Shares of Tata Communications Ltd. hit an all-time high after the company announced a restructuring initiative aimed at moving its wholly-owned subsidiary, Tata Communications (UK) Ltd., under its direct ownership.

Tata Communications UK approved a proposal to reduce its issued share capital from $12.2 million, which is divided into 7.5 million fully paid shares at $1.62 each, to $1.69 million, consisting of 1.04 million shares of the same nominal value.

This capital reduction will involve the cancellation of 6.5 million shares, currently held by Tata Communications (Netherlands) BV, an indirect wholly-owned subsidiary of Tata Communications, according to an exchange filing on Thursday.

The transaction marks a strategic shift, as the cancellation of these shares will enable Tata Communications UK to become a direct wholly-owned subsidiary of Tata Communications, thereby eliminating an intermediary layer in its corporate structure.

Following the completion of this transaction and any necessary regulatory approvals, Tata Communications will become the sole shareholder of Tata Communications UK.

In a further financial maneuver associated with the share cancellation, Tata Communications UK is set to transfer $26.8 million to Tata Communications Netherlands, which reflects the reduction in its share capital and share premium account, the filing said.

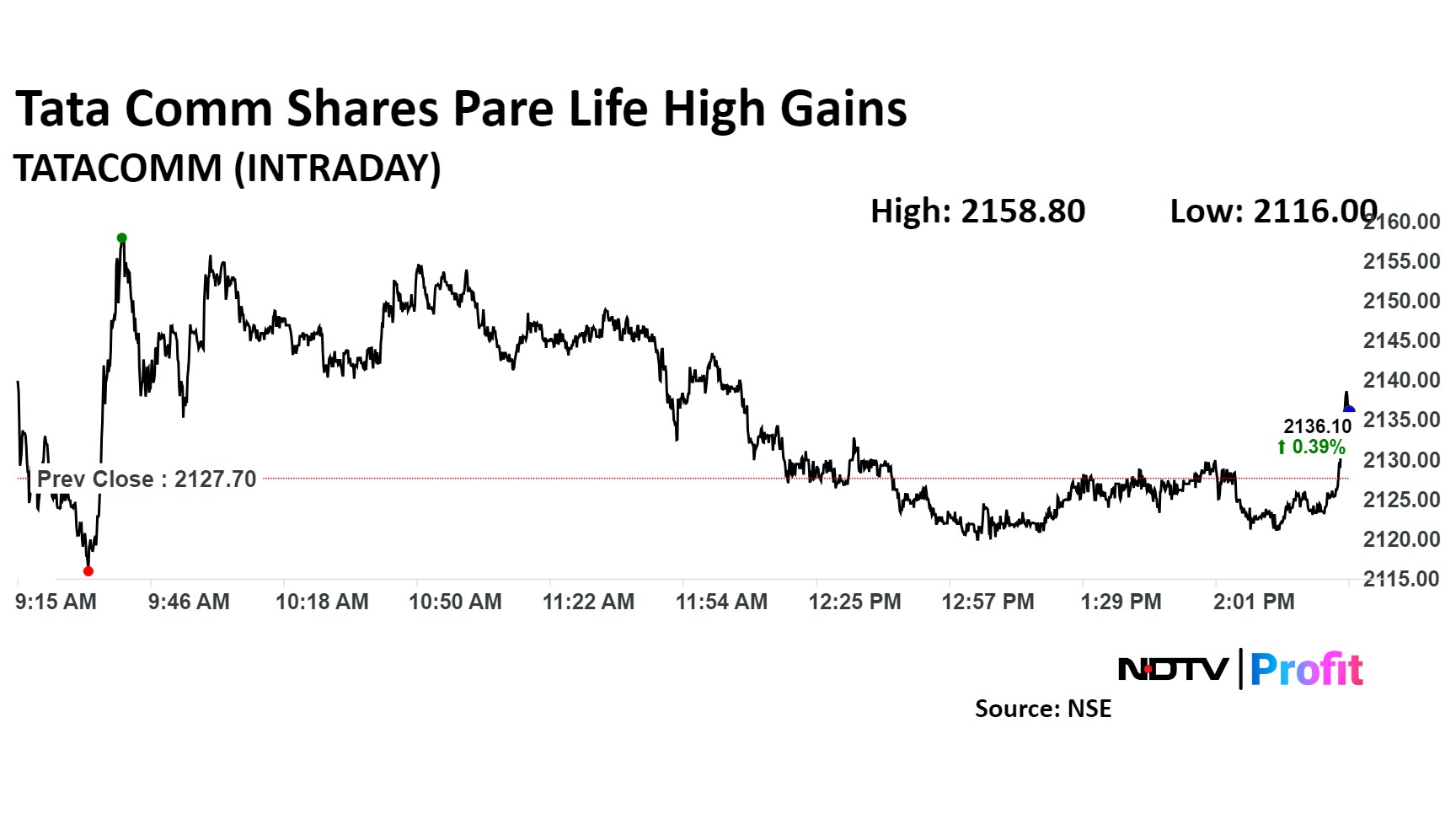

Tata Communications Share Price

Shares of Tata Communications rose as much as 1.46%, the highest level since listing, before paring gains to trade 0.03% higher at Rs 2,128.30 per share, as of 02:24 p.m. This compares to a 0.35% advance in the NSE Nifty 50.

The stock has risen 22.05% year-to-date. Total traded volume so far in the day stood at 4.4 times its 30-day average. The relative strength index was at 68.10.

Out of eight analysts tracking the company, four maintain a 'buy' rating, two recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 6.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.