Nifty is expected to remain in consolidation mode due to the absence of significant positive triggers, as analysts observe. The benchmark index closed in a doji candle within an inside range, with key support levels at 24,200 on Tuesday. Sector-wise, all sectors lagged, except for consumer durables and healthcare, which remained positive. On the stock-specific front, sugar stocks surged following speculation of an ethanol price hike.

The market is expected to continue its consolidation mode due to a lack of major positive triggers, according to Siddhartha Khemka, head of retail research, Motilal Oswal Financial Services Ltd. "However, investors should view this dip as a buying opportunity in quality stocks, particularly large-cap stocks where valuations are still attractive," he said.

"Indian market participants will be closely watching the WPI and manufacturing inflation data set to be released tomorrow," said Avdhut Bagkar, technical and derivatives analyst at StoxBox.

Rajesh Bhosale, Equity Technical Analyst at Angel One, pointed out that recent sessions have seen prices struggling around the 20-day exponential moving average, or EMA. He anticipates that Nifty may test the 50-day EMA support in the 24,040–24,000 range and could potentially dip below the recent low of 23,900.

"With the upcoming weekly expiry for both Nifty and Bank Nifty, increased volatility is expected. Traders should avoid complacency, keep positions light, and prepare for potential market fluctuations ahead of the mid-week holiday," Bhosale said. "Conversely, the 24,350–24,500 range remains a critical hurdle; only a breach beyond this range would likely favour bullish momentum," he said.

Bank Nifty witnessed a sharp bounce from its support of 50,200 levels and closed flat to positive, driven by momentum in private banks.

"The first band of resistance (for Bank Nifty) is at 51,300 levels, which is the band of averages for an upward breakout; the trend reversal is placed at 49,800 levels. RSI is piercing upwards to cross its average line and will build positive momentum on the crossover of the same in the next few days," according to Vikas Jain, head of research at Reliance Securities.

F&O Action

The Nifty August futures are down 0.81% to 24,161 at a premium of 22 points, with open interest up by 2.5%.

Nifty Bank August futures are down by 1.25% to 50,052 at a premium of 221 points, while its open interest is up by 17%.

The open interest distribution for the Nifty 50 Aug. 14 expiry series indicated most activity at 25,000 call strikes, with 23,500 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 14, the maximum call open interest was at 50,500 and the maximum put open interest was at 42,000.

FII/DII Activity

Overseas investors remained net sellers on Tuesday for the second consecutive day.

The FPIs offloaded equities worth Rs 2,107.2 crore, while domestic investors remained net buyers for the eighth consecutive session and mopped up equities worth Rs 1,239.96 crore, the NSE data showed.

Market Recap

The benchmark equity indices ended lower for the second consecutive day to log their worst session since Aug. 5 as shares of banks weighed on them. The NSE Nifty 50 closed 208 points or 0.85%, down at 24,139.0 and the S&P BSE Sensex ended 692.89 points or 0.87%, lower at 78,956.03.

During the day, both the Nifty and the Sensex fell as much as 0.95% to 24,116.50 and 78,889.38, respectively.

The broader markets underperformed the benchmark indices as the BSE MidCap and the SmallCap settled 0.94% and 1.14% lower, respectively.

On the BSE, 19 out of 20 sectoral indices ended lower and one advanced. Commodities declined the most, while consumer durables emerged as the best-performing sector.

The market breadth was skewed in favour of the sellers as 2,657 stocks declined, 1,282 rose and 87 remained unchanged on the BSE.

Major Stocks In News

Vedanta: The company to sell 2.6% stake in Hind Zinc through offer for sale via stock exchanges.

SJVN: The board received in-principal approval for diluting stake in SJVN Green Energy and received approval for monetisation of Nathpa Jhakri Hydro Power Station via securitisation of partial future revenue/return on equity.

Mahindra and Mahindra: The company reported total production down at 1.2% at 69,138 and total sales up 2.1% at 64,929, total export down 40% at 1,515.

Hero MotoCorp: The company grew in the fiscal first quarter due to a rebound in sales of its commuter motorcycles. Profitability improved as premiumisation gathered momentum.

Bombay Dyeing: The company completed the sale of Worli land parcel in Mumbai to Sumitomo Realty for Rs 538 crore.

Global Cues

Asian stocks surged in response to a Wall Street rally, driven by recent US inflation data that strengthened expectations of a Federal Reserve rate cut in September. Equity benchmarks in Japan and South Korea climbed over 1% at the open, continuing their rebound from a historic selloff on Aug. 5.

