Tata Elxsi Ltd.'s net profit rose in the second quarter of fiscal 2025, beating estimates. However, brokerages are cautious on the stock due to concerns over growth in certain sectors and stretched valuations.

Jefferies is skeptical on recovery of Tata Elxsi's healthcare vertical, while HDFC Securities sees some recovery for the vertical by the end of the fiscal.

Tata Elxsi's net profit rose 24.7% QoQ to Rs 229.4 crore in the July-September period, compared to a Bloomberg estimate of Rs 200.85 crore. Its revenue fell short of projections, rising 3.1% QoQ to Rs 926.4 crore, below the estimated Rs 947.02 crore.

Here is what brokerages have to say about Tata Elxsi's second quarter performance.

JPMorgan

Maintained an 'underweight' rating on the stock with a target price of Rs 6,400 per share, implying a potential downside of 17%.

Revenue and margins missed expectations.

Transportation growth remains strong, but media and telecom verticals continue to be weak.

Healthcare vertical has bottomed out from client-specific issues but recovery is uncertain.

Achieving fiscal 2024 growth in fiscal 2025 seems challenging.

Margins are expected to be lower in fiscal 2025, compared to the previous fiscal.

Valuations are expensive at 53 times forward P/E.

HDFC Securities

Has a 'reduce' rating on the stock with a target price of Rs 6,925 apiece, implying a downside of 11%.

Strength in transportation (56% of revenue) offset by weakness in media and communications and healthcare.

Healthcare vertical could recover by fiscal 2025 end, but media and communications recovery may take longer.

Transportation and top-tier client growth will drive future growth.

Valuations remain high, despite an expected improvement in the growth trajectory.

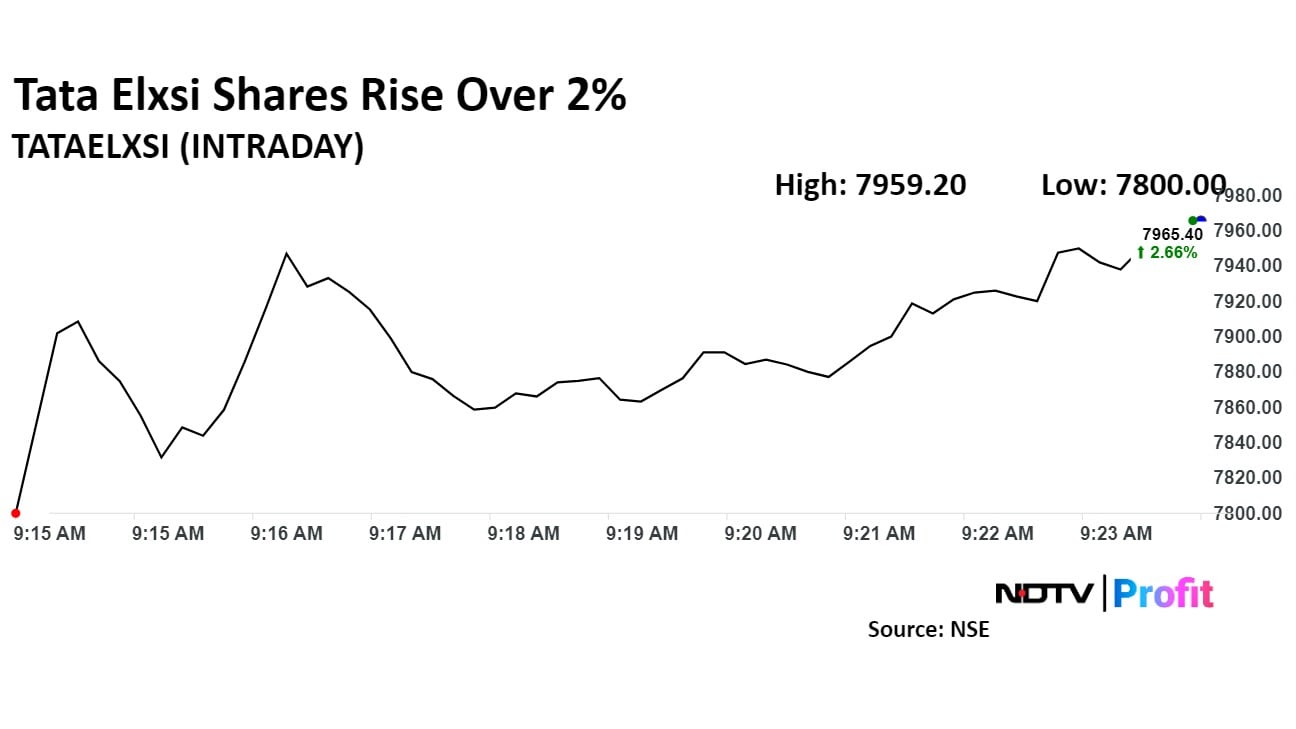

Tata Elxsi Share Price Today

Tata Elxsi share price rose as much as 2.58%.

Tata Elxsi's share price rose as much as 2.58% before paring gains to trade 1.26% higher at Rs 7,857.25 apiece at 9:43 a.m., compared to a 0.10% decline in the benchmark Nifty 50.

The stock has risen 8.62% in the last 12 months and fallen 9.69% on a year-to-date basis. Total traded volume so far in the day stood at 4.9 times its 30-day average. The relative strength index was at 58.26.

Of the 13 analysts tracking Tata Elxsi, two have a 'buy' rating on the stock, one recommends a 'hold' and 10 suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 16%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.