(Bloomberg) --

An estimated slowdown in revenue growth for India's top technology companies is threatening to stall the relentless surge in the nation's stocks, which were among Wall Street's top emerging-market picks.

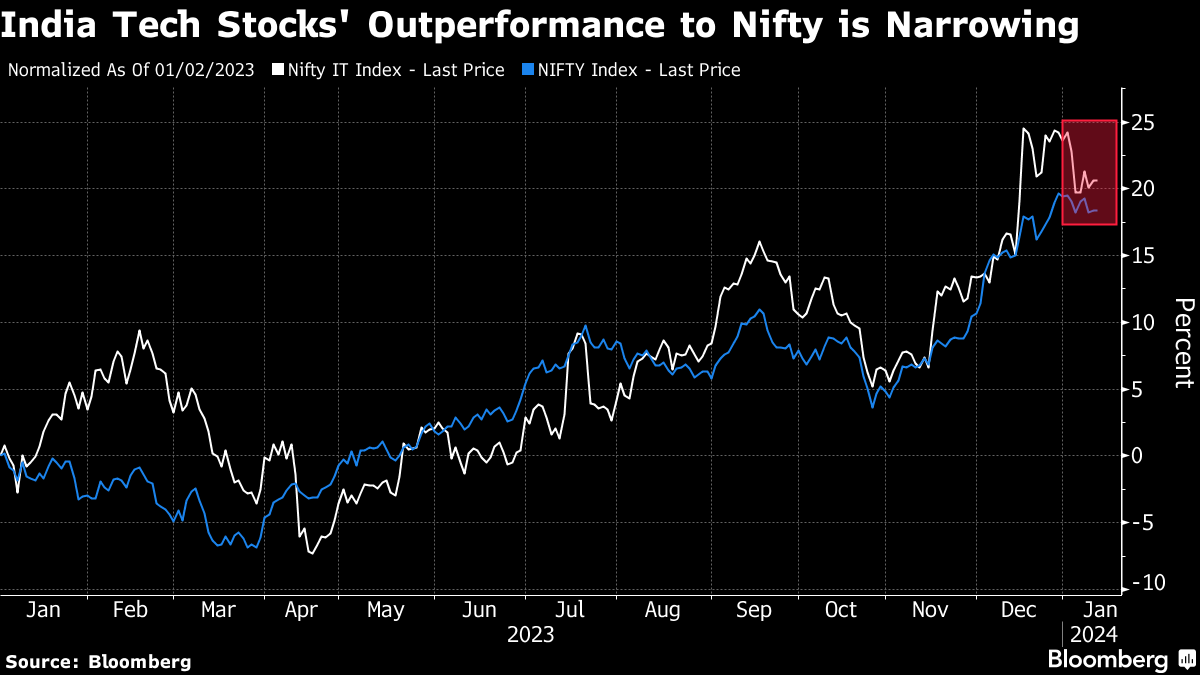

As investors await these results this week, a gauge of Indian tech shares has fallen for three straight weeks after rallying for the most part in 2023. The broader benchmark NSE Nifty 50 Index was also in the red so far this year after gaining 20% in 2023.

India took the world by storm last year, powered by its fast economic growth, a growing middle class and rising manufacturing prowess as China falls out of favor. Its stock market value reached more than $4 trillion for the first time as global investors poured more than $20 billion into its equities on a net basis in 2023, most in three years. But there are signs that earnings may not grow fast enough to sustain the rally.

“There's a lot of positivity that is being factored in but earnings growth in 2024 should moderate compared to last year due to margins compressing even as revenue growth picks up,” said Rajat Agarwal, Asia equity strategist at Societe Generale. “It does not look like that this is going to be a year of very strong returns for the market.”

