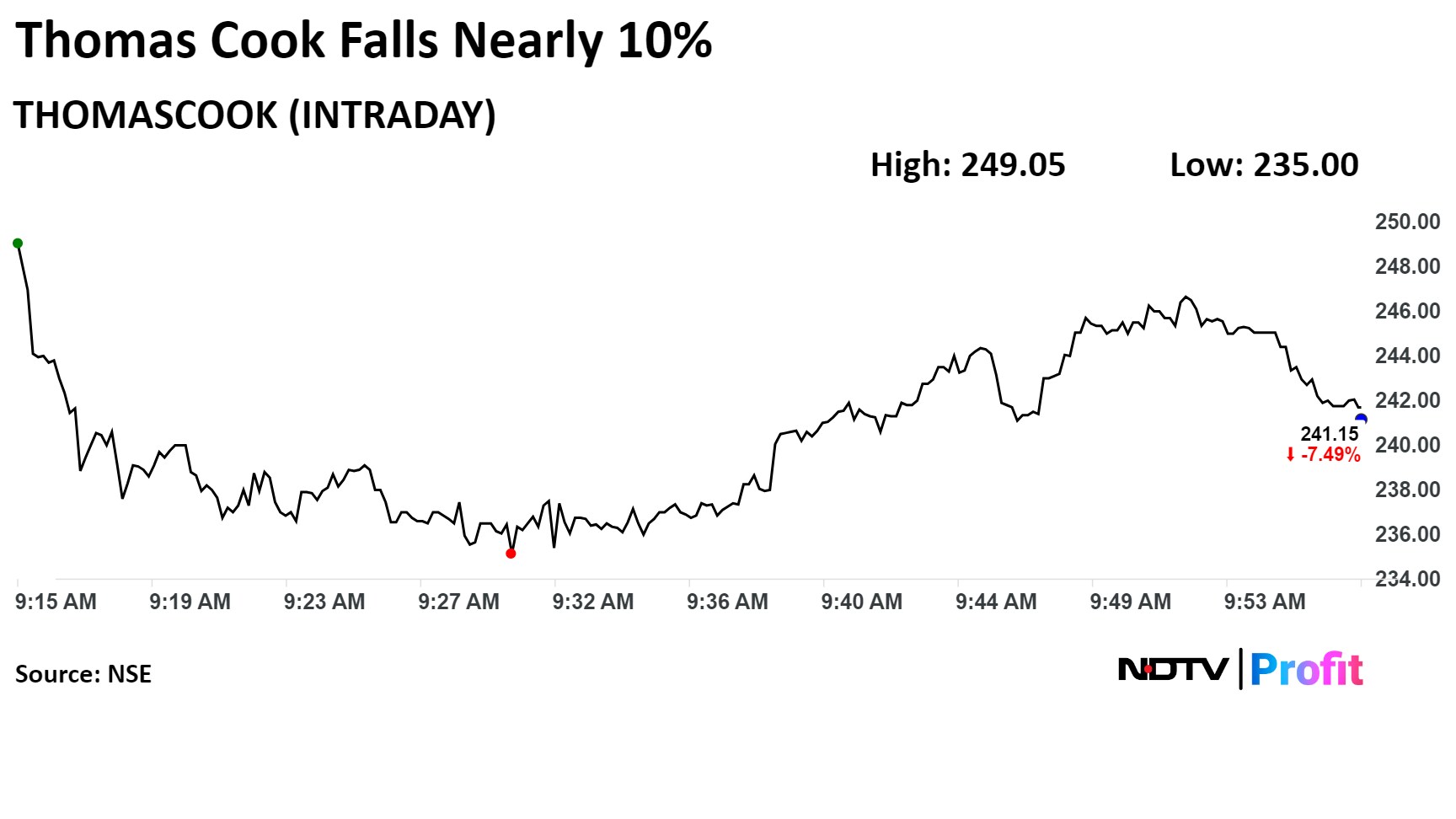

Shares of Thomas Cook (India) Ltd. tumbled nearly 10% on Thursday after its first-quarter profit missed analysts' estimates.

The company's net profit rose 3.1% year-on-year to Rs 73 crore in the quarter ended June 2024, according to an exchange filing. That compares with the consensus estimate of Rs 94.3 crore taken from analysts polled by Bloomberg.

Thomas Cook Q1 FY25 (Consolidated, YoY)

Revenue up 10.9% at Rs 2,106 crore. (Bloomberg estimate: Rs 2,297.8 crore).

Ebitda up 9.9% at Rs 136 crore versus. (Bloomberg estimate: Rs 152.4 crore).

Margin flat at 6.5% (Bloomberg estimate: Rs 6.60%).

Net profit up 3.1% at Rs 73 crore. (Bloomberg estimate: Rs 94.3 crore).

The company also announced a further investment of up to Rs 2.5 crore in Indian Horizon Marketing Services Ltd., a wholly owned subsidiary of the company, through rights issue and further issue of capital in one or more tranches offered by it, the company said in its filing.

The company's interest is limited only to the extent of its shareholding, and the proposed investment will be done at arm's length.

Shares of Thomas Cook fell as much as 9.85% to Rs 235 apiece, the lowest since July 23. It pared losses to trade 6% lower at Rs 245.30 apiece, as of 10:21 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

The stock has risen 81.08% on a year-to-date basis and 112.3% in the last 12 months. Total traded volume so far in the day stood at 3.67 times its 30-day average. The relative strength index was at 49.03.

Both the analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 15.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.