The NSE Nifty 50 closed at 23,992.55 on Tuesday, supported by a rebound in other Asian markets, particularly Japan, which had experienced its worst downturn since 2008. Despite this, analysts observed that the day's sell-off reflects ongoing market nervousness, with no strong signs of support forming.

Both major indices and broader market segments saw declines, though the Nifty Realty, Nifty Metal, Nifty Media, and Nifty IT indices posted gains. Other sectors finished in red.

Key trend-setting levels for the Nifty and Sensex are 23,900 and 78,290, respectively, said Shrikant Chouhan, head of equity research at Kotak Securities. "A drop below these levels could lead to further declines to 23,700 or even 23,600 and 78,000–77,800, where support from retracements and long-term averages may be found," he said.

Chouhan recommended selective buying around these levels, with major resistance seen at 24,150/79,000 and 24,400/79,700. He advised reducing weak long positions near 24,300/24,400.

The Nifty needs to surpass the 24,300–24,350 range to initiate a strong pullback. Otherwise, the index may continue its downward trend towards the 23,630 support level, according to Ruchit Jain, lead researcher at 5paisa.com. "We advise traders to stay cautious in the short term and wait for signs of reversal," he said.

The Nifty Bank index has continued to underperform, with significant selling pressure in banking and NBFC stocks.

"The index closed near the short-term support of 49,700, the 50% retracement level of the recent uptrend. Without signs of strength, a breach of this support could lead to a continued correction towards the 61.8% retracement level around 48,860, Jain said. He advised caution and was waiting for a trend reversal.

The GIFT Nifty was up 0.27%, or 65 points at 24,192.50 as of 6:56 a.m.

F&O Action

The Nifty August futures are down 0.05% to 24,056 at a premium of 64 points, with open interest down by 8.32%.

Nifty Bank August futures are down by 0.63% to 49,919 at a premium of 171 points, while its open interest is up by 3.3%.

The open interest distribution for the Nifty 50 Aug. 8 expiry series indicated most activity at 25,000 call strikes, with 22,300 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 7, the maximum call open interest was at 52,000 and the maximum put open interest was at 49,000.

FII/DII Activity

Foreign portfolio investors remained net sellers for the third consecutive session on Tuesday. FPIs offloaded equities worth Rs 3,531.2 crore, according to provisional data from the National Stock Exchange.

Domestic investors remained net buyers for the third consecutive session and mopped up equities worth Rs 3,357.5 crore, the NSE data showed.

Market Recap

The benchmark equity indices fell for the third consecutive session on Tuesday and closed at the lowest level in over a month, as they erased all their morning gains in the second half of the session.

The NSE Nifty 50 fell 63.05 points, or 0.26%, to end at 23,992.55, while the S&P BSE Sensex closed 166.33 points, or 0.21%, down at 78,593.07. During the day, the Nifty had risen as much as 1.36%, and the Sensex had jumped 1.39%.

The broader markets underperformed the benchmark indices, as the BSE MidCap and the SmallCap ended 0.71% and 0.57% lower, respectively.

On the BSE, 16 sectors ended on a negative note and four settled higher, with Telecommunication declining the most and Realty rising the most.

Global Cues

Asian stocks were mixed in early trade after a slight recovery in the previous session. The Nikkei 225 was trading 67 points, or 0.20% lower at 34,193.0, while the S&P ASX 200 was 6.60 points, or 0.09% down at 7,674 as of 06:39 a.m.

Following Monday's fall, US markets rallied thanks to a renewed wave of dip buying. All major groups in the S&P 500 climbed, with the index closing 1% higher.

The S&P 500 and Nasdaq Composite advanced 1.04% and 1.03%, respectively as of Tuesday. The Dow Jones Industrial Average rose 0.76%. Shares of Nvidia Corp. rose as much as 7.23% to top gains among chipmakers. The "Magnificent Seven" index increased, as did the Russell 2000, which closed 1.23% higher.

The week began with a global rout that was triggered by the Bank of Japan's decision to hike interest rates. All stocks in the US and Asian markets took a hit which was further accentuated by weak economic data from the US, as traders weighed the possibility of aggressive rate cuts going ahead.

Brent crude was trading 0.31% lower at $75.98 a barrel. Gold was 0.45% down at $2,361.49 an ounce.

Key Levels

US Dollar index at 102.95.

US 10-year bond yield up by 0.26%.

Brent crude is down 0.31% at $75.98 per barrel.

Bitcoin was up 0.84% at $56,356.

