The RSI oscillator on the daily chart is negative, indicating a negative short-term momentum, while the 21,950 zone is a crucial support for the short term, according to Ruchit Jain, lead of research at 5paisa.com. If Nifty manages to trade within this channel, then there should be a pullback move from this support and if this is breached, then we could see an extension of this down move towards the 21,740 level, Jain said.

"On the flip side, 22,330–22,380 is the immediate resistance on the pullback move. FIIs have also recently formed fresh short positions in the index futures segment, which is a negative sign."

India VIX, which gauges market volatility has been higher for four straight sessions. Geopolitical tensions and weakness in information technology may linger over large-cap stocks in trade today. The 22,000 call strike has added 1.82 crore contracts and now becomes key resistance zone.

The short-term momentum for the market remains negative based on above data, according to Jain. "However, the Nifty is close to its immediate support and the readings on the lower time frame charts are oversold."

"We have been seeing pressure on every bounce and Nifty has tested the lower band of the rising channel around 21,960 in the previous session," Ajit Mishra, senior vice president of research at Religare Broking Ltd., said. Its break would prompt a further fall to the 21,750–21,600 zone, and volatility across sectors is further adding to the traders' worries, he said. "We thus suggest limiting positions and waiting for clarity."

The GIFT Nifty was trading 76.5 points lower or 0.35% down 21,948.50 as of 06:36 a.m.

FII And DII Activity

Overseas investors remained net sellers of Indian equities on Thursday for the fourth consecutive session.

Foreign portfolio investors offloaded stocks worth Rs 4,260.3 crore and domestic institutional investors remained net buyers for the seventh day in a row and mopped up equities worth Rs 2,285.5 crore, the NSE data showed.

Markets On Thursday

India's benchmark stock indices erased intraday gains to extend their losing streak to the fourth session on Thursday as Axis Bank Ltd., ICICI Bank Ltd. and HDFC Bank Ltd. dragged.

The benchmarks have now recorded the longest losing streak since Oct. 26. The NSE Nifty 50 closed 152.05 points or 0.69%, lower at 21,995.85 and the S&P BSE Sensex ended 454.69 points or 0.62%, lower at 72,488.99.

The Nifty slipped below 22,000 for the first time since March 26. Intraday, the Nifty rose as much as 0.81% to 22,326.50 and the Sensex rose 0.73% to 73,473.05.

On the NSE, 11 out of the 12 sectors ended lower. The Nifty Oil & Gas sector declined the most. The broader markets ended on a mixed note. The BSE MidCap settled 0.39% lower and the BSE SmallCap ended 0.06% higher.

On the BSE, 10 sectors declined and as many advanced. The BSE Consumer Durables sector declined the most and the BSE Telecommunication rose the most among sectoral indices.

Major Stocks In News

Nestle: The company clarified media reports and reaffirmed its commitment to high standards of nutrition, quality and safety. It also said that the media reports had no material impact on its operations or performance.

Gokaldas Exports: The Bengaluru-based apparel maker has launched a qualified institutional placement to raise Rs 600 crore. The issue price has been set at Rs 775 apiece, representing a discount of 4.05% to the last closing price. The floor price is Rs 789.99.

ITC: The company's arm has acquired a 100% stake in Blazeclan Tech for Rs 485 crore.

Earnings In Focus

Wipro, Hindustan Zinc, Jio Finance, HDFC AMC, Elecon Engineering.

Top Brokerage Calls

Motilal Oswal On Infosys

Motilal Oswal maintains 'buy' on Infosys with a target price Rs 1,650 per share.

Strong deal wins improve visibility for FY26 growth.

Management sees a good pipeline of large deals despite the unchanged demand environment.

Expects FY25 dollar constant currency revenue growth of 2.5% year-on-year.

Expects double-digit dollar CC revenue growth in FY26 as macro visibility improves.

Expects FY25 EBIT margin of 21.1%, up 40 basis points year-on-year.

Lowers FY25/FY26 EPS estimates by 5–6% on weak Q4, muted FY25 revenue growth guidance.

Views Infosys as a beneficiary of IT spending acceleration over the medium term.

Motilal Oswal On Bajaj Auto

Motilal Oswal maintains a 'neutral' rating on Bajaj Auto at Rs 8,360 apiece target price per share.

Domestic 2W (industry) volumes to grow 7-8% year-on-year in FY25.

Likely to outperform the domestic motorcycles segment, led by a healthy launch pipeline.

Export outlook remains uncertain given geopolitical headwinds in key markets.

Three-wheeler ICE demand is likely to normalize over a very high base in the last two years.

Global Cues

Markets in Australia and South Korea were trading in loss, tracking overnight decline on Wall Street after US Treasury yields rose. The KOSPI was trading 40.36 points or 1.53% lower at 2,594.34, and the S&P ASX 200 was 76.60 points or 1.00% down at 7,565.50 as of 06:36 a.m.

