Indian information technology companies may be on the cusp of recovery after enduring a prolonged period of discretionary spending cuts. Revenues from generative artificial intelligence are driving a meaningful increase in capex, according to analysts, fuelling a bounce-back for the tech majors.

The brokerage maintains an 'outperform' rating on Infosys Ltd. and Tata Consultancy Services Ltd.

The target price for TCS is set at Rs 4,600 apiece, implying a potential upside of 3% over lasting closing, while the target price for Infosys at Rs 2,100 apiece implies an upside of 11% over previous closing price.

Businesses' incremental cloud migration work will be positive for IT services companies, according to Bernstein. The combination of stabilising and improving growth and generative AI revenue is driving meaningful increases in capex, which is not likely to slow in the near term, the firm said.

"With Gen AI scaling up, there are more projects on 'transformation' which will help drive IT services revenue growth. We believe this is positive for large Indian IT services which are supporting clients in the digital transformation journey," Bernstein said.

Macroeconomic factors remain favourable with rate cut cycle approaching, as Indian IT stocks log 15-35% rise since June. The growth cycle is expected to improve upcycle over next few quarters, the brokerage said.

"Cloud optimisation is no longer a meaningful headwind to growth, and Gen AI is starting to generate revenue-positive signs for IT services," the note read.

According to Motilal Oswal, the inflection phase for Gen AI will begin when enterprises are ready for widespread deployment, depending on how modern and next-gen-ready their data estate is and how well established the cybersecurity guardrails are.

"This phase will bring significant revenue opportunities for service vendors, including training LLMs, reducing compute costs, cloud migration, and maintaining LLMs," it said.

Motilal Oswal said there are limited levers for TCS to expand margins meaningfully, considering sub-contracting costs are at an all-time low and a return of growth could lead to higher costs and subcon expenses.

"It will be at the forefront of IT services innovation, including GenAI, but will face threats on its legacy business from GenAI scale-up in the next 2-3 years," the brokerage said.

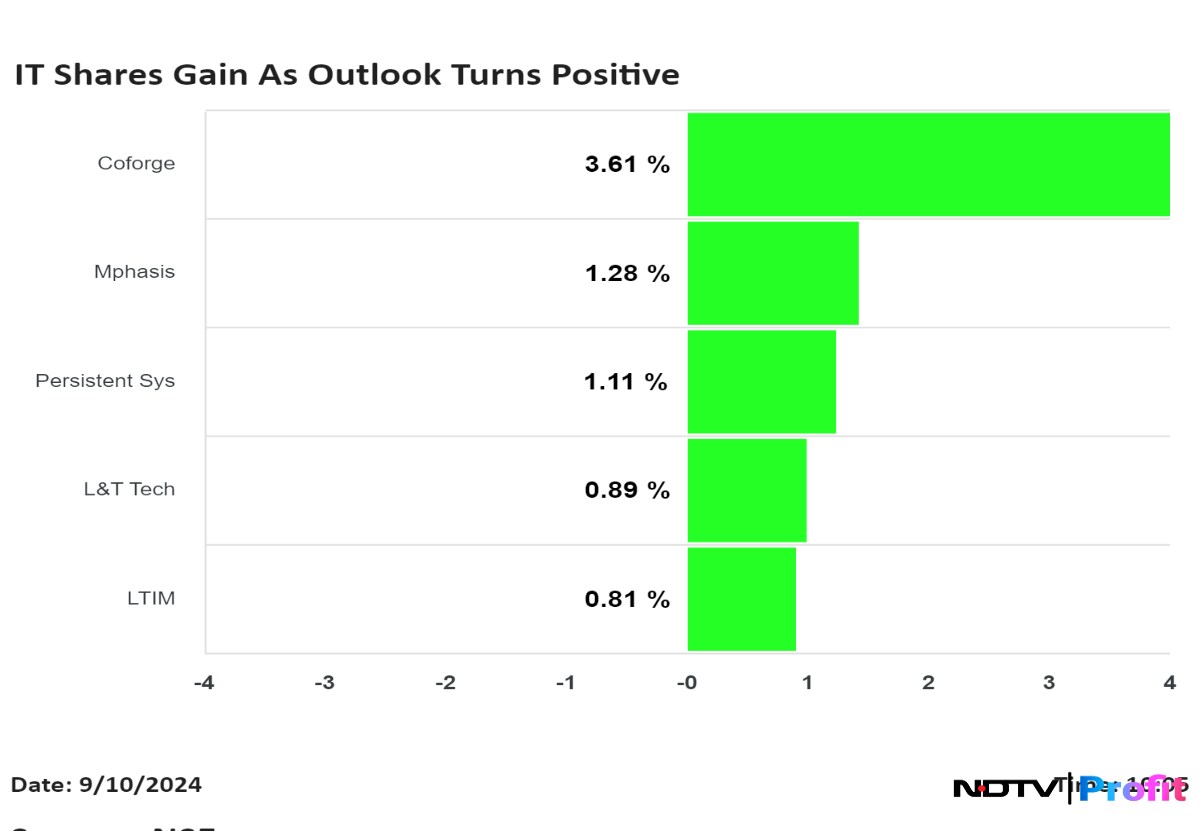

Shares of all IT companies part of the Nifty IT index were trading higher. The index was trading up 0.55% as of 10:05 a.m., compared to a 0.08% decline in the benchmark Nifty 50.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.