Torrent Power Ltd.'s share price rose to a record high on Wednesday as the company received a letter of award from Maharashtra State Electricity Distribution Co. for long–term supply of 2,000 megawatt energy storage capacity.

MSEDCL will procure storage capacity from Torrent Power's inter–state transmission system connected pumped hydro storage plant, the company said in the exchange filing.

The 2,000 MW energy storage capacity order includes a Letter of Intent for 1,500 MW capacity issued by MSEDCL on Sept. 17, the exchange filing said. Torrent Power has already received 500 MW capacity under the fresh tender, taking the total energy storage capacity order to 2,000 MW.

Separately, Torrent Power's subsidiary, Torrent Urja 17 Pvt., entered into a share subscription agreement with The Lakshmi Mills Ltd. to supply power from renewable energy sources, another exchange filing said.

Torrent Urja 17 will supply 8.5 MW solar power through open access to the units of The Lakshmi Mills Ltd., the exchange filing said. Torrent Power holds 10,000 equity shares of Rs 10 each, aggregating to Rs 1,00,000 of TU17, a subsidiary of the company.

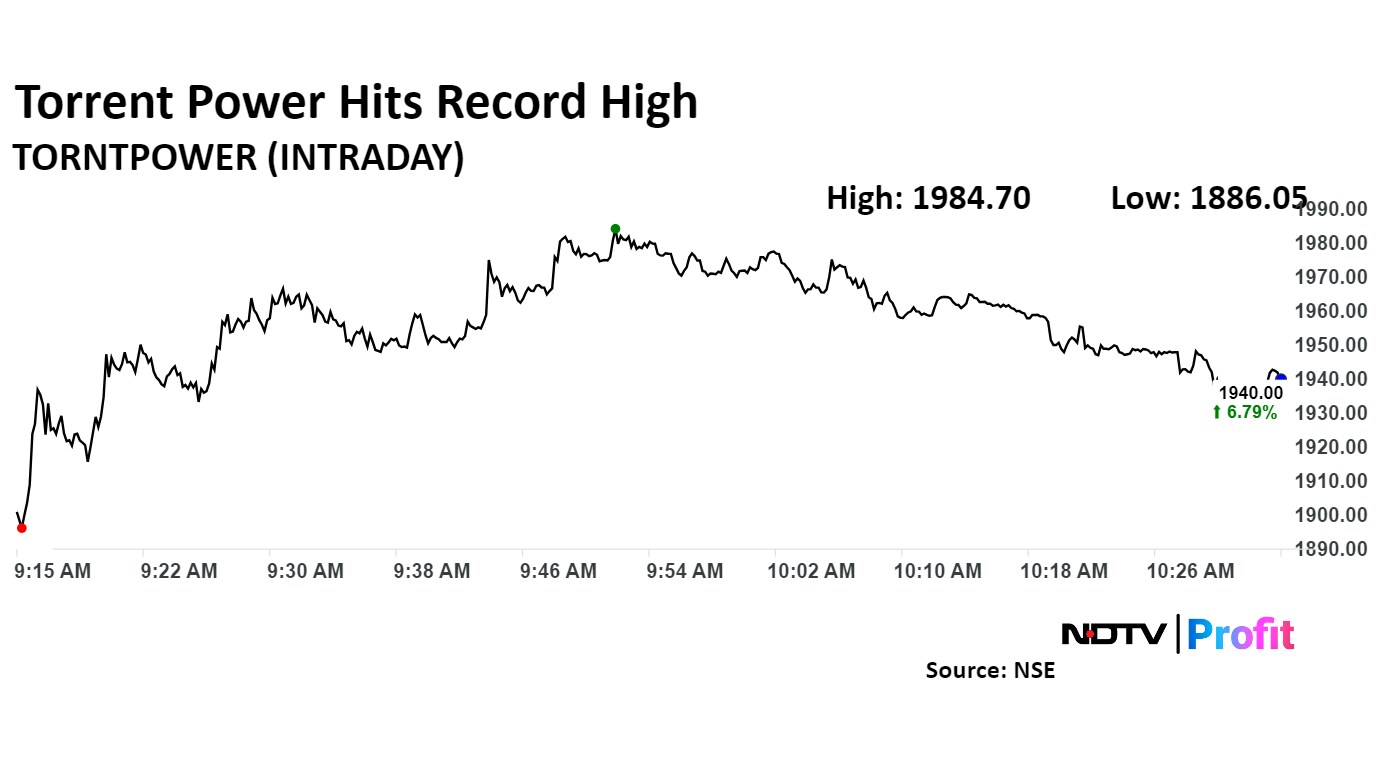

Torrent Power Share Price

Torrent Power share price rose 8.89% to Rs 1,987.15, the highest level since its listing on the bourses.

Torrent Power's share price rose 8.89%, the highest level since its listing on the bourses, before paring gains to trade 6.51% higher at Rs 1,934.85 per share as of 10:35 a.m. This compared to a 0.56% advance in the NSE Nifty 50.

The stock has gained 171.22% in 12 months, and 110.66% year-to-date. Total traded volume so far in the day stood at 9.3 times its 30-day average. The relative strength index was at 62.38.

Out of 10 analysts tracking the company, four maintain a 'buy' rating, three recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 21.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.