Tata Consultancy Services Ltd. is Macquarie's pick over Infosys Ltd. due to better rebound in spending trends after Covid-19 and the global financial crisis.

The stock is the brokerage's top pick among large-cap IT services companies and also a Macquarie Marquee idea, it said while maintaining an 'outperform' rating. The brokerage has a target price of Rs 5,740 per share, implying a 27.2% upside.

When spending picks up, the brokerage said, it expects more cloud migration deals to be bundled between applications and infrastructure services and sees TCS as better positioned than Infosys.

The brokerage expects the Tata-group company to grow faster than Infosys in both fiscals 2026 and 2027.

"When clients' IT spending picks up in CY25, we think standalone application deals could further decline, while the fastest growing part of the market could be bundled between application services and infrastructure management services deals," it said. "We think TCS has an edge over INFO (Infosys) in bundled deals as we think it has a significant lead in IMS (especially in data centre management)."

TCS is trading at a 27.6 times fiscal 2026 price to earnings compared to Infosys at 27.4 times, the brokerage said. "We think this implies investors expect similar risk and growth profiles or slightly slower growth for TCS as we see it offering lower risk with steady Unbilled DSOs (Days Sales Outstanding) that are lower than that of Infosys," it said.

However, TCS' stock has underperformed Infosys on a year-to-date basis, as well as in the last 12 months. It has risen 15.58% year-to-date and 24.27% in the last 12 months, compared to Infosys' 23.2% rise on a year-to-date basis and 32.4% in 12 months.

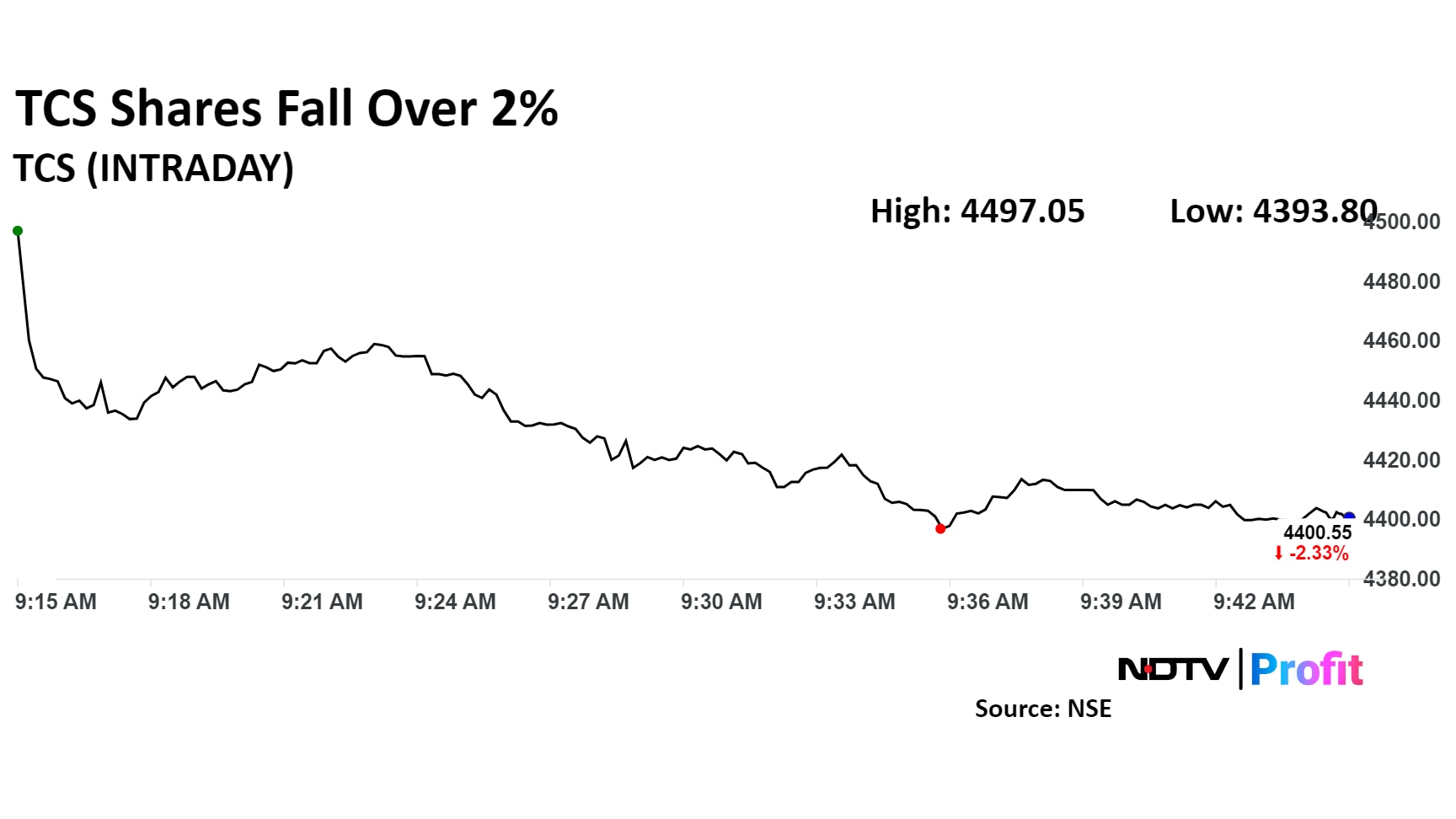

In today's session, the stock fell, as global markets await the outcome of Federal Reserve's meeting amid uncertainty over the quantum of the cut in the benchmark interest rate of US.

Shares of the company fell as much as 2.9% to the lowest level since Aug. 16, before paring some loss to trade 2.6% lower at Rs 4,387.50 per share at 10:07 a.m. This compared to a flat NSE Nifty 50.

Total traded volume so far in the day stood at 0.42 times its 30-day average. The relative strength index was at 44.16.

Of the 47 analysts tracking the company, 31 maintain a 'buy' rating, nine recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 0.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.