The first initial public offering from the house of Tata in nearly two decades has propelled a little-known Tata Group stock to all-time highs.

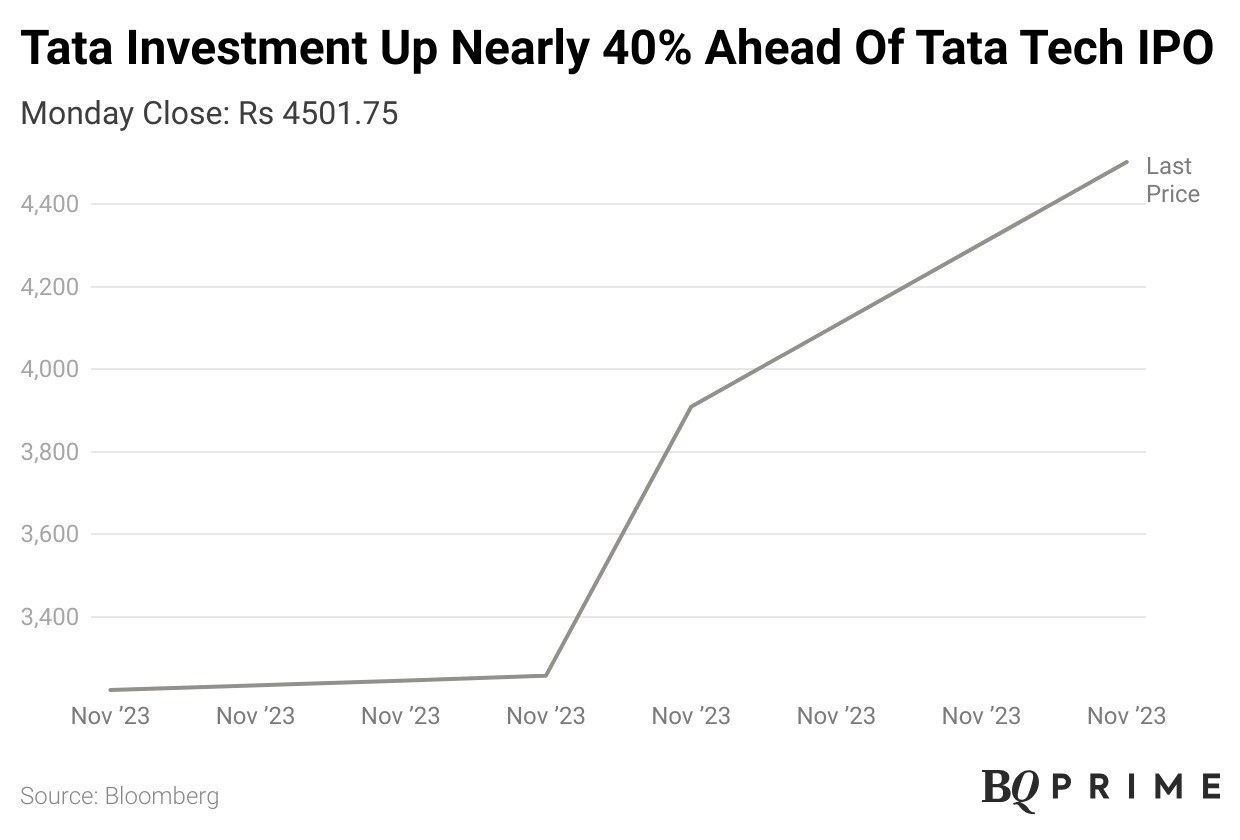

On Monday, shares of Tata Investment Corp. surged as much as 17.65% to an intraday high of Rs 4,598.70 apiece, before giving up some of the gains to settle at an all-time high of Rs 4,501.75 apiece—up 15.17% from its previous close. The stock's trading volume was 27 times its 30-day average, Bloomberg data showed.

On Friday, the stock was locked in an upper circuit of 20%.

The outperformance and surge in trading volume can be attributed to the Nov. 22-24 Tata Technologies IPO—a first for Tata Group since the listing of Tata Consultancy Services Ltd. in August 2004. Tata Investment Corp., a non-banking financial company of sorts, invests primarily in Tata stocks. A new investment avenue from the salt-to-software conglomerate in nearly 20 years clearly has investors enthused.

Additionally, the public shareholding of Tata Investment Corp. is tiny at 1.34 crore shares, equivalent to 26.61% of the stake, according to the company's shareholding pattern as of Sept. 30. Promoter Tata Sons Pvt. and related entities hold 3.71 crore shares—equivalent to a 73.38% stake.

To be sure, Tata Investment Corp. owns a 0.33% stake in Tata Motors—the promoter of Tata Technologies and the biggest selling shareholder in the IPO. The pure offer-for-sale of 6.08 crore shares at Rs 475–500 apiece will see the automaker offload as much as 11.41% of its stake in the ER&D company. All the proceeds will go to the selling shareholders.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.