Swiggy Ltd. bagged a 'neutral' rating as Motilal Oswal Financial Services Ltd. initiated coverage on the food delivery and quick commerce company, days after its debut on the national bourses, citing its strengths to capitalise on the growth potential.

The Bangalore-head-quartered delivery platform is well-positioned to capitalise on any growth by expanding its customer base, increasing the order volumes and values, and improving its unit economics and profitability, Motilal Oswal said in a report.

The brokerage has a target price of Rs 475 per share, implying an upside of 13% from the previous close.

Fast commerce presents a once-in-a-lifetime chance to revolutionise Indian customers' purchasing habits, the brokerage said. With the present numbers, Swiggy has allowed its leadership to "slip away" despite being a category inventor and innovator in both rapid commerce and meal delivery. "Tight execution and better leveraging its platform can fix these issues, in our opinion, though."

According to the report, Swiggy's all-in-one app model allows for high cross-utilisation across services and improved operational efficiency, even though Zomato now leads the food delivery and rapid commerce industries. "Leveraging a unique blend of convenience, high-frequency offerings, and user stickiness, Swiggy stands out in the competitive landscape."

The contribution margins for the food delivery business will improve from 6.4% currently to 9.0% in the financial year 2028, Motilal Oswal finds. "We expect fixed costs to remain elevated as it invests in opening more dark stores."

The brokerage expects Swiggy to turn profitable in fiscal 2027, with a profit after tax margin of 1.9%, against a negative 20.9% margin in the previous fiscal.

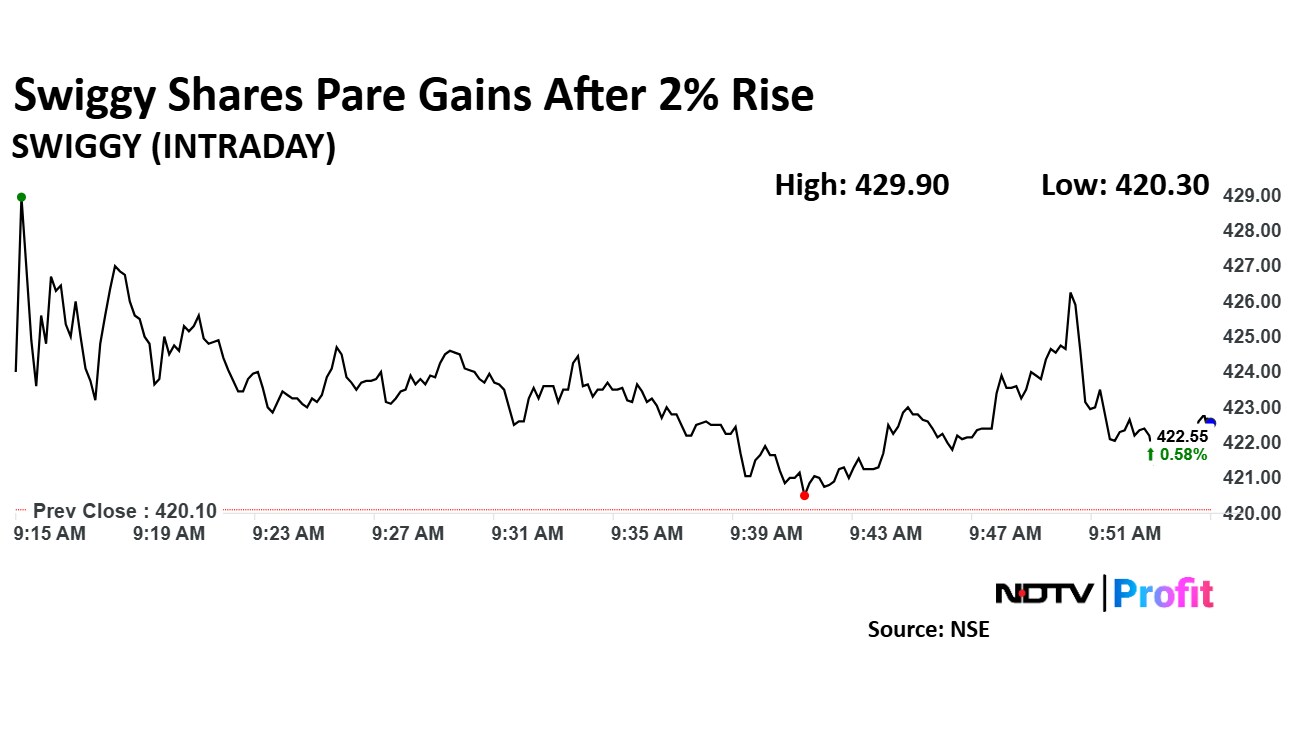

Swiggy Share Price Today

Swiggy's stock rose as much as 2.33% during the day to Rs 429.9 apiece on the NSE. It was trading 0.54% higher at Rs 422.35 apiece, compared to a 0.94% advance in the benchmark Nifty 50 as of 09:53 a.m.

The scrip has risen 21% since its listing on Nov. 13.

Three out of five analysts tracking the company have a 'buy' rating on the stock, one suggests a 'hold' and one has a 'sell', according to Bloomberg data. The average of 12-month analysts' consensus price target implies a potential upside of 2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.