The Nikkei was trading 0.27% higher, while South Korea's Kospi was up 0.92% as of 6:31 a.m.

US stocks surged and bond yields declined following the latest inflation data, which bolstered expectations that the Federal Reserve will implement its anticipated interest rate cut in September.

The S&P 500 ended 1.68% higher while the Nasdaq Composite gained 2.43%, on Tuesday. The Dow Jones Industrial Average advanced 1.04%.

Brent crude was trading 0.53% higher at $81.12 a barrel. Gold was up 0.05% at $2,466.41 an ounce.

Key Levels

U.S. Dollar Index at 102.63

U.S. 10-year bond yield at 3.85%

Brent crude up 0.50% at $81.09 per barrel

Nymex crude up 0.61% at $78.83 per barrel

Bitcoin was up 0.32% at $60,781.86

Money Market

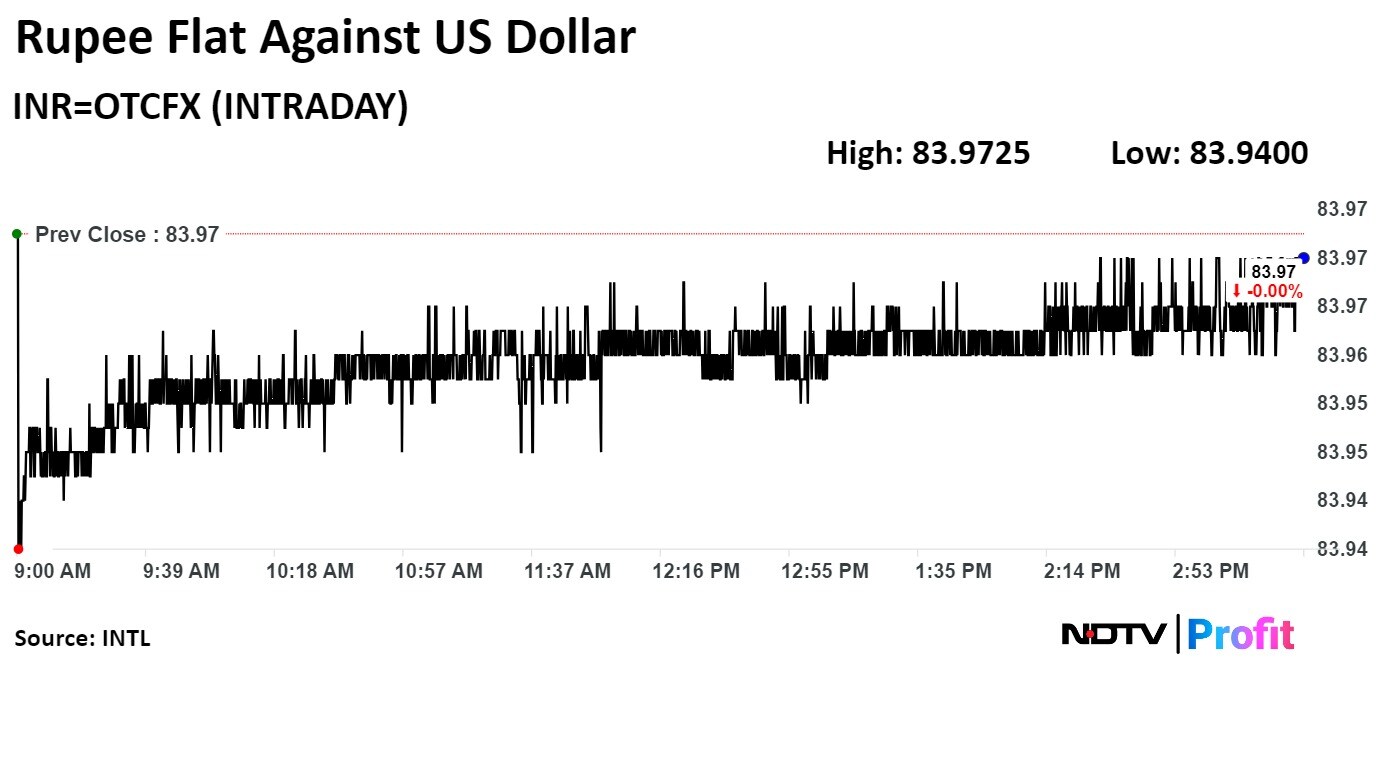

The Indian rupee closed flat against the US dollar on Tuesday after opening stronger amid a steady dollar and easing crude oil prices.

The rupee closed flat after appreciating two paise to Rs 83.95 in the morning against the US dollar. It had closed at Rs 83.97 on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.