The Nifty is facing resistance at higher levels, unable to surpass the 20-day moving average near 24,400, according to analysts, after the benchmark index closed flat at 24,144 on Wednesday. The volatility index, India VIX, eased by 4.40%, settling at 15.46, signaling reduced market volatility.

"A closing above 24,400 would have negated the near-term downtrend. Instead, it's now retesting last week's lows. Traders should exit their long positions if Nifty breaks below the support zone of 23,800-24,000," Kush Bohra, founder of KushBohra.com., said.

Shrikant Chouhan, head of equity research at Kotak Securities, highlighted that for day traders, 24,215/79,300 is a key level. "A move above this could lead to a brief rally up to 24,250–24,300/79,500–79,750. Conversely, if the index falls below the 50-day SMA at 24,050/78,900, selling pressure may intensify, potentially dragging the index down to 23,900/78,500 or further to 23,840/78,300."

The index formed a small red candle and remained below the 34-day exponential moving average at 24,230, indicating ongoing weakness, according to Hrishikesh Yedve, AVP of technical and derivatives research at Asit C Mehta Investment Intermediates Ltd. "As long as the index stays below 24,230, downward pressure is likely to persist. The 50-DEMA at 24,020 provides support, making the 24,000-24,020 range critical for the short term," Yedve said.

Avdhut Bagkar, technical and derivatives analyst at StoxBox, mentioned that markets may stabilise once this selling phase concludes.

The Bank Nifty index opened marginally negative and remained under pressure throughout the day, closing at 49,727. Hrishikesh Yedve noted that the index formed a red candle on the daily chart, indicating persistent weakness. "However, the index is finding support near 49,650-49,660 levels. A sustained move below 49,650 could push the index toward 49,000," Yedve said.

F&O Action

The Nifty August futures were up 0.06% to 24,174 at a premium of 31 points, with open interest down 4%.

Nifty Bank August futures were down 0.19% to 49,955 at a premium of 228 points, while its open interest was up by 3%.

The open interest distribution for the Nifty 50 Aug. 22 expiry series indicated most activity at 25,000 call strikes, with 23,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 21, the maximum call open interest was at 60,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors remained net sellers for the third consecutive day on Wednesday.

The foreign portfolio investors offloaded equities worth Rs 2,595.3 crore, while domestic investors remained net buyers for the ninth consecutive session and mopped up equities worth Rs 2,236.2 crore, the NSE data showed.

Market Recap

The benchmark indices ended the lacklustre session flat on Wednesday. Tata Consultancy Services Ltd. and Infosys Ltd. supported the gains, while ICICI Bank Ltd. and Coal India Ltd. weighed.

The NSE Nifty 50 closed 4.75 points or 0.02%, higher at 24,143.75, while the S&P BSE Sensex settled 149.85 points or 0.19, up at 79,105.88. Intraday, the Nifty rose 0.24% to 24,196.50, and the Sensex rose 0.35% to 79,228.94.

The broader indices underperformed as the BSE MidCap ended 0.41% lower and the SmallCap closed 0.57% down.

Five out of 20 sectoral indices on the BSE ended higher and 15 declined. BSE Metal fell the most and BSE IT was the top gainer.

The market breadth was skewed in the favour of sellers as 2,391 stocks declined, 1,531 advanced, and 114 remained unchanged on the BSE.

Major Stocks In News

SBI and PNB: The Karnataka government ordered all departments to close their accounts with the State Bank of India and Punjab National Bank, citing alleged financial irregularities. All state government departments, public undertakings, corporations, boards, local bodies, universities, and other institutions must withdraw their deposits and investments from these banks immediately.

Vedanta: The company to sell 3.31% stake in Hindustan Zinc through OFS via stock exchange mechanism.

Hindustan Zinc: The company opened its offer for sale for 13.37 crore shares and set floor share price at Rs 486 per share.

Ola Electric: The company reported a revenue up 32% at Rs 1,644 crore in the first quarter of fiscal 2024-2025.

Tata Steel: The company acquired additional 115 crore shares in T Steel Holdings for Rs 1,528 crore.

Paras Defence: The company received Rs 305 crore order from L&T for the electro-optics system.

Reliance Power: The company reported a revenue of Rs 1,992 crore, up by 4.1% in the first quarter of fiscal 2024-2025.

Jindal Stainless: The company has announced the commissioning of its Nickel Pig Iron smelter facility located in an industrial park in Indonesia.

Glenmark Pharma: The company reported a net profit up 96.53% at Rs 340 crore in the first quarter of fiscal 2024-2025.

Lupin: The company received US FDA tentative approval for ANDA for Brimonidine Tartrate.

Global Cues

Asian stocks rose on Friday following strong US jobs and spending data that alleviated recession fears. Equity benchmarks in Japan surged more than 2% at the open.

