Shares of Tata Motors Ltd. fell on Wednesday after it increased the prices of its commercial vehicles by 2%, effective July 1. The price increase is to offset the impact of rising commodity prices.

This is the third instance of a price hike implemented by the automaker in 2024. Tata Motors had announced the first increase in price of up to 3% from Jan. 1 followed by 2% from April 1.

The price hike will be applicable to the entire range of commercial vehicles and will vary depending on the individual model and variant, the company said in an exchange filing.

Tata Motors subsidiary Jaguar Land Rover Ltd. and Chery Automobile Company Ltd. are set to produce an advanced portfolio of electric vehicles based on Chery's EV architecture, exclusively under the Freelander name, according to an another exchange filing on Wednesday.

“Today we are taking this important strategic step for JLR, one that underlines our ongoing commitment to China and complements our existing business in China. We believe that working together to develop new models of collaboration for the world's largest and fastest-growing electric vehicle market, combined with the appeal of the Freelander brand, promises a very exciting future for CJLR,” said Adrian Mardell, chief executive officer at JLR.

Yin Tongyue, chairman of Chery Group, said, “Chery and JLR are forging an innovative collaboration model that epitomises our growth path for the future. The blend of Chery's advanced EV technology with the distinctive appeal of the Freelander brand will undoubtedly provide China and global consumers with a unique electric vehicle experience.”

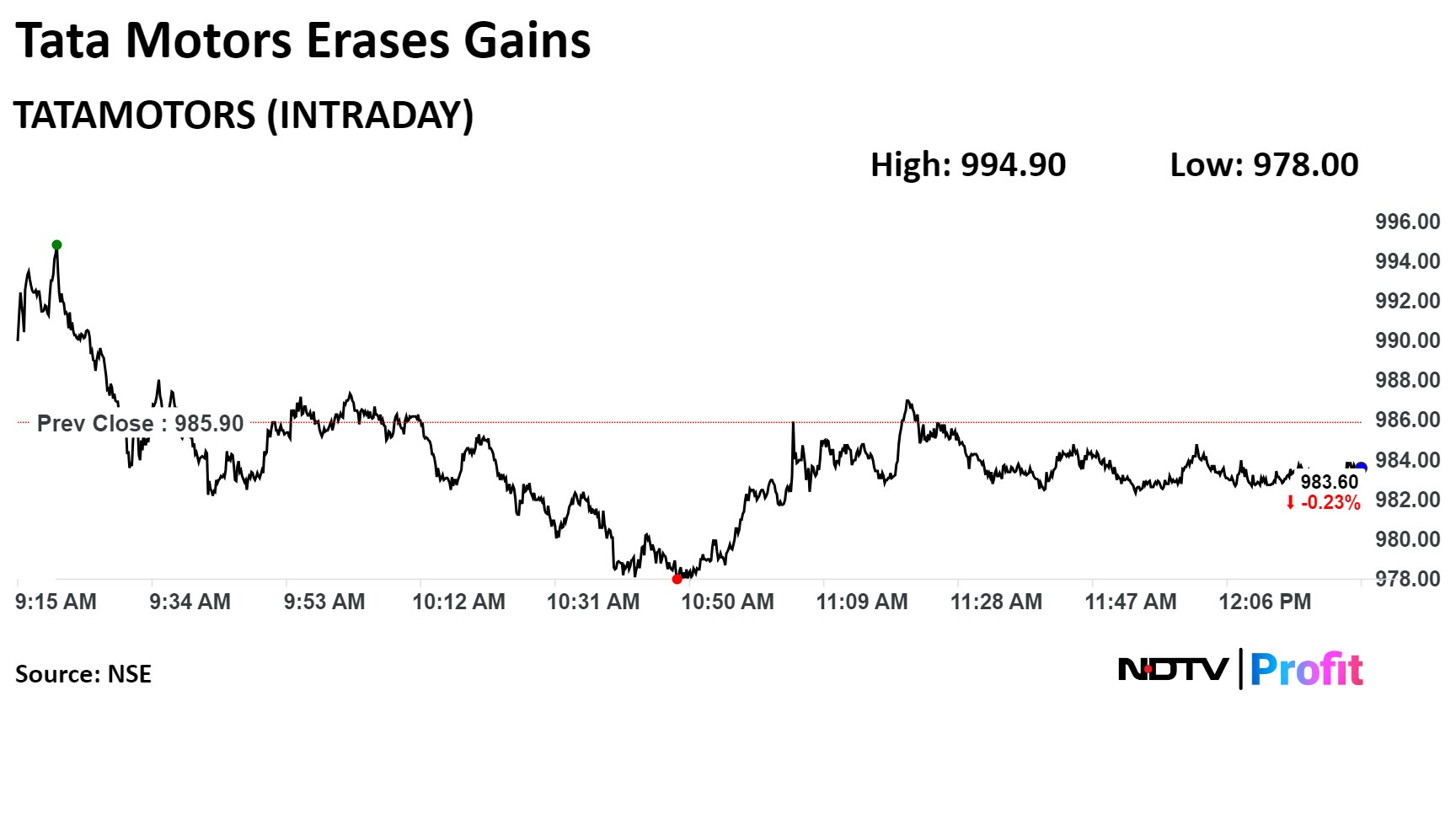

Shares of the company fell as much as 0.91% to Rs 994.90 apiece. It pared losses to trade 0.29% lower at Rs 983.15 apiece as of 12:20 p.m. This compares to a 0.04 decline in the NSE Nifty 50 Index.

The stock has risen 26.04% on a year-to-date basis and 65.06% in the last 12 months, according to NSE data. Total traded volume so far in the day stood at 0.39 times its 30-day average. The relative strength index was at 54.57.

Out of 33 analysts tracking the company, 21 maintain a 'buy' rating, eight recommend a 'hold,' and four suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.