Multibagger Suzlon Energy Ltd. share price jumped nearly 4% in early trade on Tuesday after profit surged nearly twofold in the second quarter of fiscal 2025.

The wind turbine manufacturer reported a bottom line of Rs 200.6 crore in the July-September quarter, compared to Rs 102.3 crore in the same period last year. The results came after market hours on Monday. Revenue rose 48% to Rs 2,103.4 crore, over last year's Rs 1,421.4 crore.

On the operating side, earnings before interest, tax, depreciation and amortisation advanced 31% to Rs 294.2 crore. However, margin declined to 14% from last year's 15.8%.

As of October, Suzlon Energy's wind order book stood at its highest ever point at 5.1 GW, which it plans to execute within the next 18 to 24 months, as per officials in a post-earnings conference call.

To support this growth, the company is ramping up its manufacturing capacity to 4.5 GW by March 2025. In addition, it successfully monetised its corporate office for Rs 440 crore.

The second half of the fiscal is expected to see an increase in turbine commissioning, with anticipated wind installations in India projected at 5 GW for this year, 6 GW for fiscal 2026, and a significant leap to 9-10 GW annually from fiscal 2027 onward, officials said.

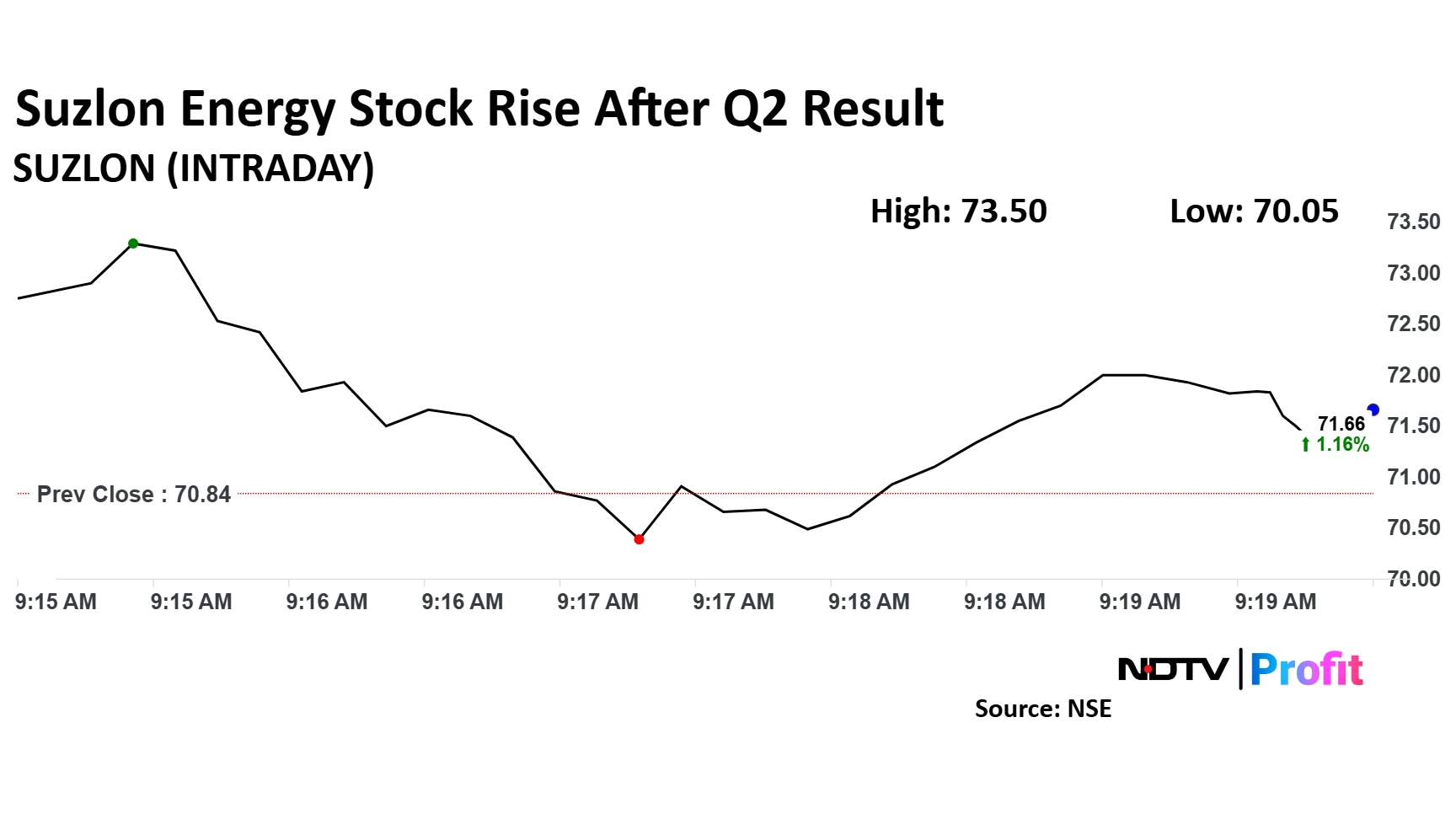

Suzlon Energy Share Price

Suzlon Energy share price rose as much as 3.8% in early trade to Rs 73.5 apiece on the NSE. It was trading 1.2% higher at Rs 71.66 per share, compared to a 0.3% decline in the benchmark Nifty 50 at 9:20 a.m.

The share price has risen 85% on a year-to-date basis and 125% in the last 12 months. The relative strength index was at 44.

Two of the five analysts tracking the company have a 'buy' rating on the stock, while three suggest 'hold', according to Bloomberg data. The average of 12-month analyst price target of Rs 76.33 implies a potential upside of 7.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.