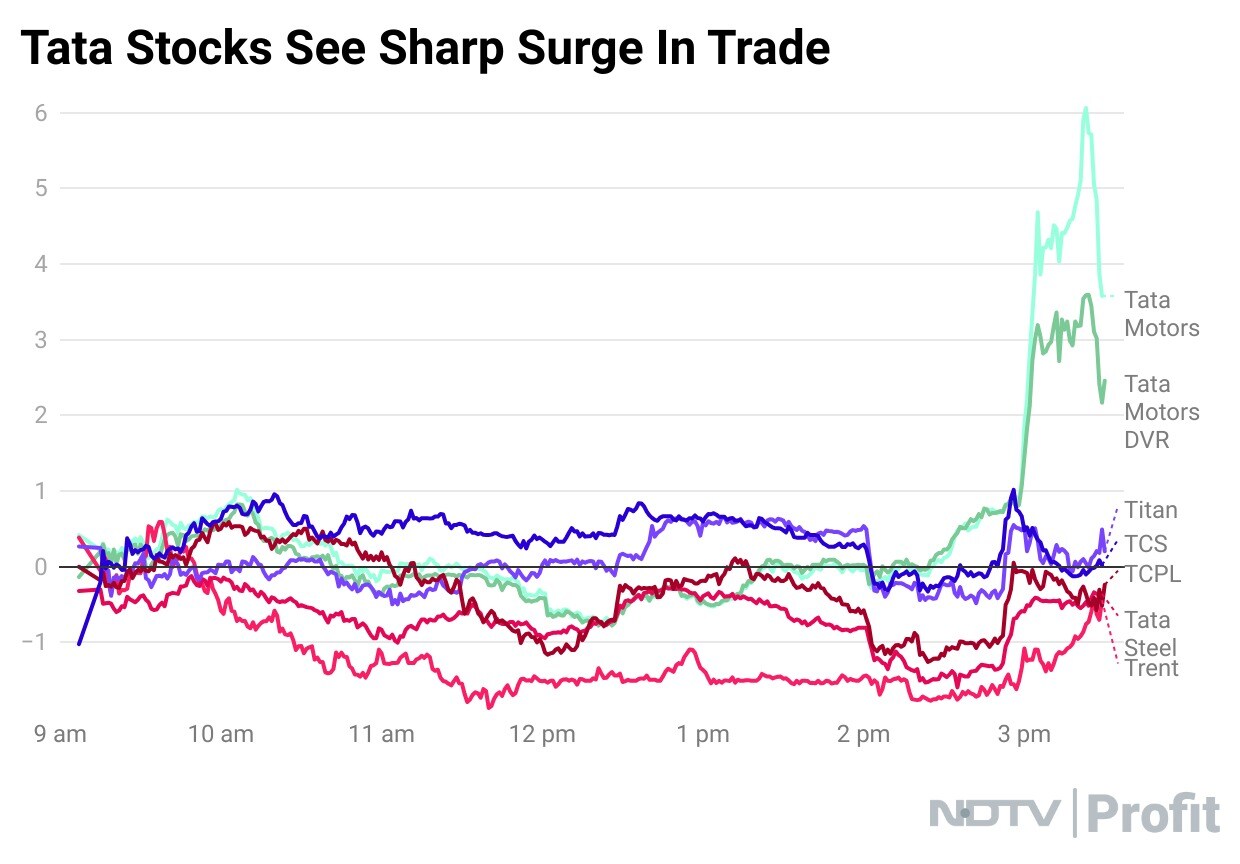

A clutch of Tata Group stocks saw a sharp uptick in the final hour of trade on Thursday, a day ahead of the conversion of Tata Motors DVR shares into ordinary stock.

Tata Motors Ltd. surged as much as 6.28% intraday to Rs 1,142 apiece in the final half hour, after trading range-bound for most of the session. Tata Motors DVR Ltd. gained as much as 3.7% to Rs 774.45 apiece during the same time. A similar spike was seen in a clutch of Tata stocks—including Tata Steel Ltd., The Titan Co. Ltd., Trent Ltd., Tata Consultancy Ltd. and Tata Consumer Products Ltd.—albeit at lower quantum.

“The spike may partially be due to heightened trading in DVR stock ahead of suspension,” an automotive analyst told NDTV Profit, but such a spike is unwarranted as “the scope of arbitrage” is small.

Tata Motors has decided to delist its DVR stock to simplify its capital structure—a move that comes ahead of a planned demerger next year. On Friday, Aug. 30, 2024, the company will issue seven ordinary shares for every 10 DVR shares held by an investor.

Upon completion of restructuring of the share capital, the equity capital will be reduced by nearly 4%. The effective shareholding of the promoter and promoter group will be reduced by 3.16%.

“The reduction will simplify and consolidate the company's capital structure and eliminate the price discount between 'A' Ordinary shares and Ordinary Shares,” Institutional Investors Advisory Services, or IiAS, said in a note. “It will lead to a reduction in the overall capital base of the company, making it 4% earnings-per-share (EPS)-accretive for all shareholders. This will also help in improving the overall market cap.

Tata Motors had issued the ‘A' Ordinary Shares in 2008 as part of a rights issue with the objective of raising funds for overseas investments.

The rights attached to the ‘A' Ordinary Shares are similar to the rights attached to the Ordinary Shares in all respects, except that they have 5% additional dividend rights and one tenth voting rights. The DVR, hence, trades at a discount to Ordinary Share.

On Thursday, Tata Motors shares rose 4.19% to Rs 1,119.65 apiece on the BSE even as the benchmark Sensex ended the day 0.43% higher at 82,134.61 points. The DVR stock gained 2.53% to Rs 765.17.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.