Gold spot was down 0.45% at $2,361.49 an ounce.

Major Stocks In News

Hindalco Industries: The Central Bureau of Investigation booked the company for alleged corruption in getting environmental clearances for coal mining between 2011 and 2013.

Welspun Living: The company's Rs 278 crore buyback will open on August 9 and close on August 16.

Tata Power: The company is to acquire a 40% stake in Khorluchhu Hydro Power for Rs 830 crore and company to terminate the Global Depository Shares program.

Cupid: The company will set up a new unit in the UAE to capture market share in the GCC region.

GR Infraprojects: The company emerged as the lowest bidder for the transmission project in Karnataka.

Aurobindo Pharma: The company has US FDA approval for Estradiol vaginal inserts. The product is to be launched in Q2FY25.

Suzlon Energy: The company bought a 76% stake in Renom Energy Services for Rs 660 crore.

Money Market Update

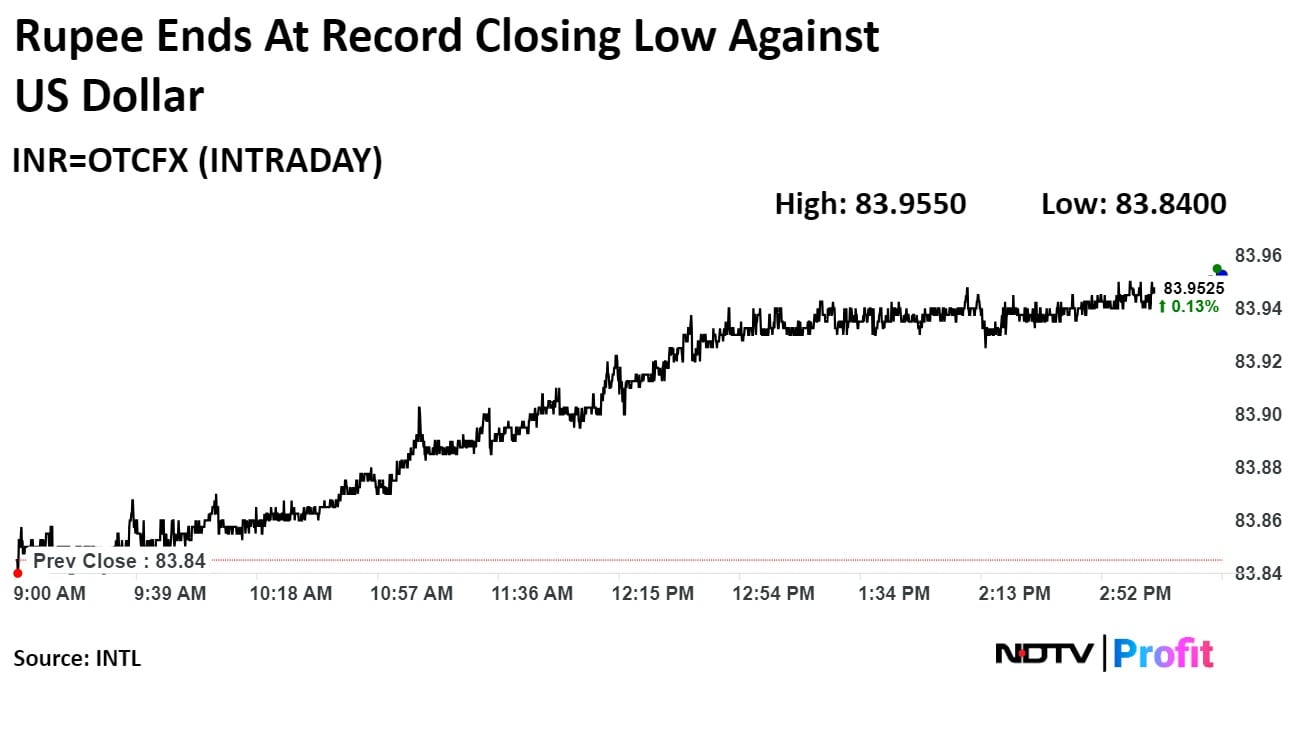

The Indian rupee closed at a record low on Tuesday as global funds continued to pull out of domestic stocks amid the ongoing unwinding of the yen carry trade and rising fear of recession in the US.

The local currency depreciated 12 paise to end at an all-time low of Rs 83.96. It had closed at Rs 83.84 against the greenback on Monday. The currency had opened at Rs 83.86 against the dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.