Tata Motors Ltd.'s share price hit the lowest level in over 10 months after analysts trimmed the target price subsequent to the company reporting a decline in net profit, against an expectation of a rise. Emkay Global Research, UBS Global Research, and Nuvama cut the target price as they factored in the automobile manufacturer's weak performance.

Jaguar Land Rover's 11% volume decline led to a 50% drop in Tata Motors' Ebitda, UBS Global Research said. "This (July–September) quarter's performance backs our caution and raises significant risk to optimistic estimates on the street."

UBS Global Research has a 'sell' rating on the stock.

The brokerage cut the target price to Rs 780 apiece from Rs 825 apiece, earlier. The target price implied a 3% downside from Friday's closing price.

Emkay Global Research cut the target price to Rs 1,000 compared to Rs 1,175 earlier, which implied an upside of 24% from Friday's closing price. The brokerage has a 'buy' rating on the stock.

Similarly, Nuvama cut the target price to Rs 767 apiece from Rs 1,010 apiece. The target price implied a 4% downside from Friday's close.

Tata Motors Q2 FY25 (Consolidated, YoY)

Revenue down 3.5% at Rs 1.01 lakh crore versus Rs 1.05 lakh crore (Estimate: Rs 1,03,005 crore).

Ebitda down 14.2% at Rs 11,736 crore versus Rs 13,676 crore (Estimate: Rs 14,636 crore).

Margin down 140 basis points at 11.6% versus 13% (Estimate: 14.20%).

Net profit down 10% at Rs 3,450 crore versus Rs 3,832 crore (Estimate: Rs 4,805 crore).

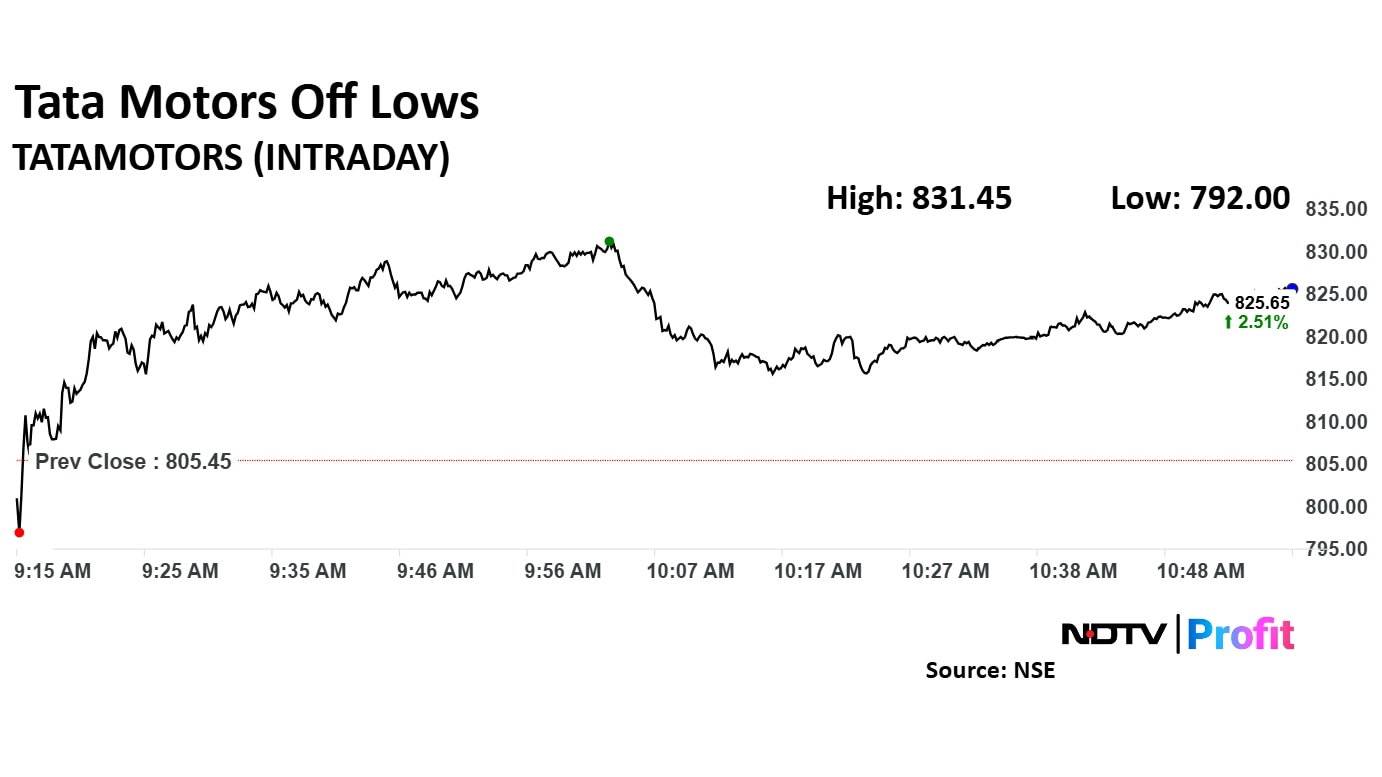

Tata Motors Share Price Today

Tata Motors Ltd. share price was 2.51% higher at Rs 825.65 apiece.

Share price of Tata Motors Ltd. declined 1.37% to Rs 792 apiece, the lowest level since Jan. 24. It erased all loss to trade 2.45% higher at Rs 805.45 apiece as of 10:58 a.m., as compared to a 0.47% advance in the NSE Nifty 50.

The stock gained as much as 25.45% in 12 months, and 5.42% on year-to-date basis. Total traded volume on NSE so far in the day stood at 1.21 times its 30-day average. The relative strength index was at 32.96.

Out of 36 analysts tracking the company, 21 maintain a 'buy' rating, 10 recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 22.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.