices closed 0.80% and 0.70% lower, respectively, on Thursday.

On BSE, 13 sectors advanced and seven declined. The S&P BSE Utilities rose the most, and the S&P BSE Realty declined the most.

Major Stocks In News

Maruti Suzuki: The company reported total sales down 4% year-on-year at 1.75 lakh units and domestic sales down by 5% year-on-year at 1.51 lakh units for the month of July.

Godrej Agrovet: The company to acquired remaining 49% stake in Godrej Tyson Foods for Rs 323 crore and company to set up new feed plant in Maharashtra at an initial investment of up to Rs 110 crore.

Nestle India: The company subscribed to 49% stake in Dr Reddy's JV for Rs 706 crore and sold its existing medical nutrition and nutraceuticals business to JV company for Rs 219 crore.

ITC: The company's net profit was little changed during the first quarter of fiscal 2025, while the standalone net profit of India's largest cigarette-maker stood at Rs 4,917 crore in the quarter-ended June, as against Rs 4,903 crore a year ago.

Eicher Motors: The company registered VE Commercial Vehicle sales up 13% year-on-year at 6,622 units, Motocycle sales down 8% year-on-year at 67,265 units and international motorcycle sales down 14% year-on-year at 6,057 units for the month of July.

Hero MotoCorp: The company reported total sales down year-on-year 5.4% at 3.7 lakh units, domestic sales down 6.4% year-on-year 3.47 lakh units, and Exports up 13% at 22,739 units.

Global Cues

Asian shares plunged in early trade with Japan's benchmark nosediving over 5% after US stocks struggled to gain traction with rate-cut bets and disappointing technology earnings.

Equities in Japan extended their fall while the nation's 10-year sovereign yield fell below 1%. Benchmarks in Australia and South Korea were tanked with S&P ASX 200 and Kospi down by 1.95% and 2.8%, respectively, as of 06:27 a.m.

The fall in Japanese stocks come after the Bank of Japan cut its key policy rate earlier than expected and have a hawkish message on Thursday.

Meanwhile, Wall Street came under pressure as the tech companies continued to disappoint investors with lower-than-expected earnings. During the session, yields rallied after weak economic data reinforced bets the Federal Reserve rate cut bets.

Apple Inc. reported a revenue of $85.8 billion for the third quarter against the estimated $84.4 billion. The third-quarter results were marred by dampened China sales with a revenue of 14.73 billion versus the estimated $15.26 billion.

Intel Corp. guided for a less than forecasted third-quarter revenue and announced job cuts while Amazon.com, Inc. projected weaker-than-anticipated profit numbers.

The S&P 500 Index and Nasdaq Composite fell 1.37% and 2.30%, respectively as of Thursday. The Dow Jones Industrial Average declined 1.21%.

Brent crude was trading 0.39% higher at $79.83 a barrel. Gold was 0.15% up at $2,450.05 an ounce.

Key Levels

U.S. Dollar Index at 104.37

U.S. 10-year bond yield at 3.96%

Brent crude up 0.36% at $79.81 per barrel

Bitcoin was up 0.72% at $65,160.05

Gold spot was up 0.13% at $2,449.53 an ounce.

Money Market Update

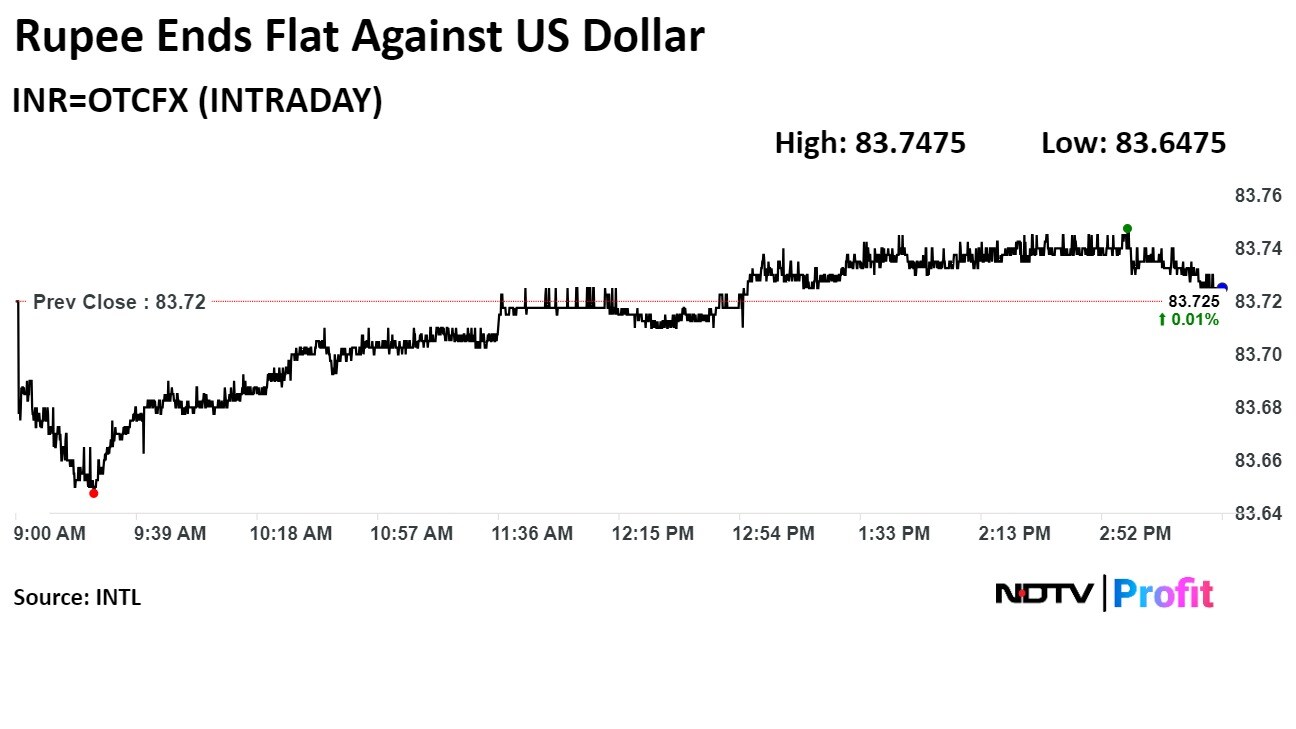

The Indian rupee closed flat against the US dollar on Thursday, amid rising oil prices. The local currency opened stronger against the US currency after the Federal Reserve hinted at a potential interest rate cut in September.

The Indian currency closed flat at Rs 83.72 after opening at Rs 83.68 against the greenback. It closed at Rs 83.73 on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.