Benchmarks in Japan declined after data showed the country's inflation rose less than expected, which weighed on investors' expectation of a rate hike in the near term.

Japan's CPI came at 2.7% in March, just below 2.8% forecasted by economists in a Bloomberg survey. Traders expect the Bank of Japan to hold rate steady in the upcoming week, and hike in October, Bloomberg reported.

The Nikkei 225 was trading 744.80 points or 1.96% lower at 37,334.90 as of 06:34 a.m.

US Treasury yields edged higher after solid economic data spurred bets that the Federal Reserve will be in no rush to cut interest rates, reported Bloomberg.

The S&P 500 index and Nasdaq Composite declined by 0.22% and 0.52%, respectively, as of Thursday. The Dow Jones Industrial Average rose by 0.06%.

Brent crude was trading 0.20% lower at $86.91 a barrel. Gold was up by 0.02% to $2,379.57 an ounce.

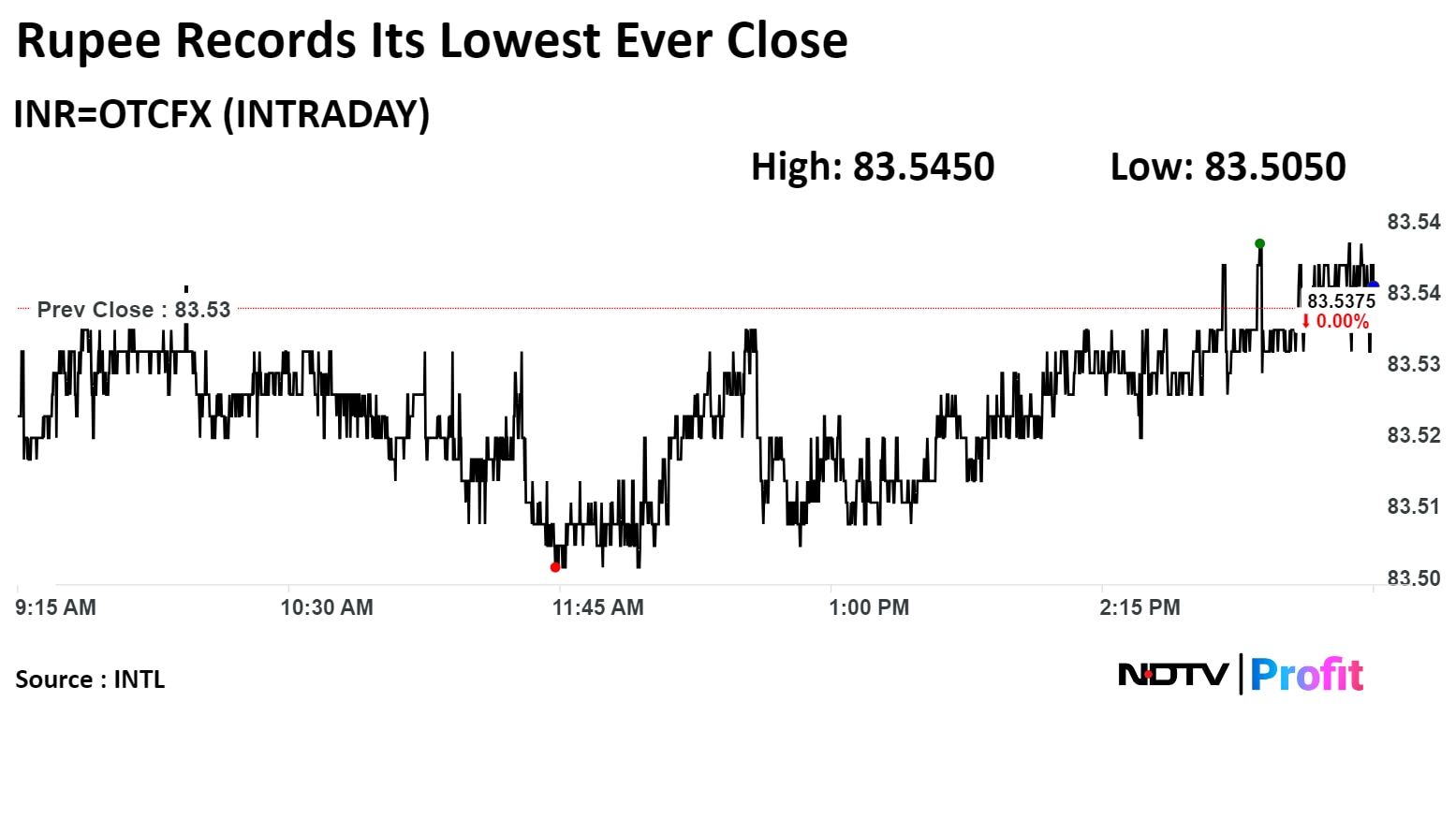

Rupee Update

The Indian rupee recorded its worst closing level against the US dollar on Thursday. The local currency closed at a new low of Rs 83.543 against the greenback.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.