Suzlon Energy Ltd.'s share price hit the 5% upper circuit on Thursday after Morgan Stanley upgraded the stock rating to 'Overweight'. However, the brokerage cut the target price to Rs 71 apiece from Rs 78. The current target price implies a 20% upside from Tuesday's closing price.

Suzlon Energy's market share is expected to rise to 35–40% by financial year 2027 from 25% in the ongoing financial year, Morgan Stanley said. The positive factors for Suzlon Energy are business moat and 5.1 gigawatt backlog.

Morgan Stanley retained margin estimates for Suzlon Energy at 10% and 12% for financial year 2026 and 2027. It also kept the total sales volume estimate for the period financial year 2025 and 2027 unchanged at 7.15 gigawatt, the brokerage said. Meanwhile, the brokerage lowered sales volume estimate for the current financial year to 1.3 gigawatt from 1.5 gigawatt.

The key risks for Suzlon Energy's growth is capacity addition delays, high operating expenditure, and high competition, Morgan Stanley said.

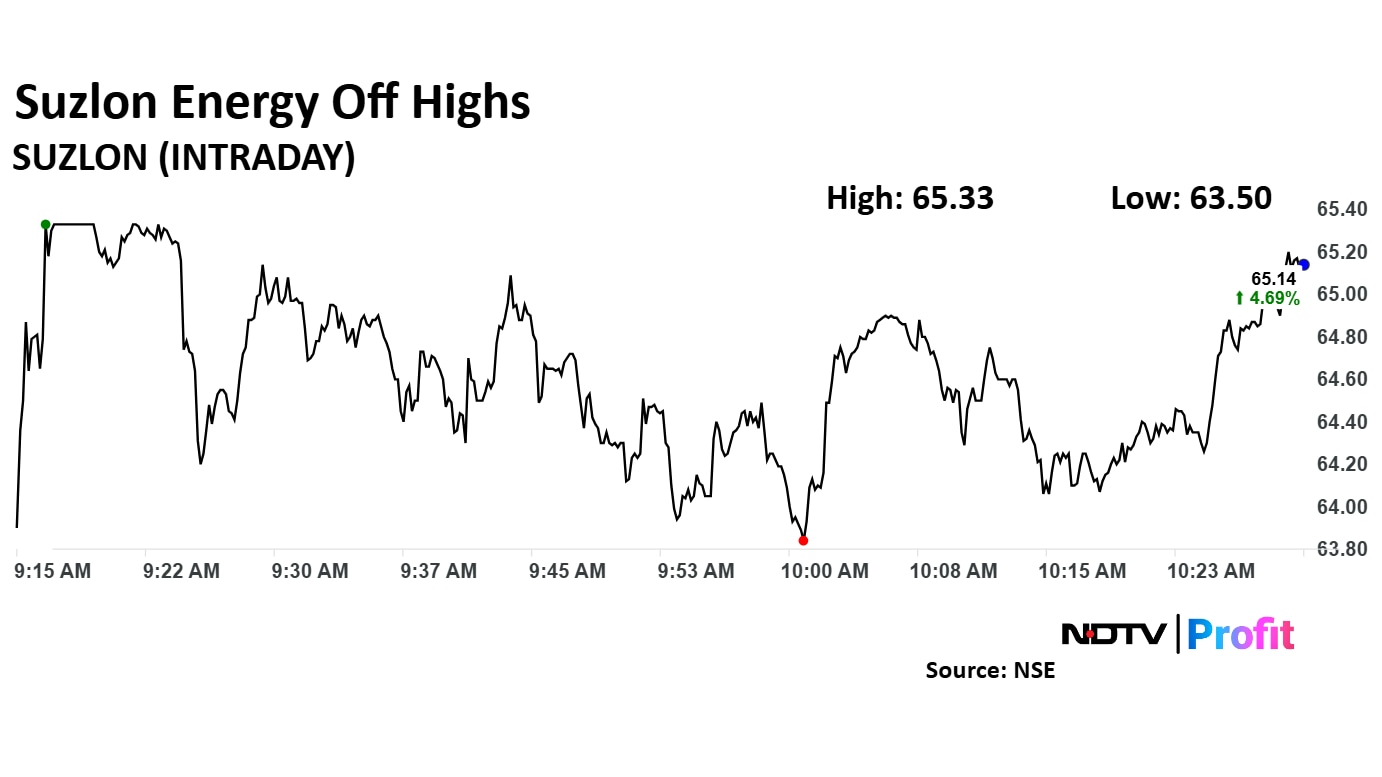

Suzlon Energy share price rose 4.69% to Rs 65.14 apiece.

Suzlon Energy share price hit the 5% upper circuit and rose to Rs 65.33 apiece, the highest level since Nov 8. It was trading 4.77% higher at Rs 65.19 apiece as of 10:44 a.m., as compared to 0.87% decline in the NSE Nifty 50 index.

The stock gained 64.78% in 12 months, and 69.9% on a year-to-date basis. Total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 47.83.

Out of five analysts tracking the company, three maintain a 'buy' rating, and two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 18.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.