The Nikkei 225 was 867.29 points or 2.36% higher at 37,593.93, and the Kospi was 39.25 points or 1.48% higher at 2,683.75 as of 06:32 a.m.

US stocks advanced while bonds fell sharply, as reports on retail spending and the labor market highlighted the resilience of the world's largest economy, easing concerns that the Federal Reserve might trigger a deeper economic slowdown.

The S&P 500 ended 1.61% higher while the Nasdaq Composite gained 2.34%, on Thursday. The Dow Jones Industrial Average advanced 1.39%.

Brent crude was trading 0.19% lower at $80.89 a barrel as of 06:35 a.m. Gold rose 0.03% to $2,457.51 an ounce.

Key Levels

U.S. Dollar Index at 103.01

U.S. 10-year bond yield at 3.91%

Brent crude down 0.19% at $80.89 per barrel

Nymex crude down 0.28% at $77.94 per barrel

Bitcoin was up 1.30% at $57,416.16

Money Market

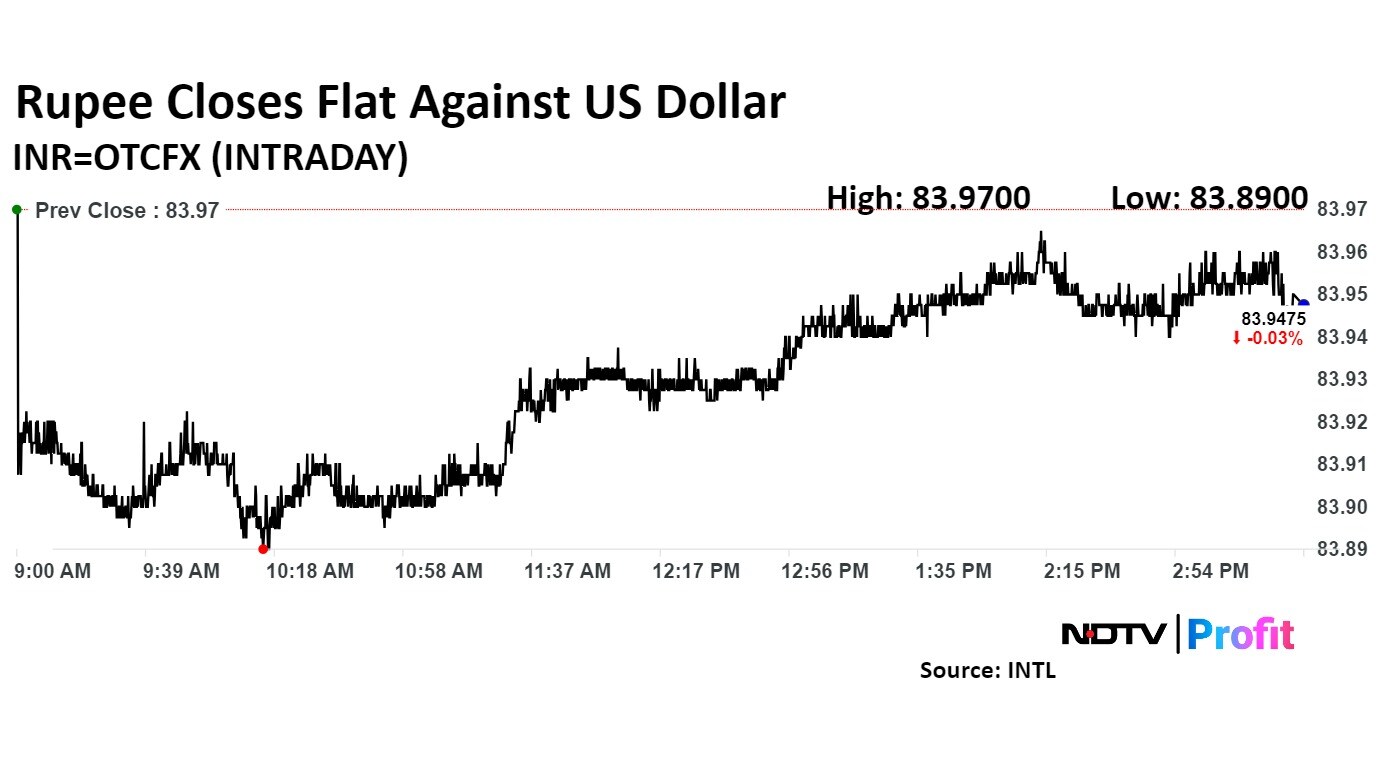

The Indian rupee closed flat against the US dollar on Wednesday after nearing the Rs 84 mark in the previous session.

The rupee closed flat after appreciating 2 paise higher from previous close to 83.95 against the US dollar. It had closed at Rs 83.97 on Tuesday.

The rupee had appreciated by six paise to open at Rs 83.91 on expectations of substantial inflow after India's weight on key MSCI equity index rises to record high.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.