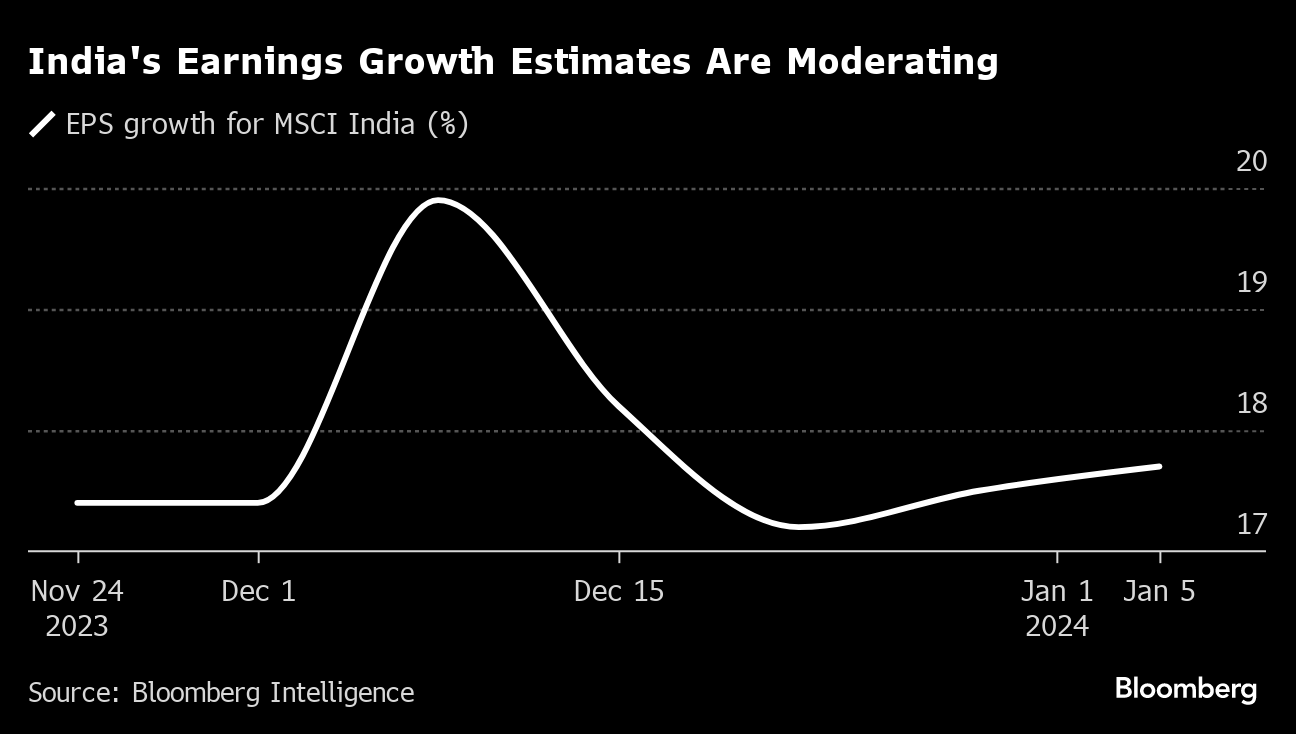

Overall, profit estimates for Indian companies have been moderating, with growth now seen at 17.7% for this year, compared with about 20% just a month ago, data compiled by Bloomberg Intelligence show. Companies covered by Jefferies Financial Group Inc. in India will likely report 14% year-over-year growth in this earnings season, slower than a 38% jump in the previous quarter, the broker said.

Software giant Infosys Ltd. is set to report its slowest sales growth in more than 14 years as key clients continue to restrict spending on technology while uncertainty in global economy persists. Tata Consultancy Services Ltd., Asia's largest software services exporter, is seen posting revenue growth of 2.6%, the smallest since 2020. Both firms are due to report their quarterly earnings on Thursday.

India's other two software majors — HCL Technologies Ltd. and Wipro Ltd. — will announce earnings Friday. Technology companies constitute about 15% of the benchmark S&P BSE Sensex Index and disappointing results from the sector have the potential to weigh on the market's performance.

Reduced spending by clients and slower revenue conversion from large deals are among factors that have dented investor optimism toward India's tech sector. Accenture's weak revenue outlook and a lack of major deal announcements in the quarter didn't help either.

Further, technologies such as artificial intelligence are increasingly performing tasks previously handled by entry-level IT workers, prompting some Indian companies to freeze hiring and withhold pay hikes. Hiring activity in India fell 10% year-on-year in November, with that in the technology sector sliding 16%, according to a report by jobs portal foundit.

Weakness in the tech-services industry — one of the largest employers in India and one that accounts for 7.5% of the South Asian nation's more than $3 trillion economy — can also have repercussions for the broader economy as the sector tends to drive consumption in India's urban centers.

“A lack of positive commentary on 2024 IT budgets, soft FY25 revenue guidance in April, and margin pressures in the second half could lead to stocks seeing earnings or valuation multiple downgrades,” analysts at Morgan Stanley wrote in a note last week.

READ: Citi, Jefferies Sound Caution on India Tech Rally on Valuation

--With assistance from Ishika Mookerjee.

(Adds details on Wipro, HCL Technologies reporting dates in seventh paragraph)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.